Letter For Debt Settlement

Description

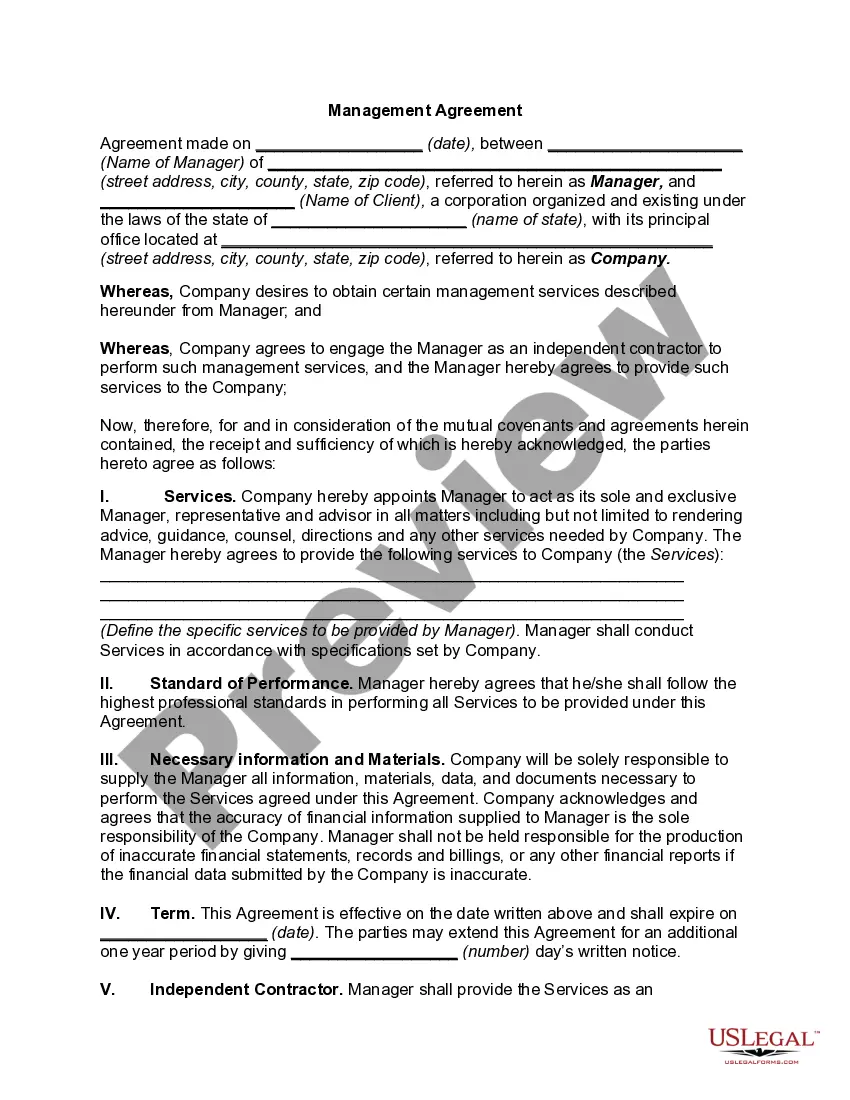

How to fill out Notice Letter To Debt Collector Of Section 808 Violation - Unfair Practices?

There is no longer a necessity to spend countless hours searching for legal forms to fulfill your local state obligations. US Legal Forms has gathered all necessary documents in one location and streamlined their access.

Our platform offers over 85k templates for various business and personal legal situations compiled by state and use case. All documents are properly composed and confirmed for legitimacy, ensuring you receive an up-to-date Letter For Debt Settlement.

If you are accustomed to our platform and already possess an account, please verify that your subscription is active before obtaining any templates. Log In to your account, select the document, and click Download. You can also return to all saved documents at any time by accessing the My documents section in your profile.

Print your form to fill it out manually or upload the sample if you prefer to complete it in an online editor. Preparing formal documents under federal and state legislation is quick and simple with our library. Try out US Legal Forms today to keep your records organized!

- If you are new to our platform, the process will require a few additional steps to complete.

- Examine the page content closely to confirm it contains the sample you seek.

- To aid in this, utilize the form description and preview options if available.

- Make use of the search bar above to find an alternative sample if the one you see does not meet your needs.

- Click Buy Now next to the template title once you identify the correct one.

- Select the most appropriate pricing plan and register for an account or Log In.

- Complete your subscription payment using a card or through PayPal to move forward.

- Choose the file format for your Letter For Debt Settlement and download it to your device.

Form popularity

FAQ

To write a full and final settlement letter, start by clearly stating your intention to settle your debt. Include relevant details such as your account number, the amount you owe, and the settlement amount you propose. Be sure to communicate the terms of the agreement, emphasizing that this will resolve the debt in full. Using a template from US Legal Forms can streamline this process, ensuring your letter is both professional and legally sound.

To make a final settlement offer, assess your financial situation to determine a feasible amount. Contact the creditor and present your offer, ensuring you express your intention to settle quickly. Request a letter for debt settlement confirming the reduced amount accepted by the creditor. This written agreement is essential for your records and peace of mind.

Yes, debt settlement letters can be effective if crafted correctly. By providing a clear offer and requesting a written agreement, you create a legally binding record for both parties. This clarity reduces misunderstandings and helps ensure that the settlement is honored. A letter for debt settlement can protect you and promote a smoother resolution.

Start by reviewing your financial situation to determine a reasonable settlement offer. When you contact your creditor, express your desire to settle the debt and present your offer based on what you can afford. Be firm but polite, and stress that you are seeking a letter for debt settlement to document any agreement. This written confirmation is vital for both parties’ protection.

To request a letter for final settlement, start by contacting the creditor directly. Clearly communicate your intention to settle the debt and ask for written confirmation of the terms, including the total amount. Make sure to specify that you would like a letter detailing the final settlement. This letter is crucial for keeping records and ensuring both parties agree on the settlement terms.

The 777 rule suggests that debt collectors should cease communication if you have not responded to their letters after three attempts over seven days. Understanding this can empower you, especially when dealing with harassment. In your letter for debt settlement, you can mention this rule to remind creditors of your rights, and to ensure that they adhere to legal practices. Utilizing this knowledge can aid you in creating a fair resolution with your creditors.

Writing a debt settlement letter involves clearly stating your intention to settle your debt for a reduced amount. Start by including your account details and the proposed lump-sum offer. In the letter for debt settlement, explain your financial situation, express your willingness to resolve the debt, and ask for a written agreement in return. This approach can help establish a legal record of your agreement.

During your negotiations, emphasize your desire to settle the debt while acknowledging your financial constraints. Use concise language and make your offer realistic, keeping in mind what you can afford. Reinforce your commitment to settling the account by referring to your letter for debt settlement as evidence of good faith.

When trying to settle a debt, focus on being honest about your financial difficulties. Clearly state your offer and back it up with a solid explanation of your situation. Make your intentions clear by mentioning your letter for debt settlement, as this will solidify your commitment to resolving the matter swiftly and with respect.

To write a letter to clear debt, start by addressing the creditor and clearly stating your intent to settle the debt. Include your account number, the amount owed, and your proposed settlement offer. Remember to express your willingness to resolve the issue amicably, and refer to your letter for debt settlement as a means of formal communication.