Mortgage California Regarding With Ein Number

Description

How to fill out Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

It’s no secret that you can’t become a law expert overnight, nor can you learn how to quickly prepare Mortgage California Regarding With Ein Number without having a specialized background. Creating legal documents is a time-consuming process requiring a certain education and skills. So why not leave the creation of the Mortgage California Regarding With Ein Number to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court paperwork to templates for in-office communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the document you need in mere minutes:

- Discover the document you need with the search bar at the top of the page.

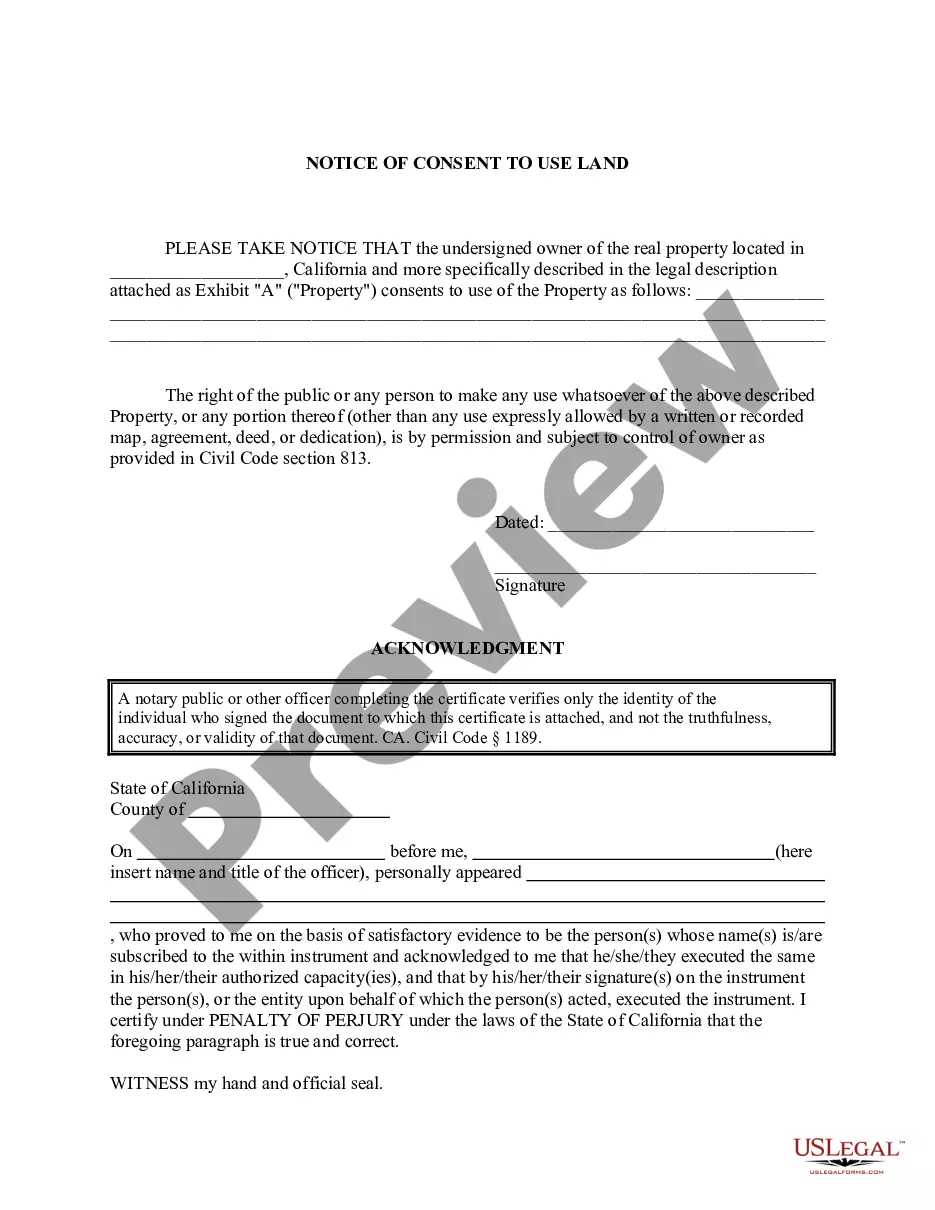

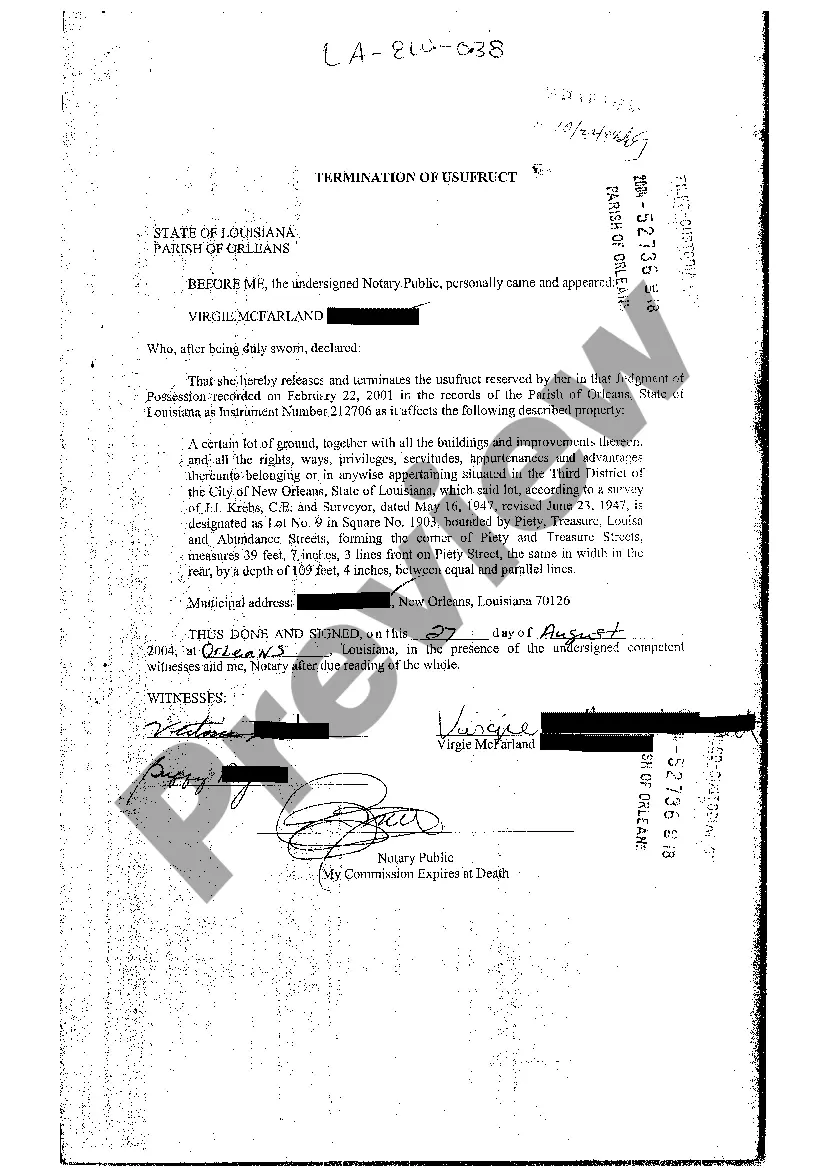

- Preview it (if this option provided) and check the supporting description to determine whether Mortgage California Regarding With Ein Number is what you’re looking for.

- Start your search again if you need any other template.

- Register for a free account and choose a subscription plan to purchase the form.

- Choose Buy now. As soon as the transaction is complete, you can download the Mortgage California Regarding With Ein Number, fill it out, print it, and send or mail it to the designated people or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

An Employer Identification Number (EIN) is a nine-digit number that IRS assigns in the following format: XX-X. It is used to identify the tax accounts of em- ployers and certain others who have no employees. However, for employee plans, an alpha (for example, P) or the plan number (e.g., 003) may follow the EIN.

You can locate your EIN on your confirmation letter from the IRS, old tax returns, old business loan applications, your business credit report, or payroll paperwork. You can also call the IRS to look up your federal tax ID number. If you need to locate another company's EIN, you can start by asking the company.

A California EIN, or employer identification number, is issued by the IRS to different business entities. It is also known as a Federal Tax ID Number or Tax ID Number (TIN). It is the equivalent of a social security number for businesses.

You can apply for and receive an EIN from the Internal Revenue Service by submitting a Form SS-4. This can be done online, by phone, by mail, or by fax. We suggest online filing, as this is the fastest and simplest method. There is no fee to obtain an EIN.

The EIN is nine digits just like an SSN. But the first seven digits come first and the last two are proceeded by a hyphen.