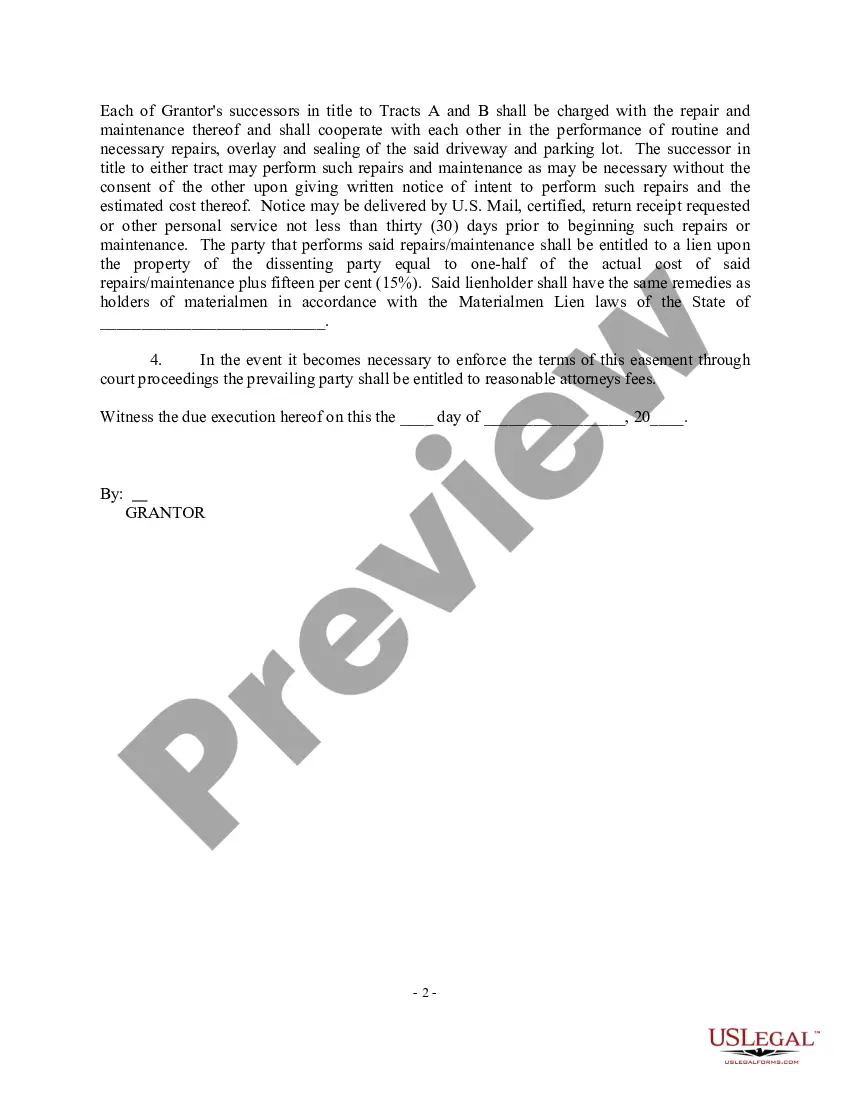

Easement Agreement Form For Driveway

Description

How to fill out Driveway Easement And Shared Parking Agreement?

Acquiring legal document examples that adhere to federal and state regulations is essential, and the internet provides a plethora of choices to select from.

However, why waste time searching for the appropriate Easement Agreement Form For Driveway template online when the US Legal Forms digital library has already compiled such documents in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 fillable templates created by attorneys for various professional and personal circumstances. They are easy to navigate with all documents organized by state and intended use. Our specialists stay informed about legal updates, ensuring that your documents are current and compliant when acquiring an Easement Agreement Form For Driveway from our site.

Click Buy Now once you've found the correct form and choose a subscription plan. Create an account or Log In and process the payment with PayPal or credit card. Select the format for your Easement Agreement Form For Driveway and download it. All templates sourced from US Legal Forms are reusable. To re-download and fill out previously acquired forms, visit the My documents tab in your profile. Enjoy the broadest and most user-friendly legal document service!

- Obtaining an Easement Agreement Form For Driveway is straightforward and fast for both existing and new users.

- If you have an account with an active subscription, Log In and save the document sample you need in the appropriate format.

- If you're new to our website, follow these steps.

- Review the template using the Preview feature or through the text outline to verify it fulfills your needs.

- Use the search function at the top of the page to find another sample if necessary.

Form popularity

FAQ

A copy of your federal tax return unless your federal return reflects a North Carolina address. Other required North Carolina forms or supporting schedules.

Each individual will need to file a separate North Carolina income tax return on Form D-400 using the filing status of single or, if qualified, head of household or qualifying widow(er).

If you don't qualify for NC Free File, you can still eFile for a Fee using a competitively priced online eFile provider. Available for current, amended, and prior year returns and payments.

A taxpayer who is not granted an automatic extension to file a federal income tax return must file Form D-410, Application for Extension for Filing Individual Income Tax Return, by the original due date of the return in order to receive an extension for North Carolina income tax purposes.

How to Get Forms To download forms from this website, go to NC Individual Income Tax Forms. To order forms, call 1-877-252-3052. Touch tone callers may order forms 24 hours a day, seven days a week. You may also obtain forms from a service center or from our Order Forms page.

Each payment of estimated tax must be accompanied by Form NC-40, North Carolina Individual Estimated Income Tax. You can also pay your estimated tax online. (For more information on estimated income tax, see the Department's website.)

If you don't qualify for NC Free File, you can still eFile for a Fee using a competitively priced online eFile provider. Available for current, amended, and prior year returns and payments.

Filing Requirements Chart for Tax Year 2022 Filing StatusA Return is Required if Federal Gross Income ExceedsSingle$12,750Married - Filing Joint Return$25,500Married - Filing Separate ReturnIf spouse does not claim itemized deductions$12,7504 more rows