State Military Law With Largest

Description

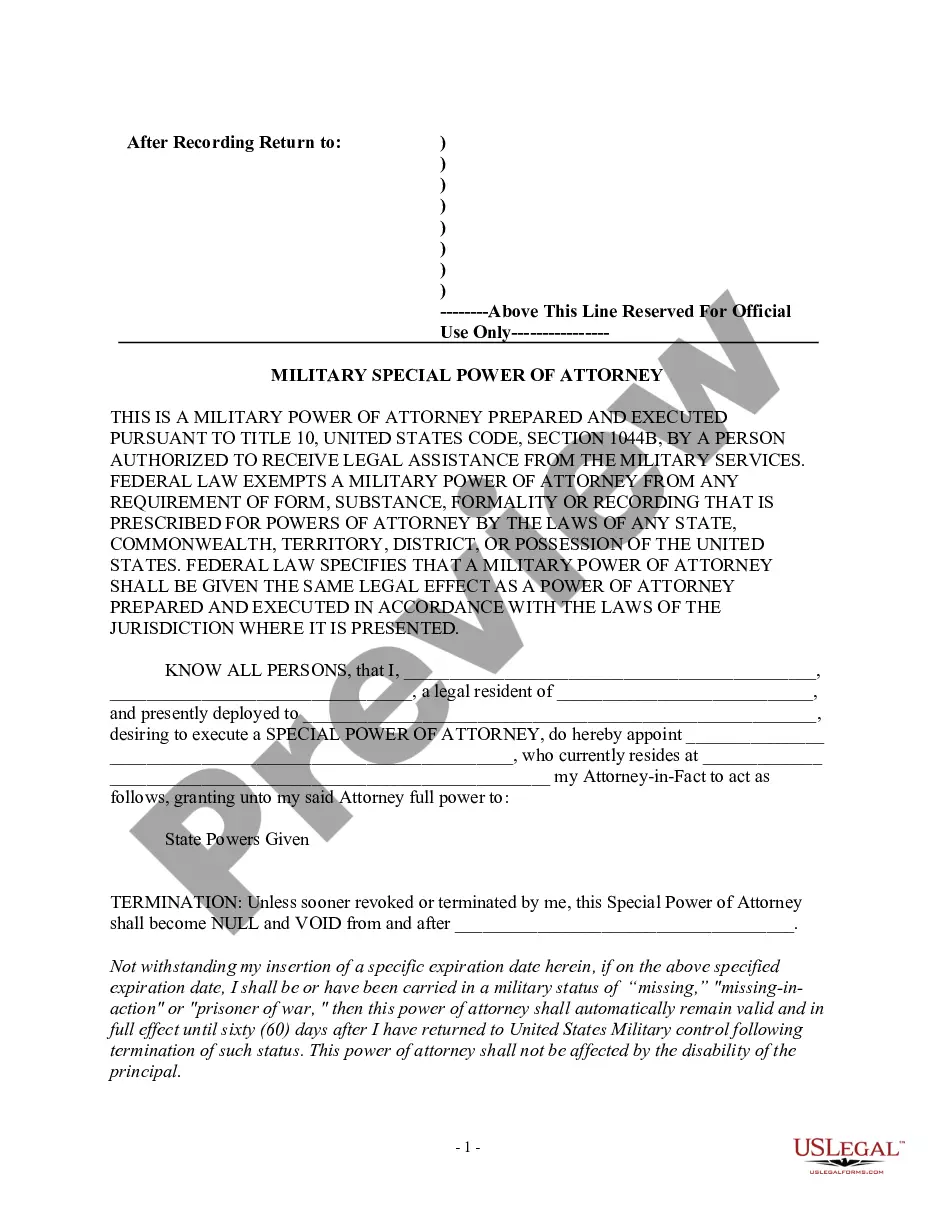

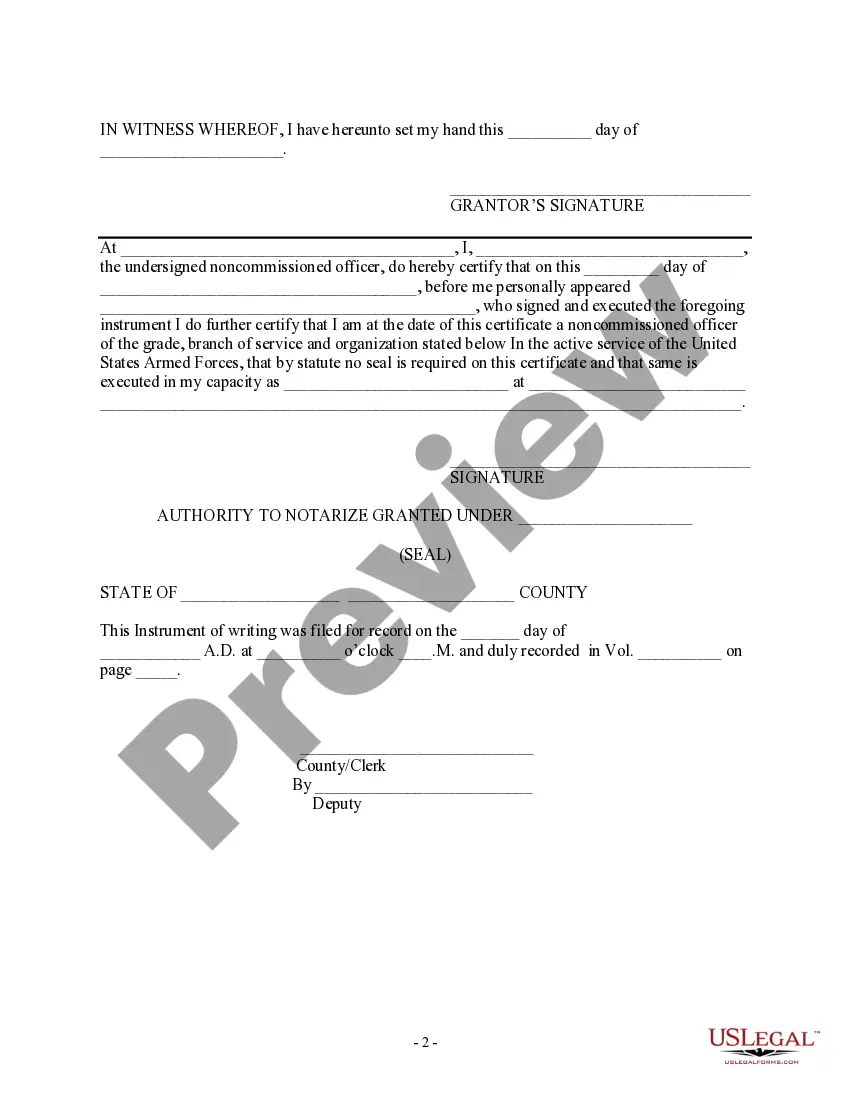

How to fill out Special Military Power Of Attorney?

It’s no secret that you can’t become a law professional immediately, nor can you grasp how to quickly prepare State Military Law With Largest without having a specialized set of skills. Putting together legal documents is a long process requiring a certain education and skills. So why not leave the creation of the State Military Law With Largest to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court papers to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our website and obtain the document you require in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether State Military Law With Largest is what you’re looking for.

- Start your search again if you need any other form.

- Set up a free account and choose a subscription plan to buy the template.

- Choose Buy now. As soon as the payment is through, you can download the State Military Law With Largest, complete it, print it, and send or send it by post to the necessary people or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

However, by law servicemembers are able to maintain a legal residence in one state even if they are stationed in another. This means that if you legally reside in a state with no income tax, then you can avoid paying state income taxes even if you are currently stationed in one with a high state income tax.

Under the SCRA, servicemembers retain the state they claimed when they entered active duty as their state of legal residence unless they take affirmative steps to change their state of legal residence.

So, both the non-military income earned by you and the military income earned by your spouse are exempt from state tax in the duty-station state. This makes military tax filing much simpler overall. Both of you still have to pay income and property taxes in your home state.

If you're in the military, you're probably taxed in your state of legal residence rather than in the state where you're stationed. Filing taxes while deployed can depend on your state of residence as well. To establish legal residence in a state, you usually must prove you live ? and intend to continue living ? there.

States that don't tax military retirement pay Alabama. Arizona. Arkansas. Connecticut. Hawaii. Illinois. Indiana. Iowa.