1099 Sales Rep Agreement Template With Notary

Description

How to fill out Independent Sales Representative Agreement?

Drafting legal paperwork from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more affordable way of creating 1099 Sales Rep Agreement Template With Notary or any other paperwork without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual catalog of over 85,000 up-to-date legal documents addresses virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific templates diligently prepared for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can quickly locate and download the 1099 Sales Rep Agreement Template With Notary. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and explore the catalog. But before jumping directly to downloading 1099 Sales Rep Agreement Template With Notary, follow these recommendations:

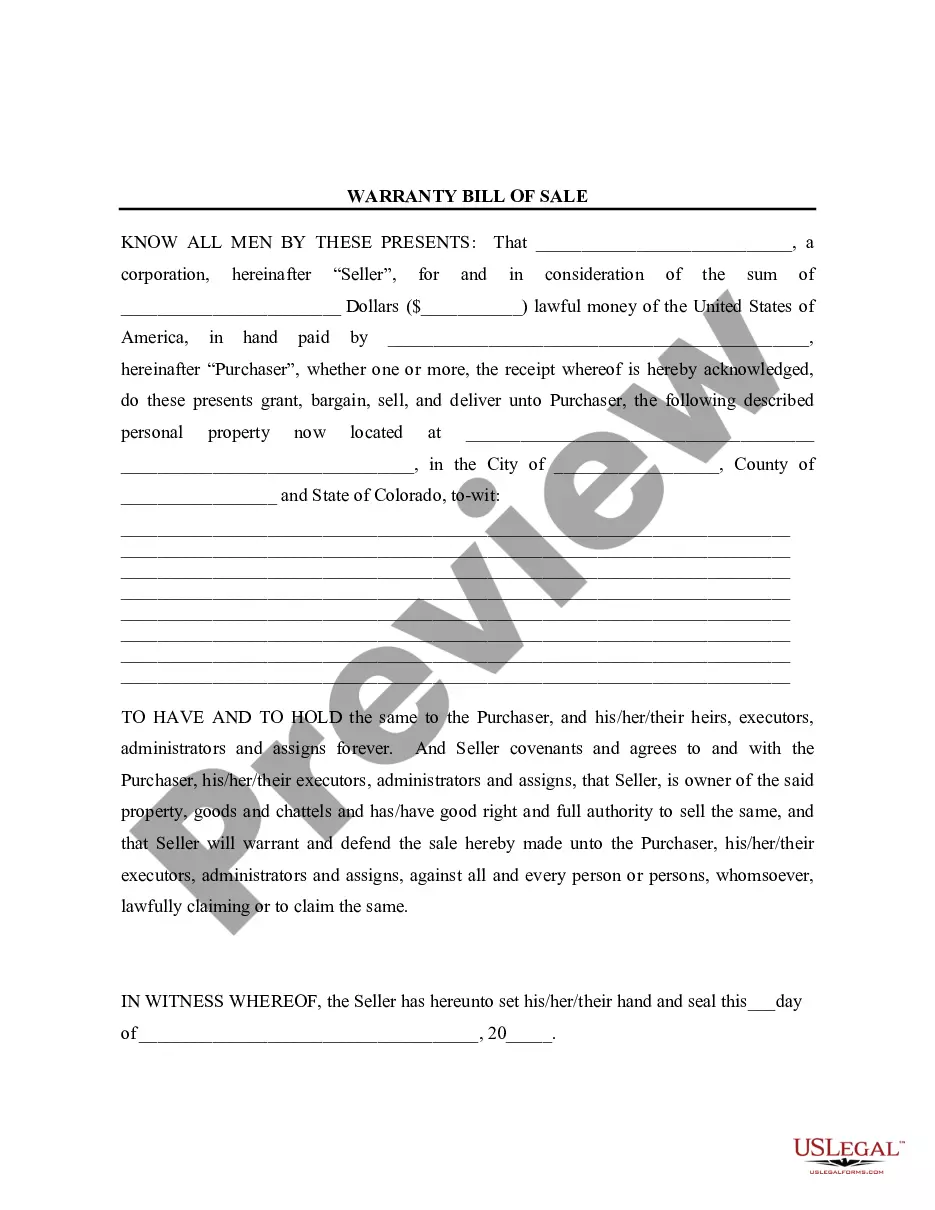

- Check the document preview and descriptions to ensure that you have found the form you are searching for.

- Check if form you choose complies with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the 1099 Sales Rep Agreement Template With Notary.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and transform form execution into something simple and streamlined!

Form popularity

FAQ

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

Even though 1099 employees are not traditional W-2 employees, it's still a good idea to have a written agreement in place. This agreement should outline the expectations of both the 1099 employee and the employer.

A 1099 commission sales representative is a professional who works as a freelancer, independent contractor or as a self-employed professional. They're often hired by employers to complete a specific, temporary task. Employers typically don't pay these representatives a salary since they're hired as a contractor.

A salesperson is an individual engaged in the selling of merchandise or services. The salesperson can be a common law employee, an independent contractor, an employee by specific statute, or an excluded employee by specific statute.

Ing to the Internal Revenue Service, you must have considered the sales rep to be an independent contractor for the entire tax year, not have a W-2 employee performing the same tasks as the contractor, treat the sales rep as a contractor on all of your tax filings and have a sound reason for considering him a ...