Example Of Form 8949 For Home Sale

Description

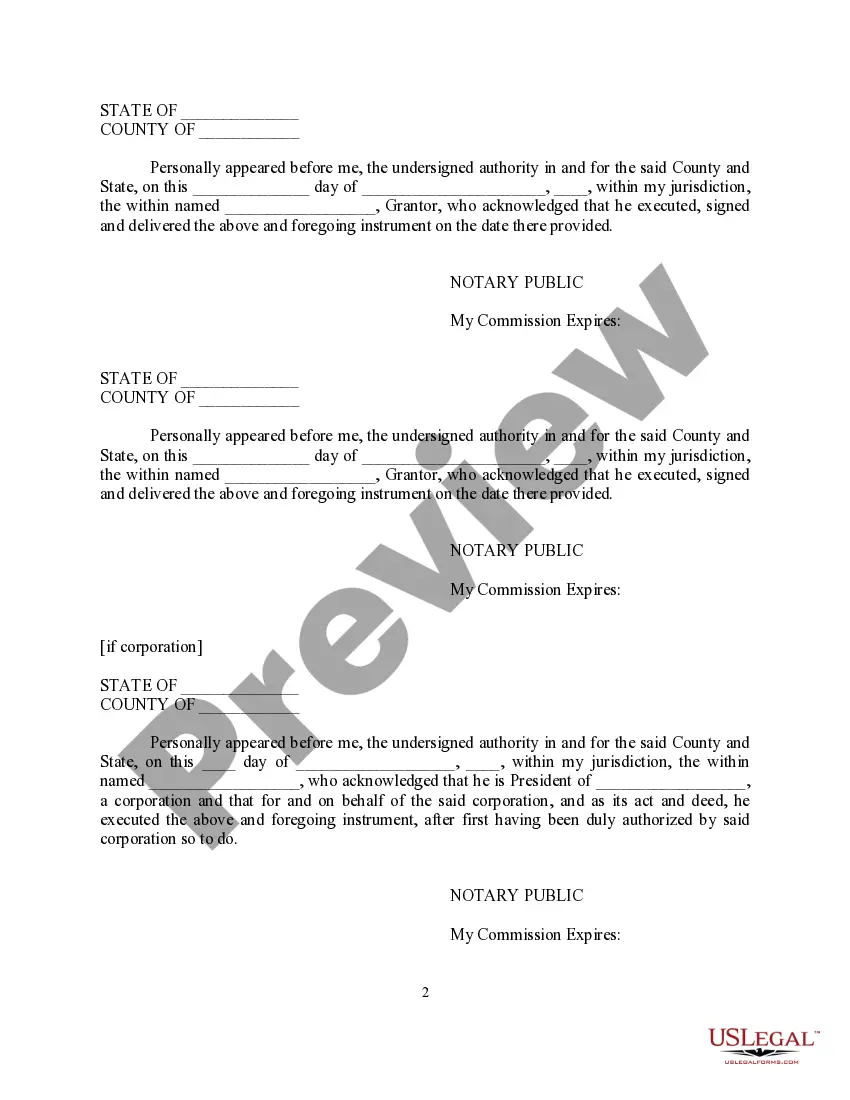

How to fill out General Right Of Way Instrument?

It’s widely acknowledged that you cannot become a legal authority swiftly, nor can you discover how to efficiently prepare Example Of Form 8949 For Home Sale without possessing a specialized skill set.

Assembling legal documents is a labor-intensive task that demands a certain level of education and expertise. Therefore, why not entrust the preparation of the Example Of Form 8949 For Home Sale to the professionals.

With US Legal Forms, one of the most comprehensive legal template collections, you can find everything from court documents to templates for in-office correspondence.

You can regain access to your documents from the My documents section at any time. If you’re a returning client, you can simply Log In and find and download the template from the same section.

Regardless of the purpose of your paperwork—whether it is financial, legal, or personal—our platform has you covered. Try US Legal Forms today!

- Find the document you require by utilizing the search bar at the top of the webpage.

- Preview it (if this feature is available) and review the accompanying description to ascertain whether Example Of Form 8949 For Home Sale is what you’re seeking.

- Start your search anew if you’re looking for a different document.

- Sign up for a free account and select a subscription plan to purchase the document.

- Click Buy now. Once the payment is processed, you can download the Example Of Form 8949 For Home Sale, complete it, print it, and send it by mail to the designated recipients or organizations.

Form popularity

FAQ

As you complete Form 8949, you'll need a few different pieces of information, including the date you acquired the property, the date you sold the property, the sales price (amount the property was sold for), and the cost or other basis (amount you paid for the property plus any fees or commissions).

You don't have to file Schedule D if you don't have any capital gains or losses to report from investments or from a business venture or partnership.

The form includes Part I and Part II to separate short-term capital gains and losses from long-term capital gains and losses, as they are subject to different tax rates. Users of Form 8949 also need to complete a Schedule D and file a Form 1099-B, which is provided by brokerages to individual taxpayers.

If you sold some stocks this year, you're probably aware that you will need to include some information on your tax return. What you may not realize, is that you'll need to report every transaction on an IRS Form 8949 in addition to a Schedule D.

Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return.