Code Escrow Agreement Withholding

Description

How to fill out User Oriented Source Code Escrow Agreement?

How to obtain professional legal documents that comply with your state regulations and prepare the Code Escrow Agreement Withholding without resorting to a lawyer.

Numerous services online provide templates for various legal situations and protocols. However, it may require time to ascertain which of the accessible samples meet both your intended use and legal standards.

US Legal Forms is a reliable platform that assists you in finding official documents created according to the most recent updates in state law, while also allowing you to save on legal fees.

If you do not have an account with US Legal Forms, follow the instructions below: Review the web page you’ve opened and verify if the form meets your requirements. To do this, utilize the form description and preview options if they are available. Search for an alternate template in the header providing your state if necessary. Click the Buy Now button once you identify the appropriate document. Choose the most suitable pricing plan, then Log In or pre-register for an account. Select the payment method (by credit card or through PayPal). Change the file format for your Code Escrow Agreement Withholding and click Download. The acquired templates remain in your possession: you can always retrieve them in the My documents section of your profile. Join our platform and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not a typical online library.

- It consists of over 85,000 verified templates catering to different business and personal circumstances.

- All documents are categorized by area and state, streamlining your search process.

- Moreover, it integrates with robust tools for PDF editing and electronic signatures, allowing users with a Premium subscription to conveniently fill out their documents online.

- It requires minimal effort and time to obtain the necessary paperwork.

- If you already possess an account, Log In and confirm that your subscription is active.

- Download the Code Escrow Agreement Withholding by clicking the relevant button adjacent to the file name.

Form popularity

FAQ

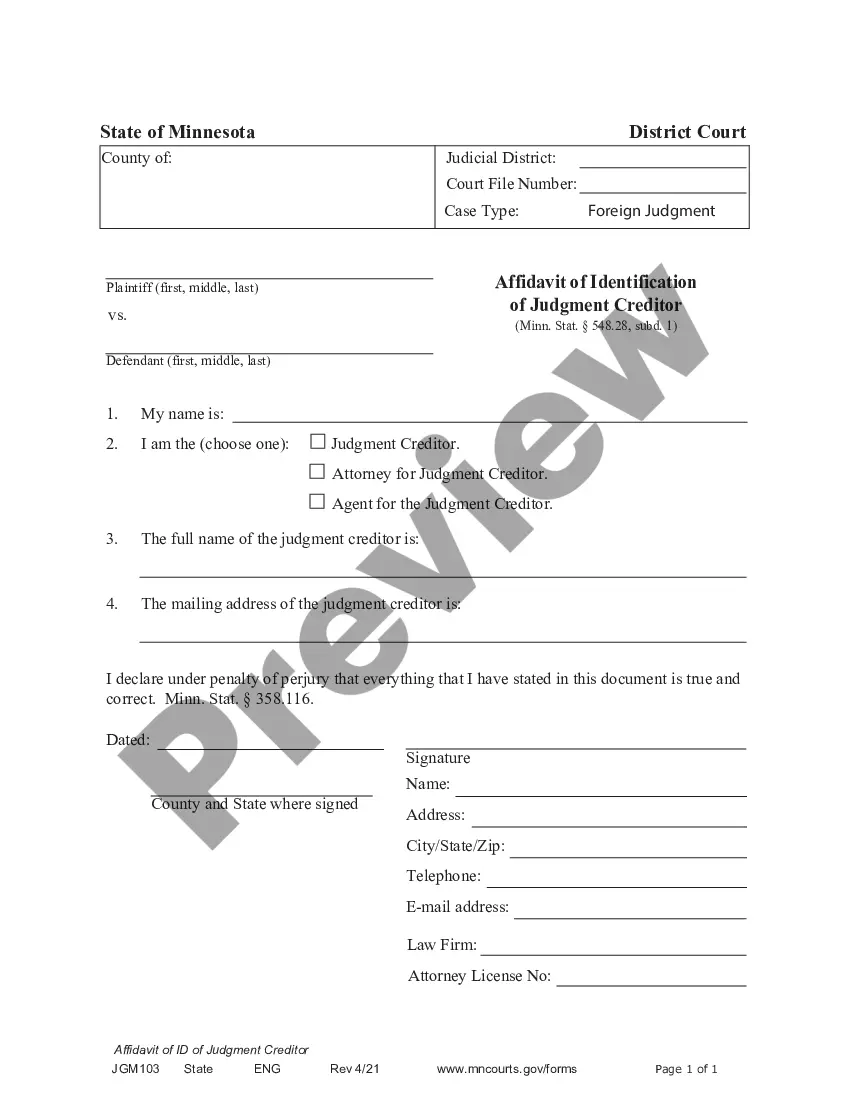

You are required to use the Electronic Federal Tax Payment System (EFTPS), discussed later, to deposit the tax withheld and required to be shown on Form 1042 (regardless of whether withholding was applied under chapter 3 or 4 or with respect to a specified federal procurement payment).

A. Purpose. Use Form 593: Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. Estimate the amount of the seller's/transferor's loss or zero gain for withholding purposes and to calculate an alternative withholding calculation amount.

Form 590 is certified (completed and signed) by the payee. California residents or entities exempt from the withholding requirement should complete Form 590 and submit it to the withholding agent before payment is made.

All remitters are required to complete the applicable part(s) of Form 593 and submit Sides 1-3 to the Franchise Tax Board (FTB) regardless of the real estate transaction. Real Estate Withholding Requirement -Withholding is required when California real estate is sold or transferred.

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.