Mortgage Transfer All Within One Year

Description

How to fill out Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

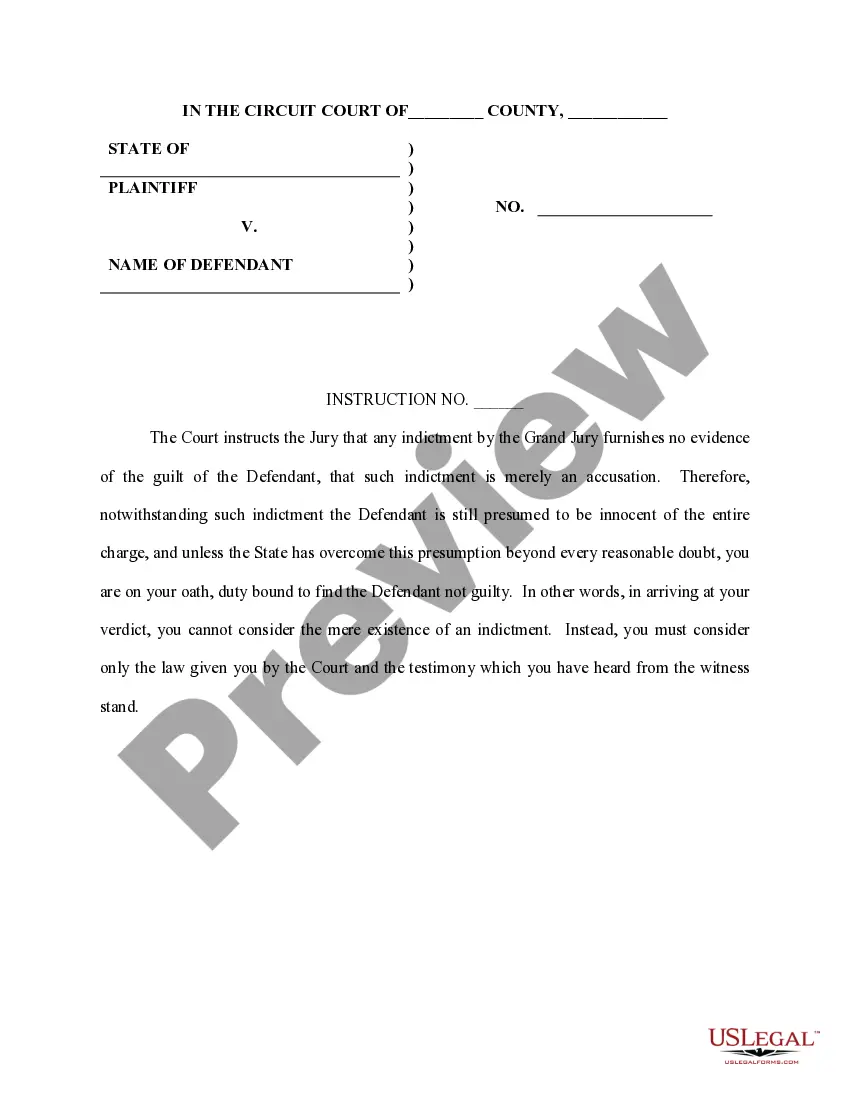

The Mortgage Transfer All Within One Year displayed on this page is a versatile official template created by qualified attorneys in compliance with federal and local laws.

For over 25 years, US Legal Forms has offered individuals, entities, and lawyers more than 85,000 authenticated, state-specific documents for any professional and personal scenario. It’s the fastest, simplest, and most trustworthy way to acquire the paperwork you require, as the service ensures bank-level data protection and anti-malware safeguards.

Select the format you desire for your Mortgage Transfer All Within One Year (PDF, DOCX, RTF) and save the document on your device. Fill out and sign the form. Print the template to complete it manually. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill out and sign your document with a legally-binding electronic signature. Re-download your documents whenever necessary. Access the My documents tab in your profile to redownload any previously acquired forms. Register for US Legal Forms to have authenticated legal templates for all of life’s situations readily available.

- Search for the document you require and review it.

- Browse through the sample you searched and preview it or examine the form description to verify it meets your requirements. If it doesn’t, use the search function to locate the suitable one. Click Buy Now when you have found the template you need.

- Register and sign in.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

Transfer of mortgage is a transaction where either the borrower or lender assigns an existing mortgage (a loan to purchase a property?usually a residential one?using the property as collateral) from the current holder to another person or entity.

Know your rights under the law You have a 60-day grace period after a transfer to a new servicer. That means you can't be charged a late fee if you send your on-time mortgage payment to the old servicer by mistake ? and your new servicer can't report that payment as late to a credit bureau.

A transfer of mortgage is the reassignment of an existing mortgage, usually on a home, from the current holder to another person or entity. Not all mortgages can be transferred; if they are, the lender has the right to approve the person assuming the loan.

This could result in a small change in the monthly payment amount. A mortgage can be transferred to a new servicing company any number of times during the life of the loan.

How to Transfer a Mortgage Review Your Mortgage Documents. It's a good idea to double-check your loan agreement to see if you're allowed to transfer the mortgage. ... Request a Transfer. Contact your lender to initiate the transfer. ... Consider Extra Help. ... Complete the Transfer.