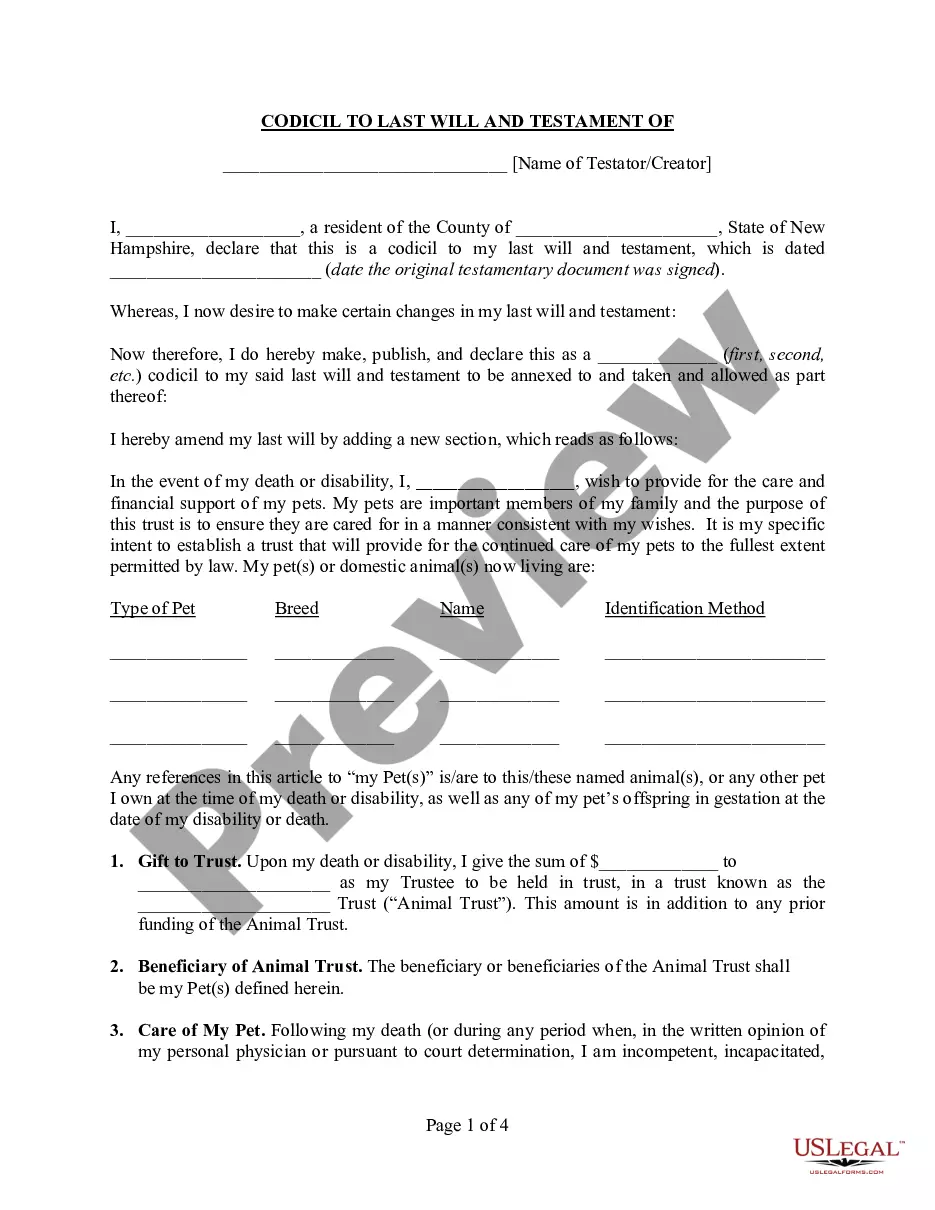

An operating agreement for LLC is a legal document that outlines the internal structure and management policies of a limited liability company (LLC). It establishes the rights, responsibilities, and obligations of its members (owners) and sets the rules for running the business. One example of an operating agreement for LLC is a single-member LLC operating agreement. This type of agreement is designed for LCS with only one member or owner. It outlines how the single member will manage the company, make decisions, and handle profits and losses. Another example is a multi-member LLC operating agreement. This type applies to LCS with multiple members or owners. It addresses how these members will share ownership, decision-making authority, and financial responsibilities, including profit distribution and allocating voting rights. Additionally, there are specialized operating agreements for LCS with specific purposes. For instance, a real estate LLC operating agreement might focus on property management and leasing terms, while a professional LLC operating agreement could outline regulations for licensed professionals such as doctors or lawyers. In a typical operating agreement for LLC, several key elements need to be addressed. These include the LLC's name and purpose, the initial capital contributions from members, the allocation of profits and losses, the management structure (whether it is member-managed or manager-managed), provisions regarding meetings and voting, buyout and dissolution procedures, and dispute resolution mechanisms. Keywords: operating agreement, LLC, limited liability company, single-member LLC operating agreement, multi-member LLC operating agreement, real estate LLC operating agreement, professional LLC operating agreement, member-managed, manager-managed, capital contributions, profit allocation, loss allocation, meetings, voting, buyout, dissolution, dispute resolution.

Example Of Operating Agreement For Llc

Description

How to fill out Example Of Operating Agreement For Llc?

It’s no secret that you can’t become a legal expert overnight, nor can you learn how to quickly prepare Example Of Operating Agreement For Llc without the need of a specialized set of skills. Putting together legal documents is a time-consuming venture requiring a certain education and skills. So why not leave the preparation of the Example Of Operating Agreement For Llc to the pros?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court paperwork to templates for in-office communication. We know how important compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s start off with our platform and obtain the document you require in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Example Of Operating Agreement For Llc is what you’re searching for.

- Start your search over if you need a different template.

- Set up a free account and choose a subscription option to buy the template.

- Choose Buy now. Once the payment is through, you can download the Example Of Operating Agreement For Llc, complete it, print it, and send or send it by post to the necessary people or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

An operating agreement should include the following: Percentage of members' ownership. Meeting provisions and voting rights. Powers and duties of members and management. Distribution of profits and losses. Tax treatment preference. A liability statement. Management structure. Operating procedures.

member LLC operating agreement is a binding document between the members of a company that includes terms related to ownership (%), management, and operations. The agreement should be created when forming the company as an understanding of how the organization will run.

LLC operating agreements usually provide much more information, and almost all the provisions for how the business will be managed, and the rights, duties, and liabilities of members and managers are contained in the operating agreement. An operating agreement is a private document.

In order to complete your Operating Agreement, you will need some basic information. The formation date of your LLC. The name and address of the Registered Office and Registered Agent. The general business purpose of the LLC. Member(s) percentages of ownership. Names of the Members and their addresses.

While most states don't require LLCs to have operating agreements, it's always a good idea to create one to ensure your business is well administered and protected from risk.