There's no longer a necessity to spend time searching for legal documents to fulfill your local state obligations. US Legal Forms has gathered all of them in a single location and streamlined their availability.

Our website provides over 85,000 templates for various business and individual legal circumstances organized by state and usage area. All forms are correctly drafted and verified for accuracy, so you can be confident in obtaining a current Letter Authorized Form Withdrawal.

If you're acquainted with our service and already possess an account, it's essential to confirm that your subscription is active before accessing any templates. Log In to your account, choose the document, and click Download. You also have the option to revisit all saved documents whenever needed by opening the My documents tab in your profile.

Print your form to complete it by hand or upload the sample if you wish to do it using an online editor. Creating official documents in accordance with federal and state laws and regulations is fast and easy with our library. Experience US Legal Forms today to keep your paperwork organized!

- If you have not previously used our service, the process will involve a few additional steps to complete.

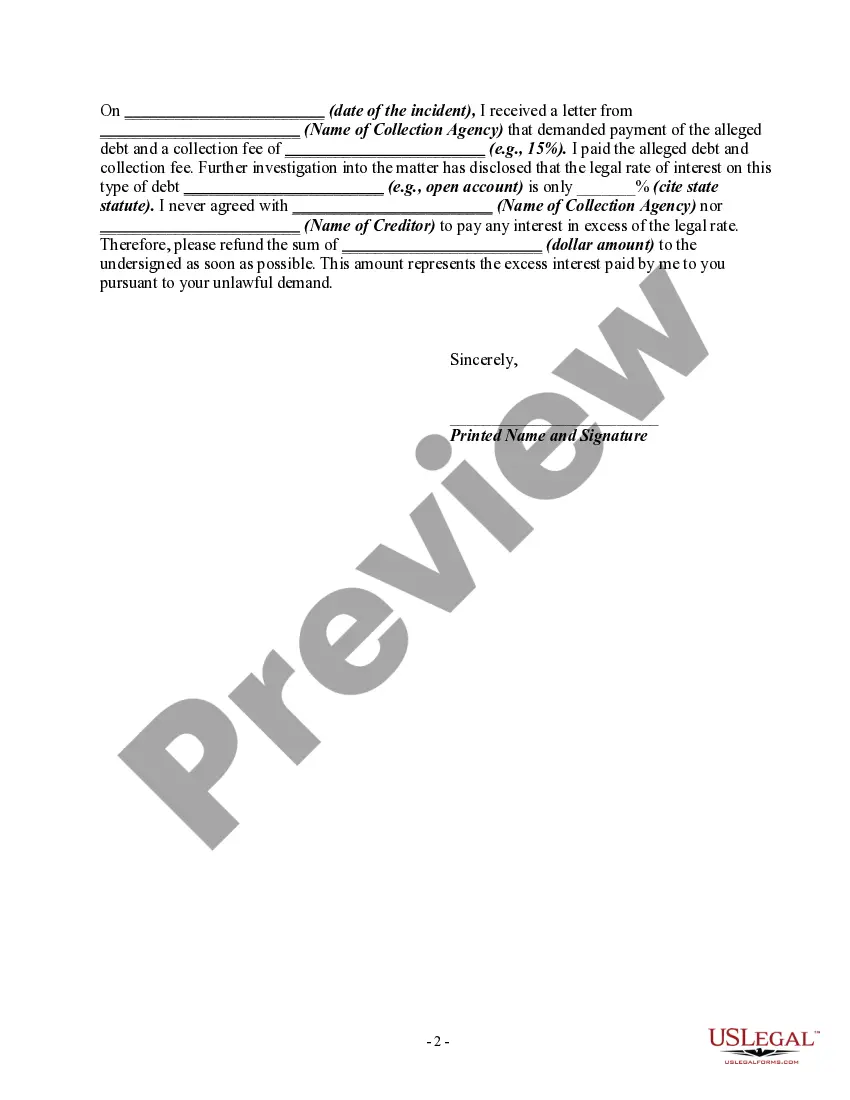

- Review the page content carefully to confirm it has the sample you require.

- To accomplish this, utilize the form description and preview options if available.

- Employ the Search field above to find another template if the prior one didn't fit your needs.

- Click Buy Now next to the template title after you've located the correct one.

- Choose your preferred subscription plan and either register for an account or Log In.

- Process your subscription payment by credit card or via PayPal to continue.

- Select the file format for your Letter Authorized Form Withdrawal and download it to your device.

How to withdraw (or cancel) your RTO registration. Get a letter from VU with your enrolment details from previous study periods.If you are not able to complete a form or require assistance please do not hesitate to contact Student Administration on your campus as listed below. Fill out the International Student Letter Request form. Registration Deposit Payment Record of registration deposit payment. Find all the forms, fact sheets and documents you need for your UniSuper account. If you have completed the generic ATO Super standard choice form, attach this letter to your form to give to your employer. Disability. Principles and requirements to enable the full and equitable participation of students with disabilities. Complete this form if you want to suspend your bank direct debit for one or more payments.