Loan Agreement Financial With Onemain

Description

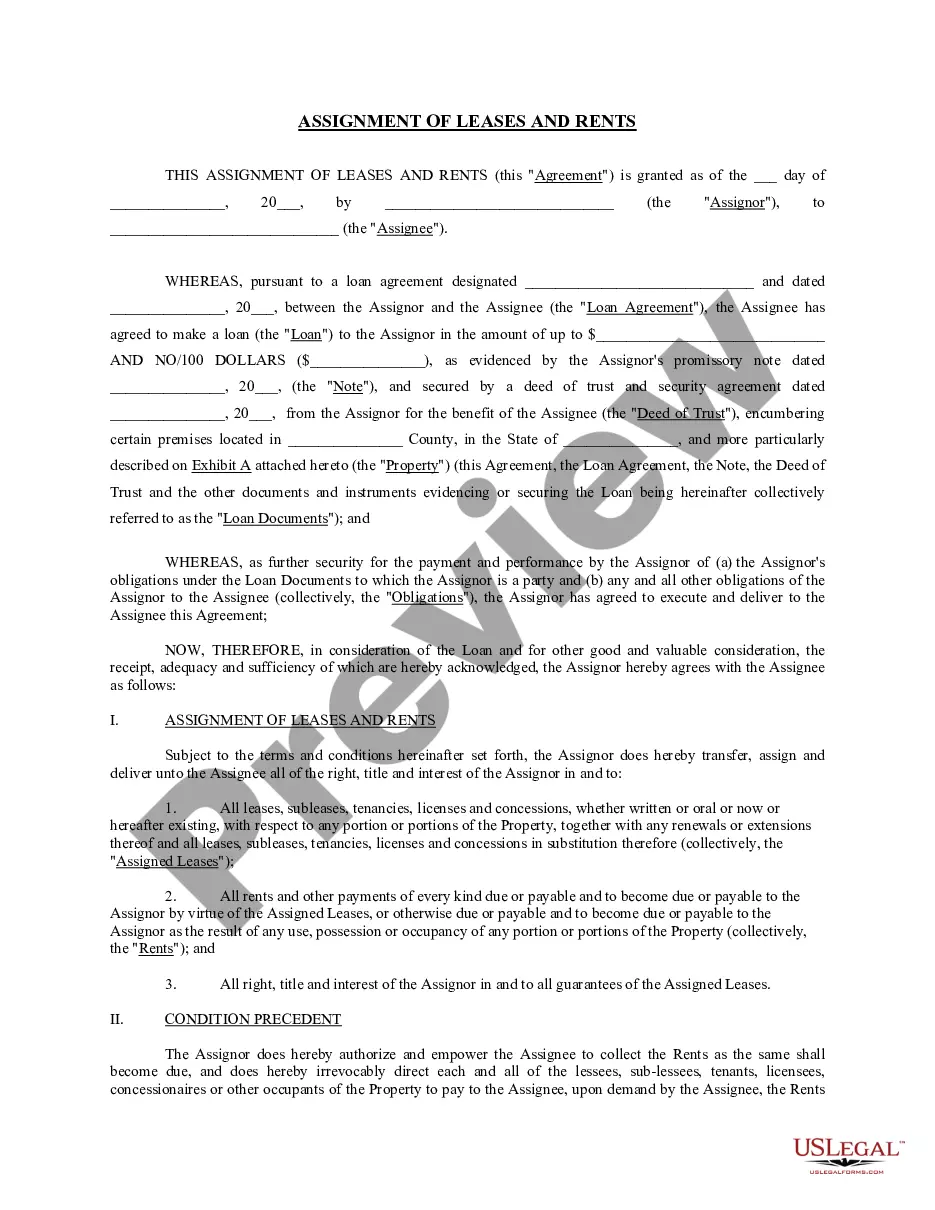

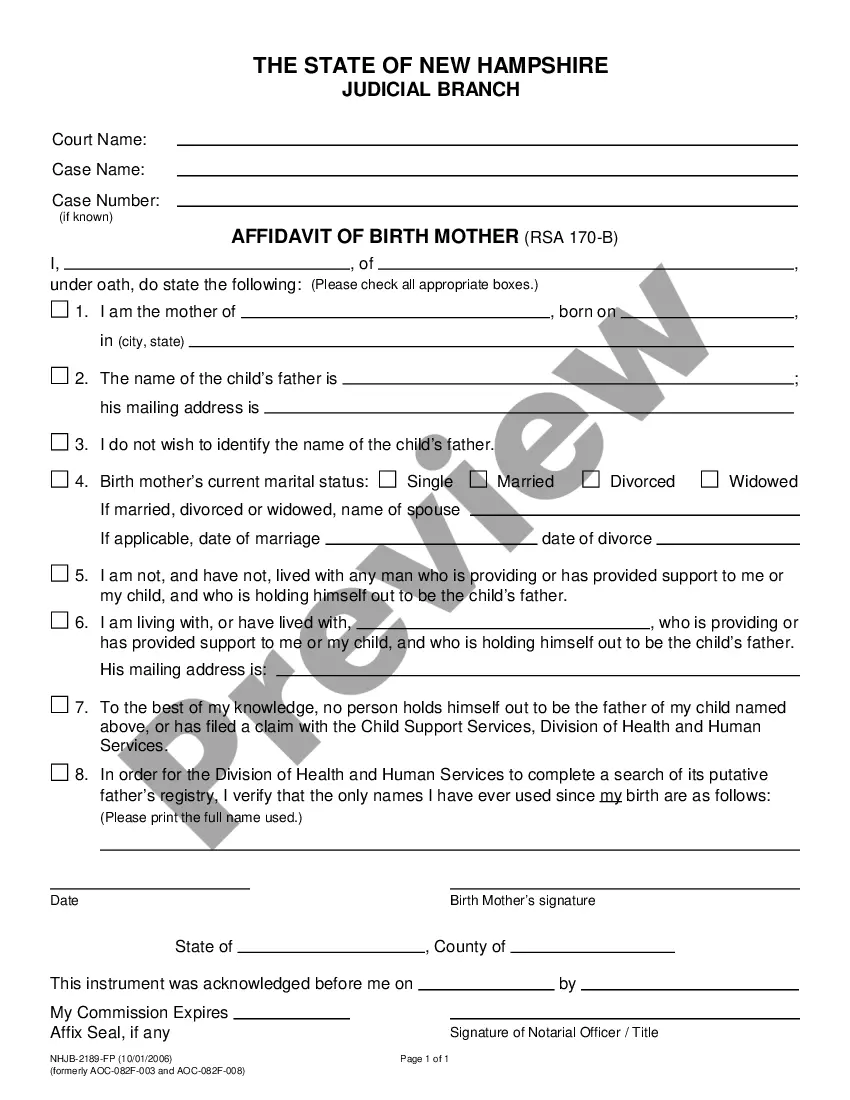

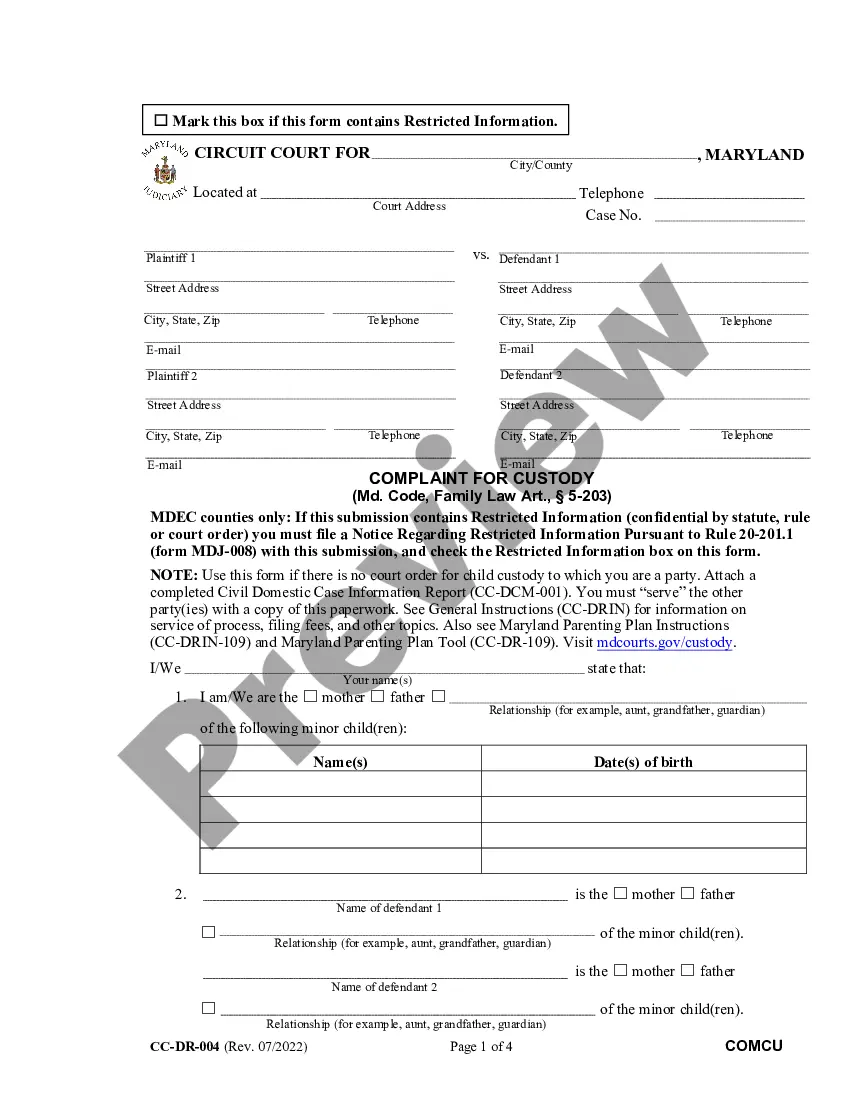

How to fill out Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

Legal managing can be overwhelming, even for knowledgeable professionals. When you are looking for a Loan Agreement Financial With Onemain and don’t have the time to devote in search of the appropriate and updated version, the processes can be demanding. A strong online form catalogue can be a gamechanger for anybody who wants to handle these situations successfully. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any needs you may have, from individual to enterprise paperwork, in one spot.

- Make use of advanced resources to accomplish and deal with your Loan Agreement Financial With Onemain

- Gain access to a useful resource base of articles, guides and handbooks and materials related to your situation and needs

Help save time and effort in search of the paperwork you need, and use US Legal Forms’ advanced search and Preview feature to locate Loan Agreement Financial With Onemain and acquire it. For those who have a monthly subscription, log in to your US Legal Forms account, search for the form, and acquire it. Take a look at My Forms tab to view the paperwork you previously downloaded as well as deal with your folders as you see fit.

Should it be the first time with US Legal Forms, register an account and get unlimited usage of all benefits of the platform. Here are the steps to take after accessing the form you need:

- Validate it is the correct form by previewing it and looking at its information.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now once you are all set.

- Select a monthly subscription plan.

- Find the formatting you need, and Download, complete, eSign, print and deliver your papers.

Enjoy the US Legal Forms online catalogue, backed with 25 years of expertise and stability. Change your day-to-day papers administration in a smooth and intuitive process today.

Form popularity

FAQ

Key takeaways Personal loan amounts vary by lender, but some lenders allow consumers to borrow up to $100,000. The amount a lender may approve you to borrow will depend on various factors, such as your credit score, income and debt-to-income ratio (DTI).

OneMain makes personal and auto loans from $1,500 - $20,000.

To cancel your loan, please contact the branch listed on your loan agreement or call (800) 961-5577.

What do I need in order to apply? A copy of a valid, government-issued ID (e.g. driver's license or passport) Proof of residence (e.g. a driver's license with your current address, a utility bill, or a signed lease) Proof of income (e.g. pay stubs or tax returns)

Minimum credit score: None; the lender doesn't have a minimum credit score, but it says an applicant should have some credit history. Minimum income: None; OneMain requires borrowers to have enough income to support their own expenses, plus the new loan's monthly payment.