Services Payment Agreement Form Irs

Description

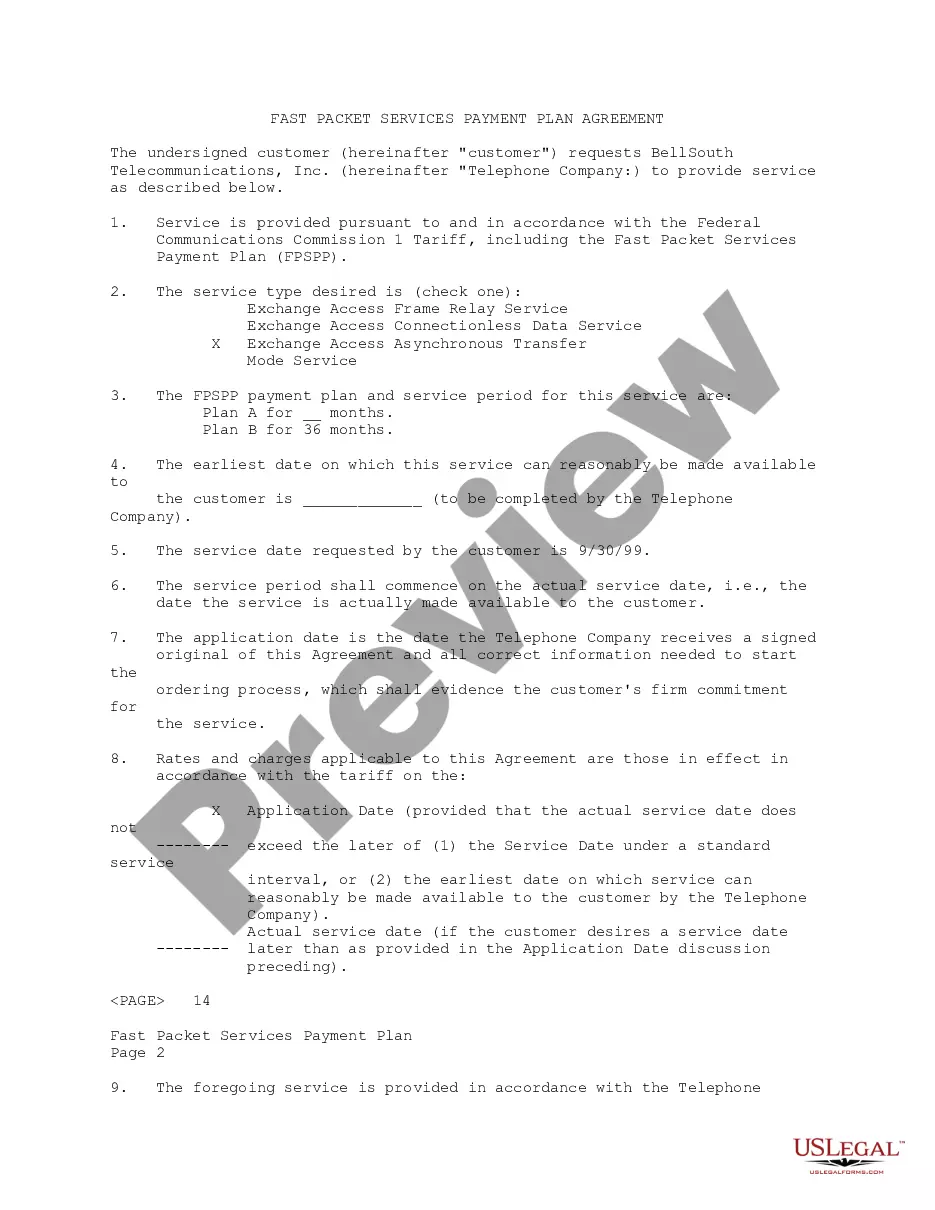

How to fill out Fast Packet Services Payment Plan Agreement?

Whether for business purposes or for individual affairs, everybody has to handle legal situations at some point in their life. Filling out legal documents demands careful attention, starting with selecting the appropriate form sample. For example, when you pick a wrong version of the Services Payment Agreement Form Irs, it will be rejected once you send it. It is therefore essential to get a reliable source of legal papers like US Legal Forms.

If you need to get a Services Payment Agreement Form Irs sample, stick to these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Examine the form’s information to make sure it fits your situation, state, and region.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search function to locate the Services Payment Agreement Form Irs sample you require.

- Get the file when it meets your requirements.

- If you have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Finish the account registration form.

- Pick your payment method: you can use a credit card or PayPal account.

- Choose the document format you want and download the Services Payment Agreement Form Irs.

- After it is downloaded, you can complete the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time searching for the right sample across the internet. Utilize the library’s easy navigation to find the proper form for any situation.

Form popularity

FAQ

Most taxpayers qualify for an IRS payment plan (or installment agreement) and can use the Online Payment Agreement (OPA) to set it up to pay off an outstanding balance over time. Once taxpayers complete the online application, they receive immediate notification of whether the IRS has approved their payment plan.

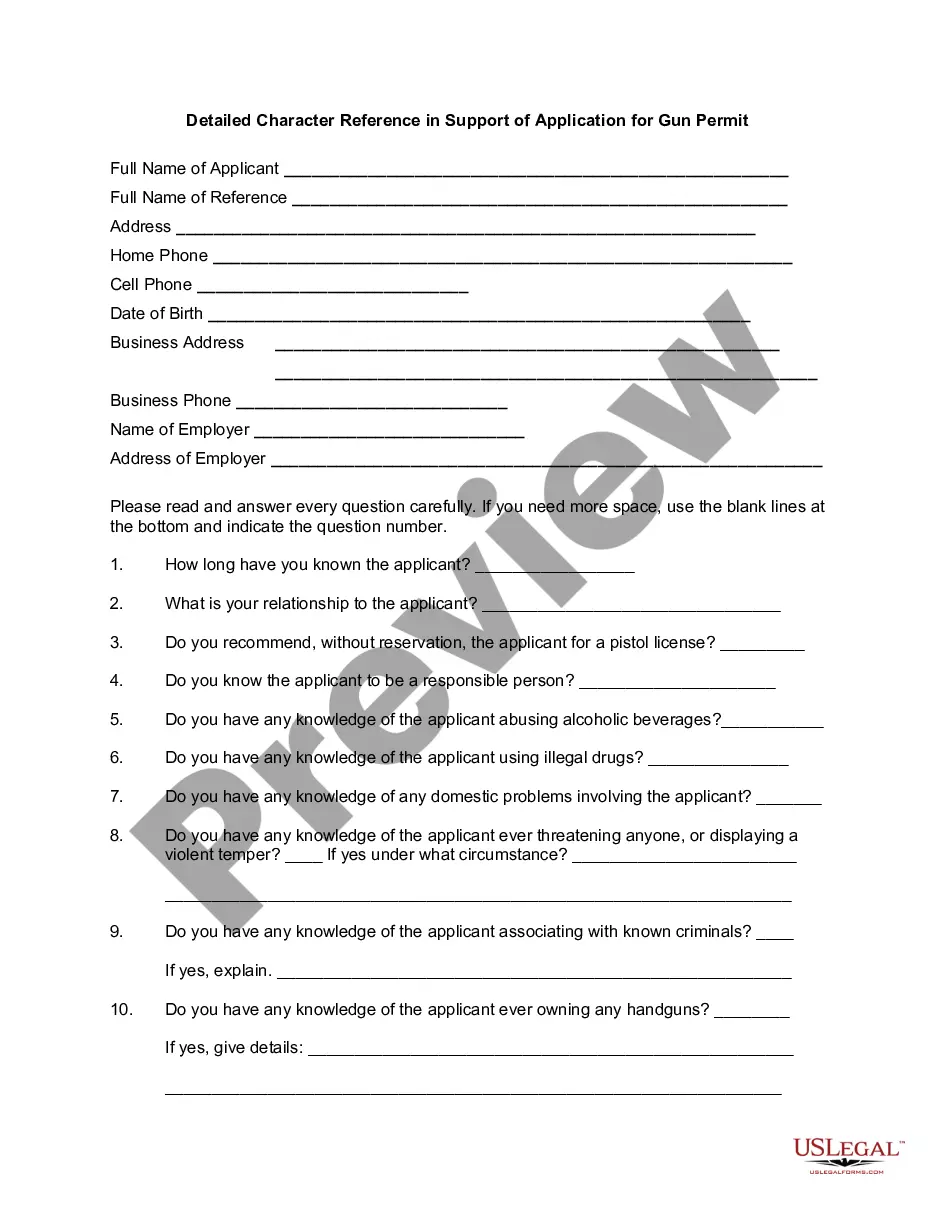

If you'd prefer to fill out the form online, you can do so directly on the IRS website. First, enter identifying information like your name, address, Social Security number, phone number, employer information, and the kinds of taxes you filed for.

How to Complete Form 433-D Direct Debit Installment Agreement YouTube Start of suggested clip End of suggested clip So we're going to put 2014. And 2015 the amount owed as of this is a number that you're going toMoreSo we're going to put 2014. And 2015 the amount owed as of this is a number that you're going to want to get from the IRS. If.

Use Form 9465 to request a monthly installment agreement (payment plan) if you can't pay the full amount you owe shown on your tax return (or on a notice we sent you). Most installment agreements meet our streamlined installment agreement criteria. See Streamlined installment agreement, later, for more information.

How to Complete Form 433-D Your name and address. Social Security Number (SSN) for individual taxpayers or Employer Identification Number (EIN) for businesses. Type of Tax ? Note the form number for the tax return you filed. ... Tax periods ? Note the tax years related to the tax debts you're making payments on.