Transfer Between Mortgage Without Refinancing

Description

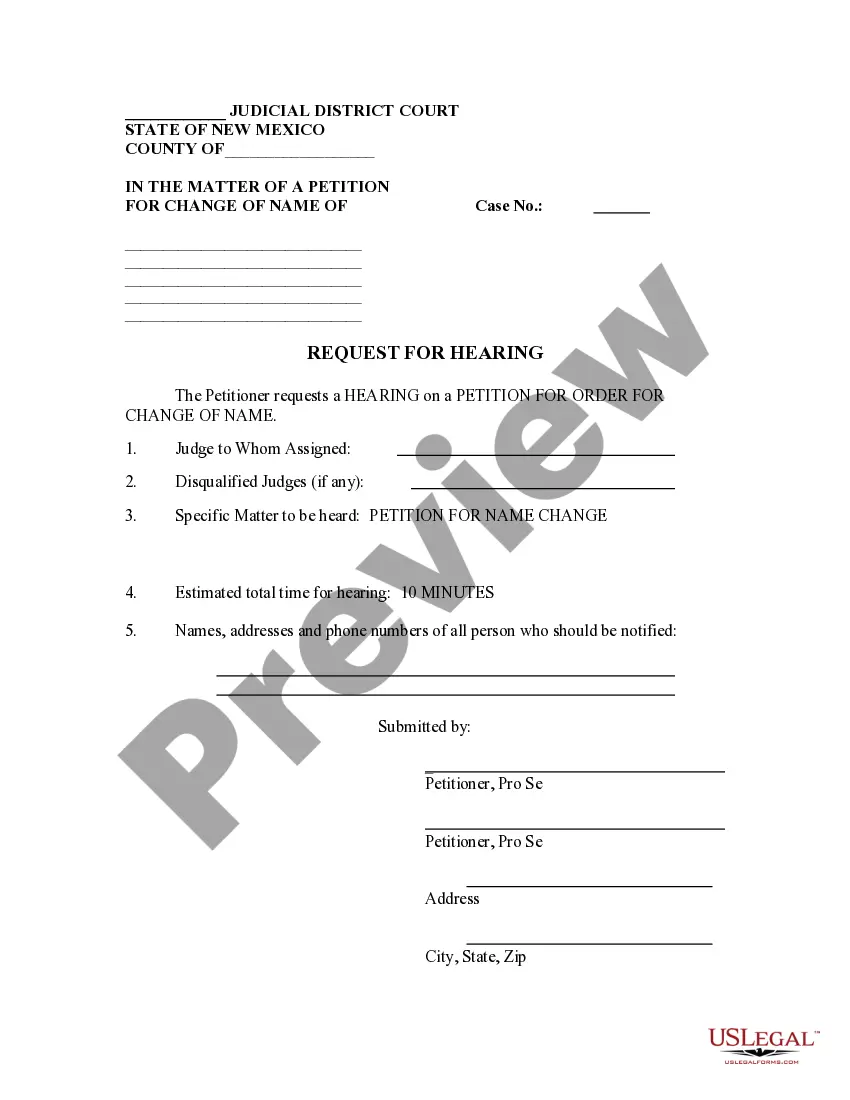

How to fill out Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

Accessing legal documents that adhere to federal and local regulations is essential, and the internet provides numerous choices. However, what's the benefit of spending time searching for the appropriate Transfer Between Mortgage Without Refinancing template online if the US Legal Forms digital library already has these documents gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for any business and personal situation. They are easy to navigate, with all documents organized by state and intended use. Our specialists keep up with legislative updates, so you can always be confident that your paperwork is current and compliant when acquiring a Transfer Between Mortgage Without Refinancing from our site.

Acquiring a Transfer Between Mortgage Without Refinancing is straightforward and quick for both existing and new users. If you already possess an account with an active subscription, Log In and store the document template you require in the desired format. If you are new to our platform, follow the instructions below.

All templates you find through US Legal Forms are reusable. To re-download and complete previously purchased forms, access the My documents section in your account. Enjoy the most comprehensive and user-friendly legal documentation service!

- Evaluate the template using the Preview feature or through the text outline to ensure it meets your requirements.

- Search for an alternative template using the search tool at the top of the page if needed.

- Click Buy Now once you've identified the appropriate form and choose a subscription plan.

- Create an account or Log In and process your payment via PayPal or a credit card.

- Choose the optimal format for your Transfer Between Mortgage Without Refinancing and download it.

Form popularity

FAQ

Yes, it is possible to take sole responsibility for a home that you're currently sharing without refinancing, even if your ex-spouse or another co-borrower or cosigner is currently on the mortgage. As long as both names are on the mortgage, both parties will continue to be financially responsible for repaying the loan.

You can transfer a mortgage to another person if the terms of your mortgage say that it is ?assumable.? If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

The only way to change mortgage servicers is to refinance your loan and move to a lender that services the loans they originate. Keep in mind, just because a company services a loan today doesn't mean they'll continue to do so long term. The industry is always changing.

A loan assumption or modification could release a co-borrower from your mortgage without refinancing into a new loan, preserving the current state of homeownership.

Mortgage Porting In order to port a mortgage, the borrower will have to sell the old home at the same time he or she is purchasing a new one. The terms of the loan will stay the same, so the amount of the mortgage must be enough to pay for the new home.