1099 Sales Rep Agreement Template For Software

Description

How to fill out Independent Sales Representative Agreement?

Creating legal documents from the beginning can occasionally be daunting. Specific situations may require extensive investigation and significant financial investment.

If you seek a simpler and more cost-effective method for drafting the 1099 Sales Rep Agreement Template For Software or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can promptly access state- and county-specific templates meticulously prepared by our legal experts.

Visit our website whenever you require a dependable and trustworthy service to swiftly find and download the 1099 Sales Rep Agreement Template For Software. If you are already familiar with our services and have previously established an account, simply Log In to your account, choose the form, and download it immediately or retrieve it again at any time from the My documents section.

Verify that the template you choose meets the criteria of your state and county. Select the most suitable subscription plan to purchase the 1099 Sales Rep Agreement Template For Software. Download the form, then complete, validate, and print it out. US Legal Forms prides itself on a strong reputation and over 25 years of expertise. Join us today and make form completion a simple and efficient process!

- Not registered yet? No issue.

- Setting it up is quick and easy, allowing you to navigate the library.

- However, before you proceed to download the 1099 Sales Rep Agreement Template For Software, consider these suggestions.

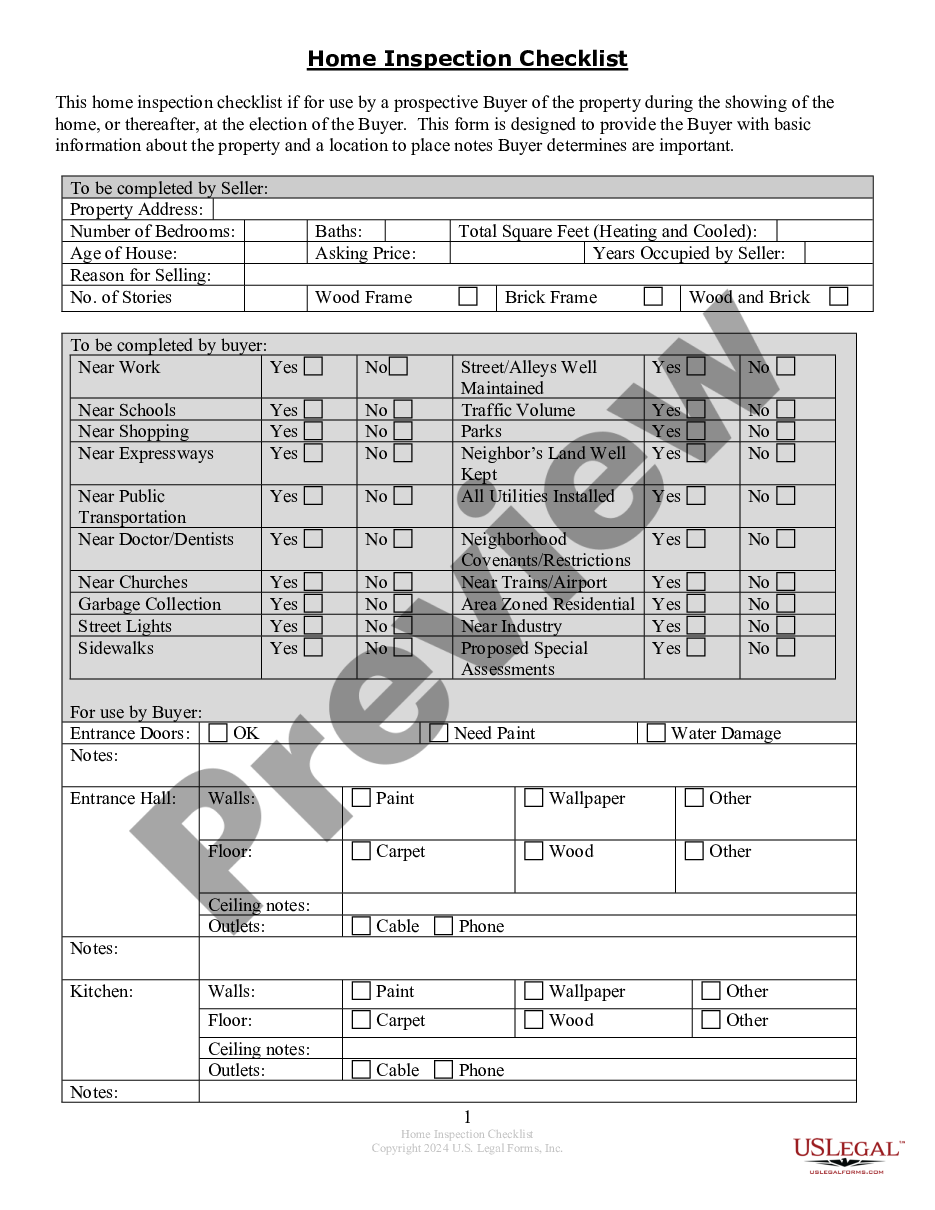

- Examine the form preview and descriptions to ensure you have located the document you need.

Form popularity

FAQ

A sales representative contract is a legal agreement between a particular company and the sales executive/representative who acts on the company's behalf to execute sales services. It provides clear guidelines for the terms of employment, compensation, and termination.

A salesperson is an individual engaged in the selling of merchandise or services. The salesperson can be a common law employee, an independent contractor, an employee by specific statute, or an excluded employee by specific statute.

Ing to the Internal Revenue Service, you must have considered the sales rep to be an independent contractor for the entire tax year, not have a W-2 employee performing the same tasks as the contractor, treat the sales rep as a contractor on all of your tax filings and have a sound reason for considering him a ...

A 1099 commission sales representative is a professional who works as a freelancer, independent contractor or as a self-employed professional. They're often hired by employers to complete a specific, temporary task. Employers typically don't pay these representatives a salary since they're hired as a contractor.

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.