Agreement Securities With Institutional Investors

Description

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

There's no longer a necessity to squander time looking for legal documents to satisfy your local state regulations.

US Legal Forms has gathered all of them in one location and improved their accessibility.

Our platform provides over 85,000 templates for any business and personal legal situations organized by state and area of application.

Utilize the Search field above to find another template if the existing one did not suit you.

- All forms are expertly drafted and verified for accuracy, allowing you to be assured of obtaining a current Agreement Securities With Institutional Investors.

- If you are acquainted with our service and already possess an account, you must ensure your subscription is active prior to acquiring any templates.

- Click Log In to your account, select the document, and hit Download.

- You can also revisit all obtained documents any time required by accessing the My documents tab in your profile.

- If you've not interacted with our service before, the procedure will require some additional steps to finish.

- Here's how new users can find the Agreement Securities With Institutional Investors in our catalog.

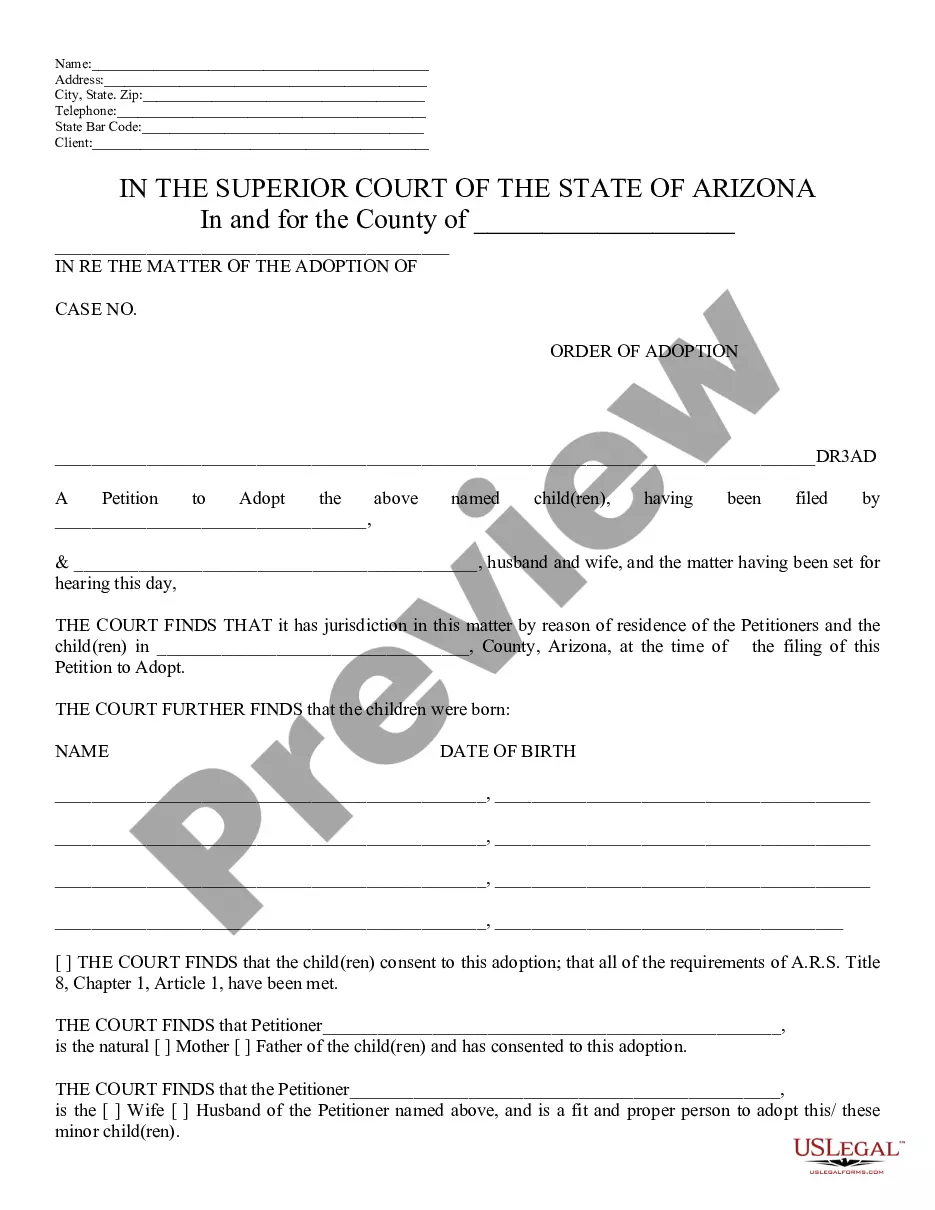

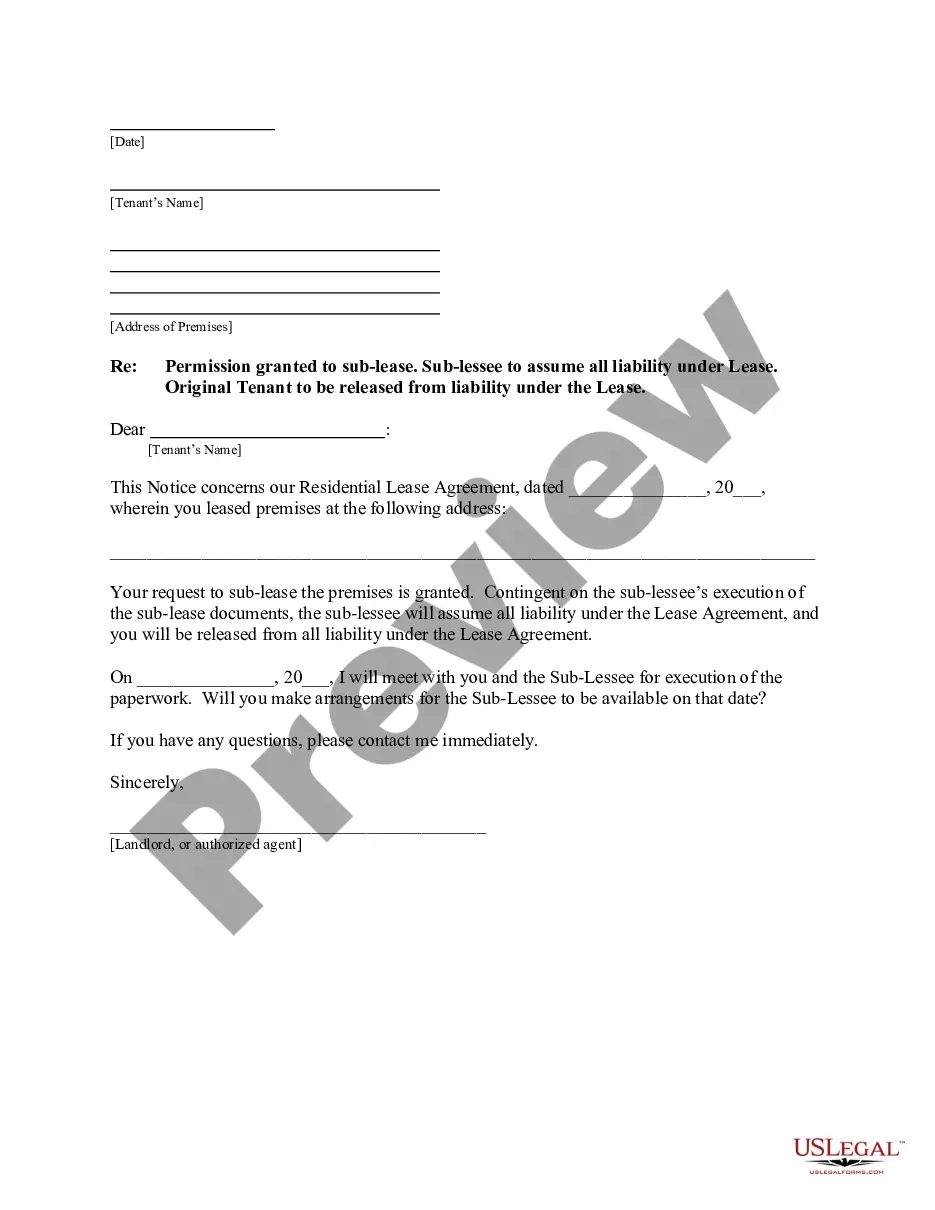

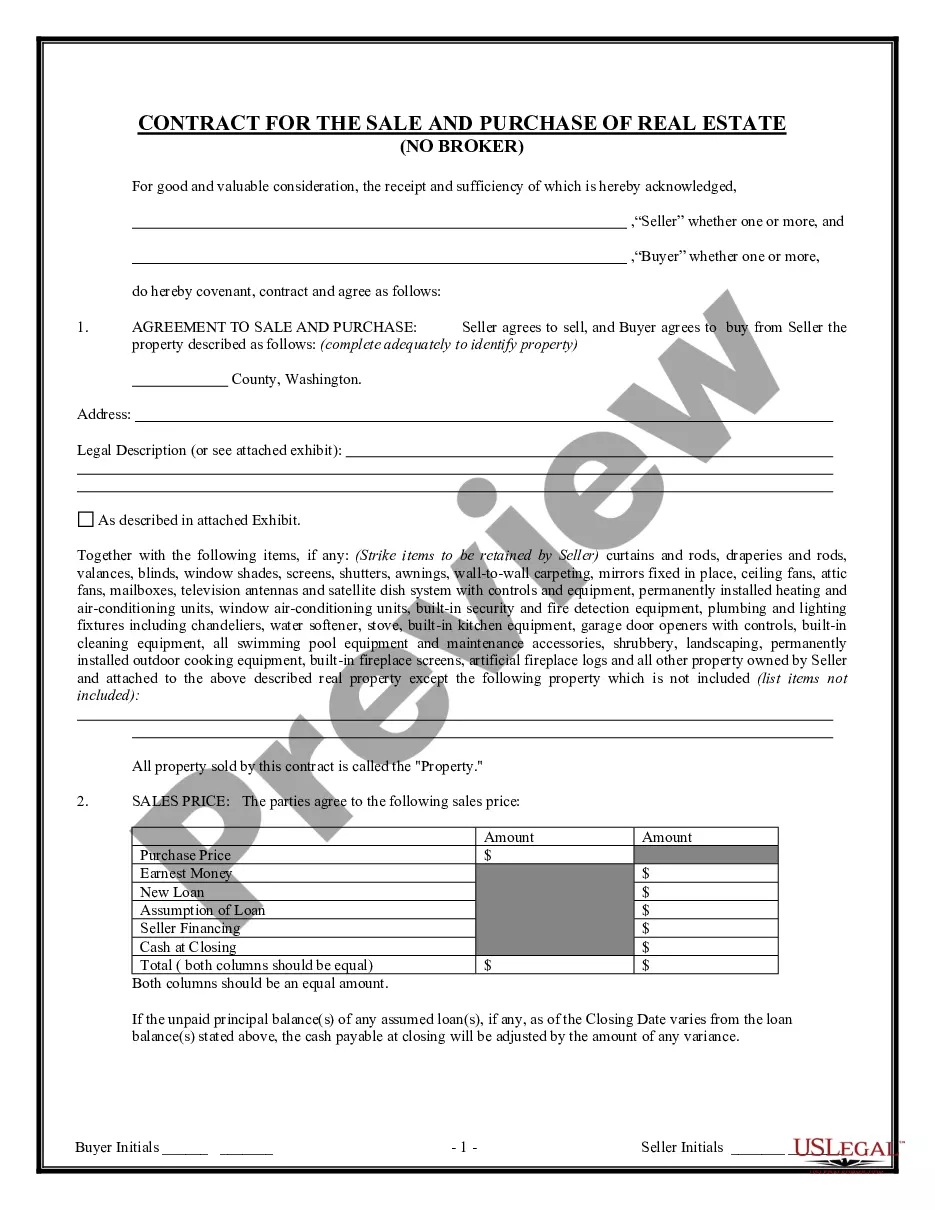

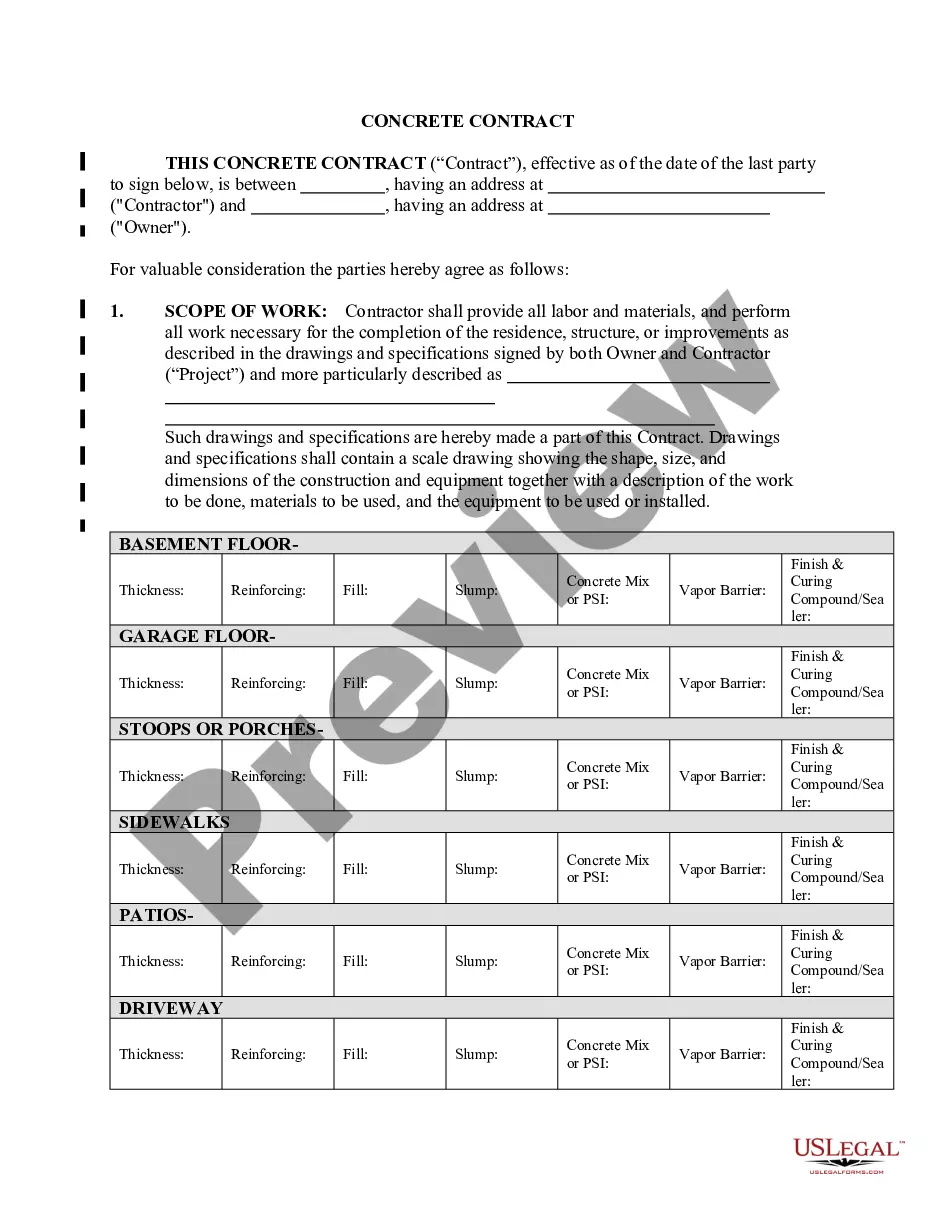

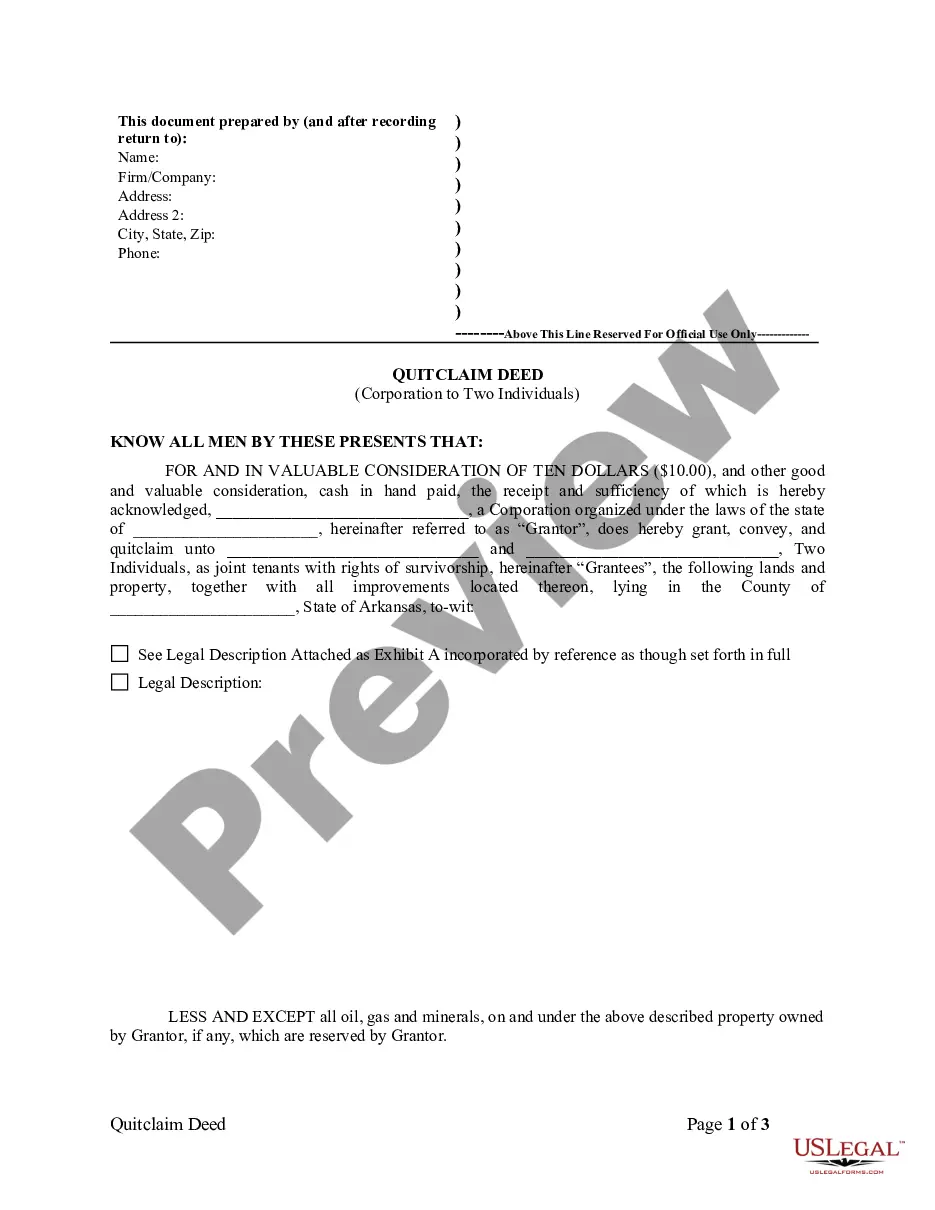

- Examine the page content meticulously to verify it has the sample you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

Institutional investors include the following organizations: credit unions, banks, large funds such as a mutual or hedge fund, venture capital funds, insurance companies, and pension funds. Institutional investors exert a significant influence on the market, both in a positive and negative way.

Private placement is the allotment of securities by a company to institutional investors and some selected individuals. It helps the company to raise funds for capital more quickly than through a public issue.

Six Tips for Effectively Pitching to Institutional Investors1) Create a game plan that prioritizes your prospects. Before embarking on a raise, you need a plan.2) Know your audience.3) Invest time preparing for meetings.4) Know what separates you from the pack.5) Beware of cliches.6) Come across as a fiduciary.

Key terms of the Investment AgreementParties. Existing shareholders and the company.Tranche payments.Completion conditions initial tranche.Initial tranche completion mechanics.Completion conditions subsequent tranches.Subsequent tranche completion mechanics.Warranties.Investor consent regime.More items...?

If you are the client, some of the basic terms you will want to bear in mind are:Authority. The agreement will grant the adviser discretionary or non-discretionary authority.Investment Guidelines.Fees and Expenses.Use of Pooled Vehicles and Other Managers.Custody.Reporting.Brokerage.Voting/Class Actions.More items...?