Violation Fair Debt With Bad Credit

Description

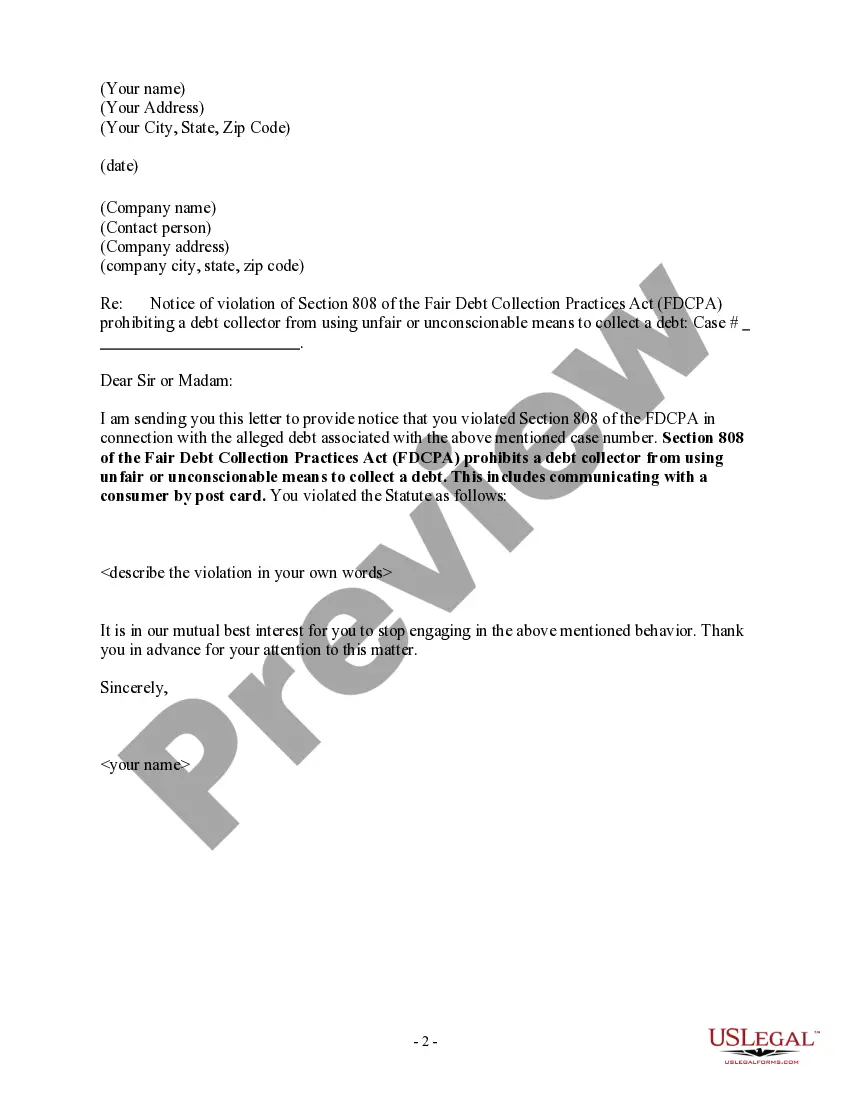

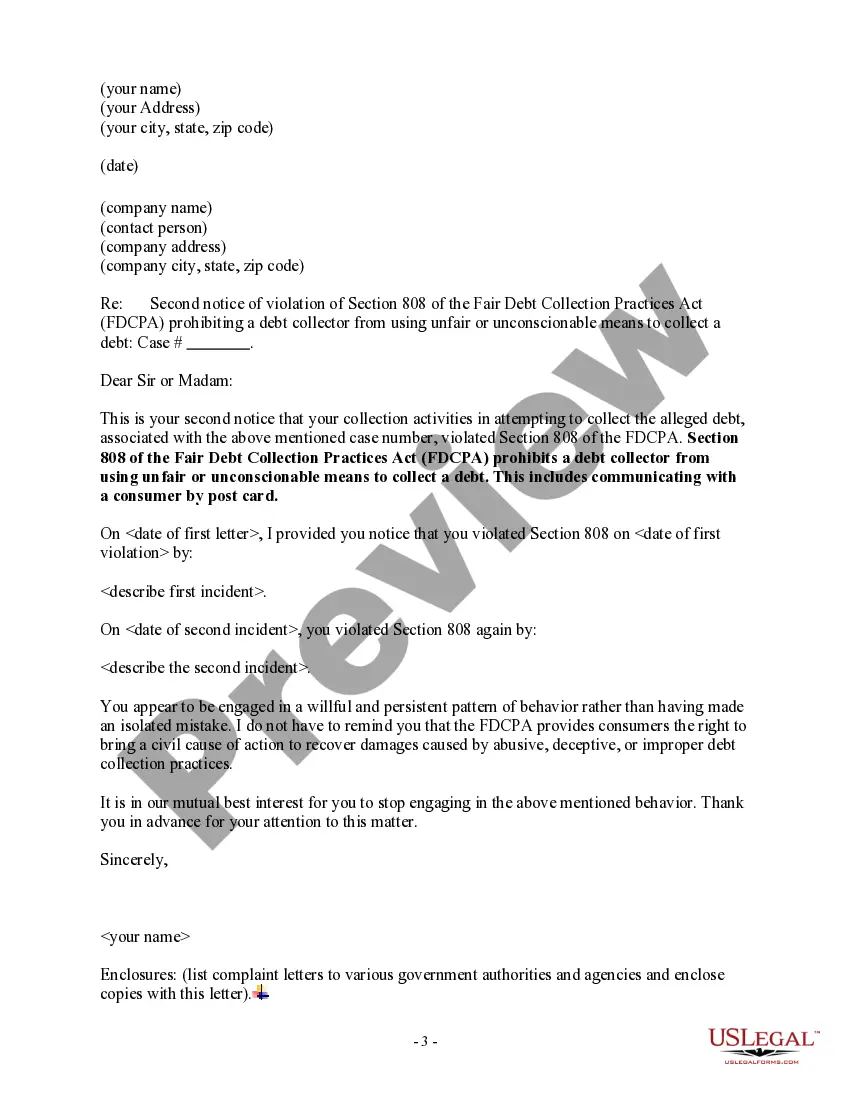

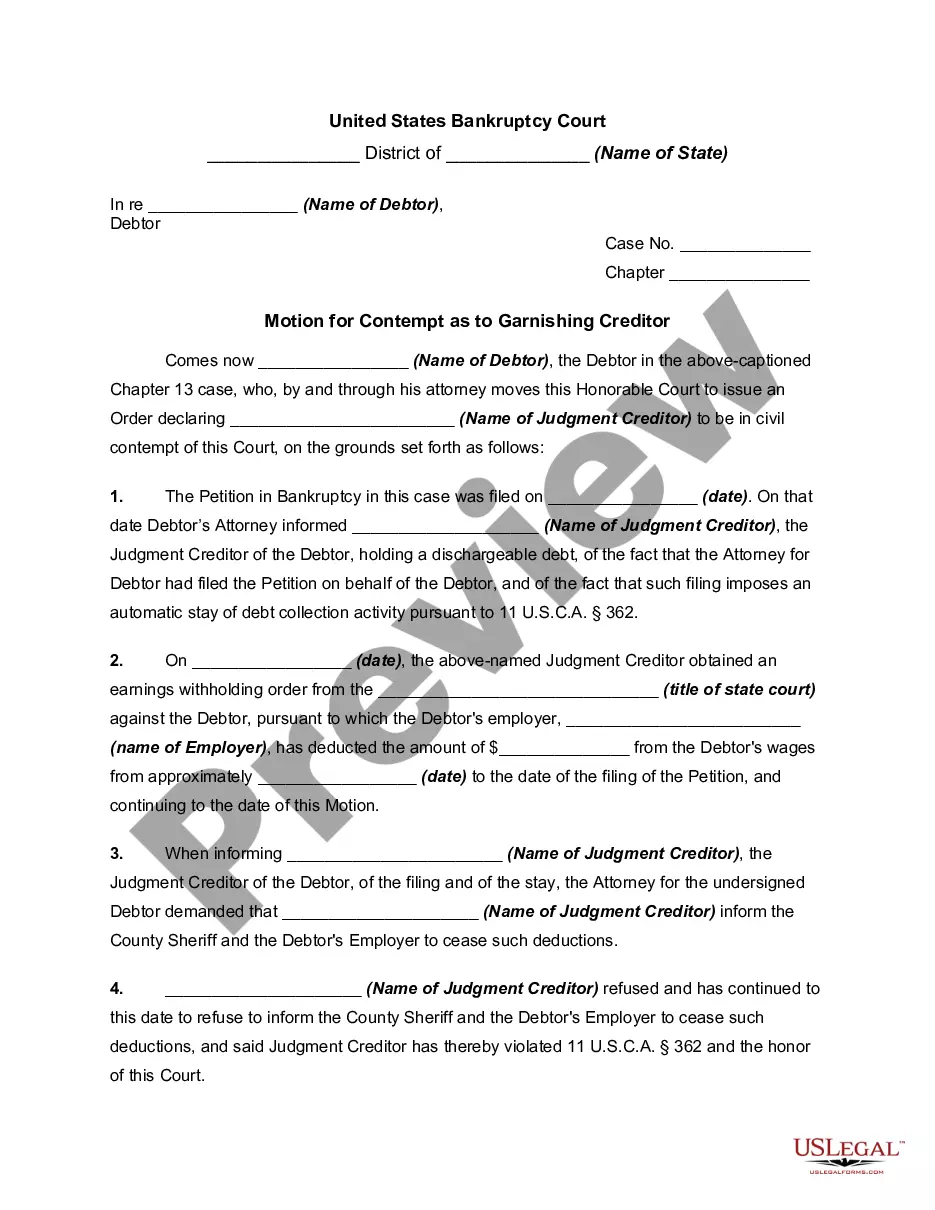

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

There's no longer a requirement to waste time searching for legal documents to fulfill your local state obligations. US Legal Forms has consolidated all of them in a single location and simplified their accessibility.

Our site offers over 85,000 templates for any business and personal legal matters organized by state and area of application. All forms are meticulously crafted and verified for accuracy, allowing you to feel confident in acquiring an up-to-date Violation Fair Debt With Bad Credit.

If you are acquainted with our platform and already possess an account, ensure your subscription is current before downloading any templates. Log In to your account, choose the document, and click Download. You can also access all previously saved documents anytime by selecting the My documents tab in your profile.

Print your form to fill it out by hand or upload the document if you prefer using an online editor. Creating legal documents in accordance with federal and state regulations is quick and easy with our library. Try US Legal Forms today to keep your paperwork organized!

- If you've never interacted with our platform before, completing the process will require a few additional steps.

- Here's how new users can find the Violation Fair Debt With Bad Credit in our library.

- Examine the page content closely to ensure it includes the sample you need.

- Use the form description and preview options if available.

- Use the Search field above to find another template if the current one isn’t suitable.

- Click Buy Now next to the template name once you identify the correct one.

- Choose the most appropriate subscription plan and sign up for an account or Log In.

- Pay for your subscription using a card or via PayPal to proceed.

- Select the file format for your Violation Fair Debt With Bad Credit and download it to your device.

Form popularity

FAQ

You can apply for debt consolidation even if you have bad credit, but approval may be tougher. Some lenders specialize in working with individuals facing these challenges, but terms might not be favorable. Addressing any issues related to violations of fair debt practices can strengthen your application. Consider exploring solutions available through US Legal Forms to enhance your ability to consolidate your debts.

Yes, you can consolidate your debt with a bad credit score, although your options may be limited. Lenders may offer alternative solutions, but be prepared for higher interest rates. It’s crucial to address any violations concerning fair debt while navigating these options. Seeking guidance through US Legal Forms can provide clarity and help you understand your choices better.

There isn't a universal minimum credit score for debt consolidation, as this can vary by lender, but many prefer scores above 600. If your score is below this threshold, you may face challenges, particularly if you have a record of violations related to fair debt with bad credit. Improving your financial profile, even slightly, can enhance your chances. Utilizing resources from US Legal Forms can help you identify ways to manage your debts effectively.

You may get denied for debt consolidation due to your credit score, income, or overall debt-to-income ratio. Lenders assess your financial history to determine risk. If you have violations related to fair debt practices, this can further complicate your chances of approval, especially with bad credit. It’s important to evaluate your financial situation and consider options like US Legal Forms to better understand your rights and potential solutions.

If a collection agency refuses to validate your debt, you should assert your rights under the Fair Debt Collection Practices Act. Requesting validation helps protect you from paying debts that may not be yours or are incorrectly attributed to you. A violation of fair debt with bad credit can occur if the agency fails to provide proper documentation. Utilizing services like USLegalForms can guide you through asserting your rights effectively and resolving the situation.

The worst a debt collector can do includes harassing you through repeated calls and threatening legal action without basis. Such actions often violate fair debt practices and can be reported. Knowing your rights regarding violations of fair debt with bad credit is critical for your protection. If you face extreme harassment, resources like US Legal Forms can guide you in taking proper legal action.

To escape deep debt, start by creating a realistic repayment plan. Consider reaching out to your creditors to discuss possible options, particularly if they have violated fair debt practices. Resources like US Legal Forms can provide you with templates to initiate dialogue with your creditors or to explore legal options. Taking these steps can ease your path out of debt, even when finances are tight.

One of the most common violations involves debt collectors contacting you at inconvenient times or places, such as late at night. This is not only unlawful but also adds stress, especially if you are dealing with financial hardship. Understanding your rights in regards to violations of fair debt with bad credit can help you take action against unethical practices. Always document any such violations for further action.

Getting out of debt starts with creating a budget and prioritizing your payments. You might consider negotiating with creditors, particularly if they have violated fair debt guidelines. Utilize resources like US Legal Forms to explore your legal rights and options. These steps will empower you to regain control over your finances, even with bad credit.

Yes, you can dispute inaccuracies on your credit report, and some bad debts may be removed. If a debt collector violates fair debt regulations, this can strengthen your case for removal. You can utilize tools from platforms like US Legal Forms to navigate disputes effectively. Remember that documenting any violations of fair debt with bad credit enhances your chances of a successful dispute.