Malpractice Insurance Tail Coverage Cost

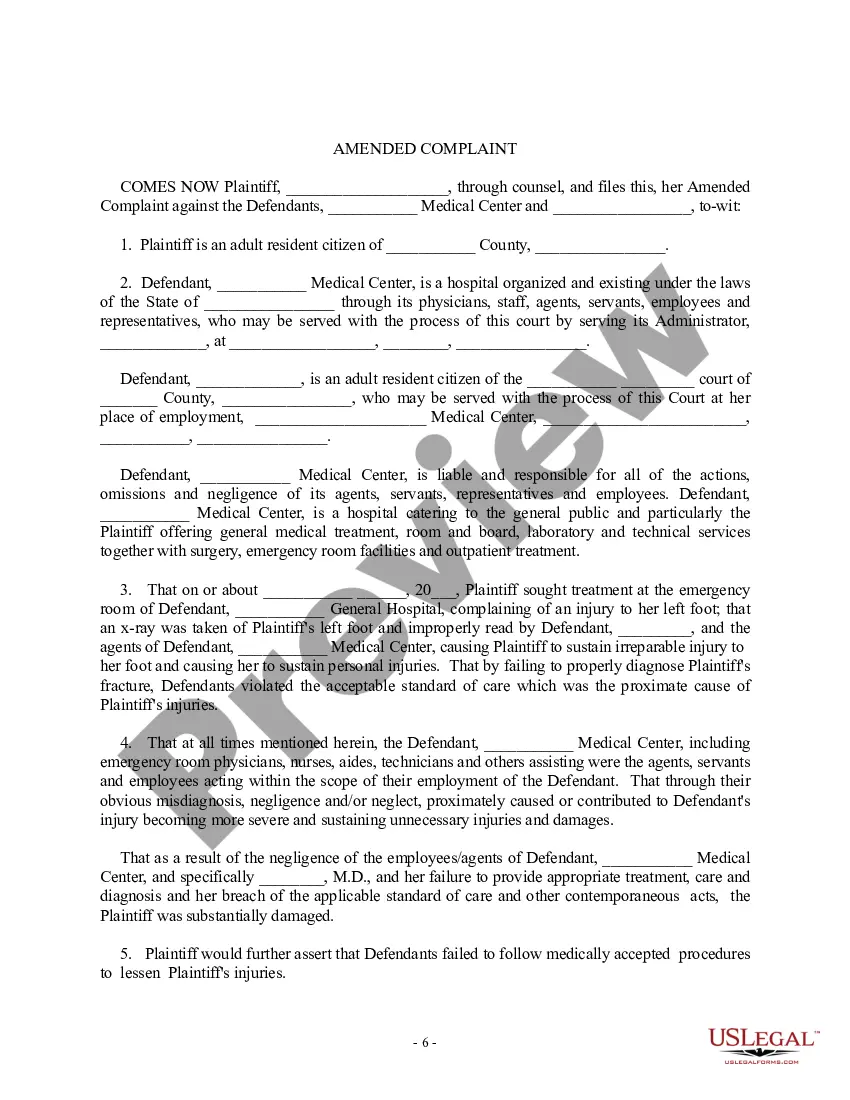

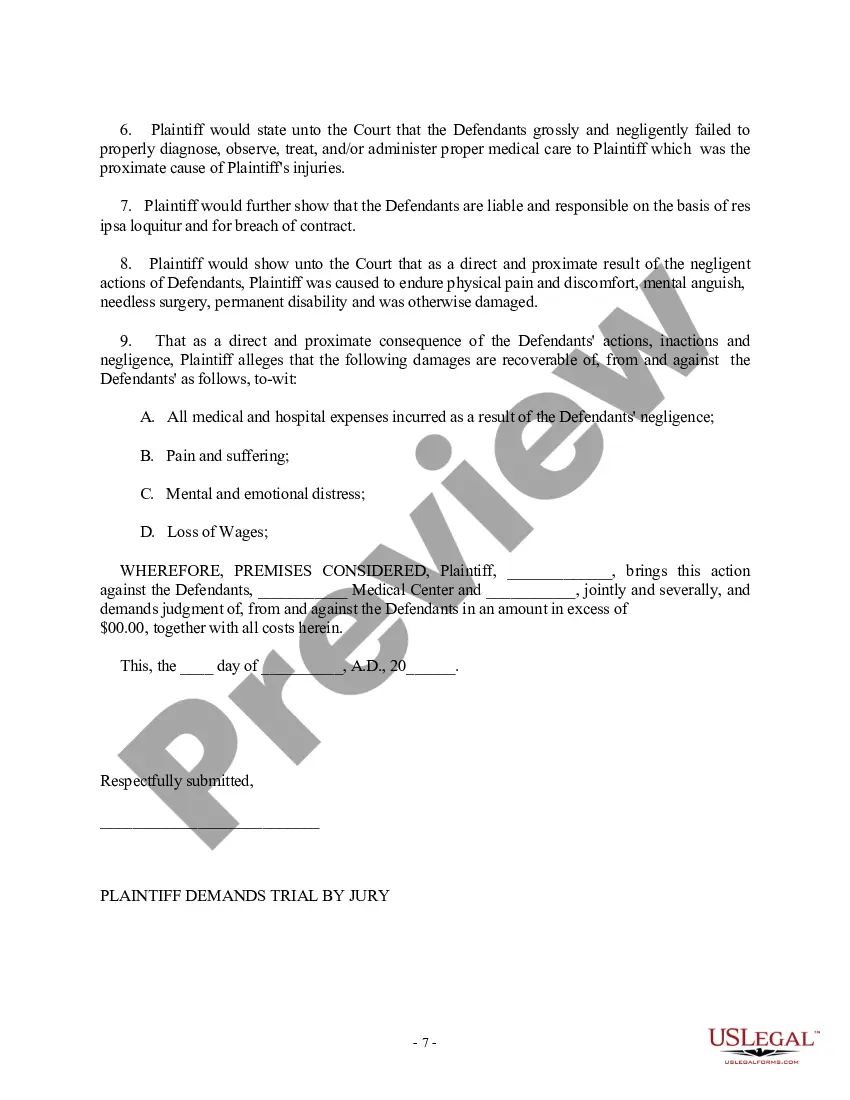

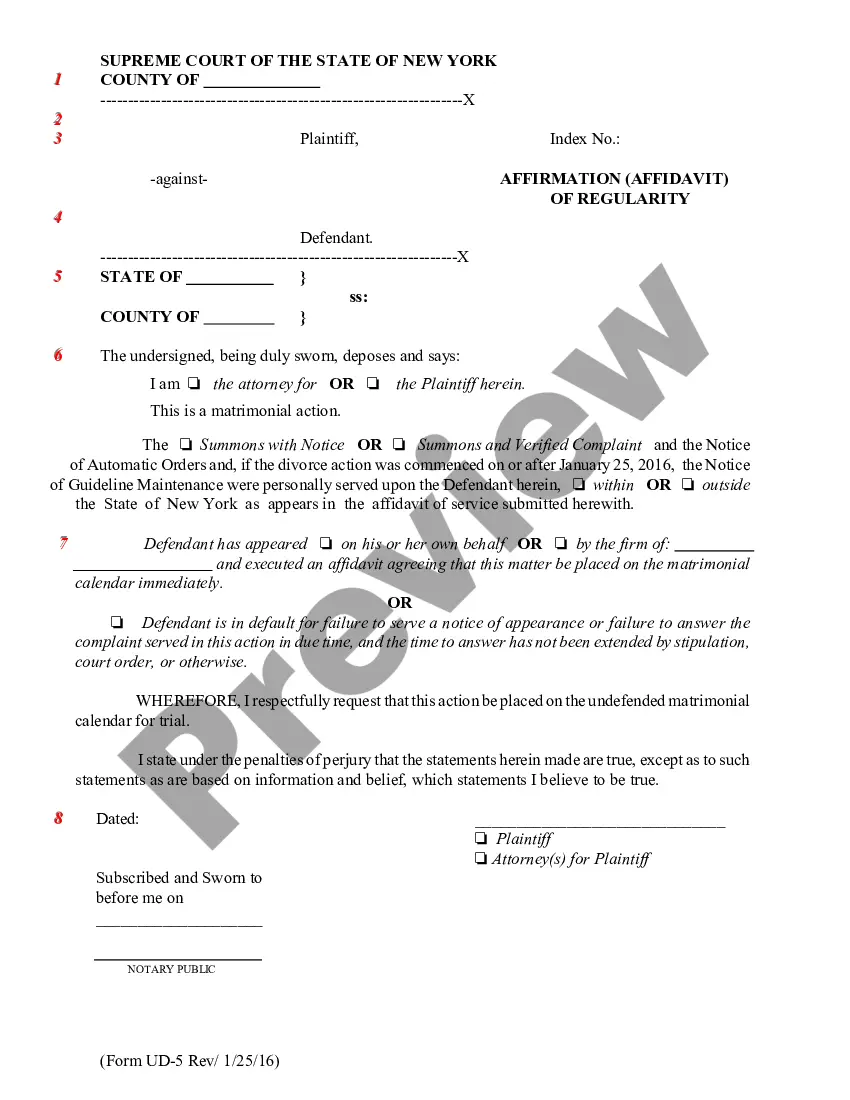

Description

How to fill out Malpractice Insurance Tail Coverage Cost?

Whether for business purposes or for individual affairs, everybody has to handle legal situations at some point in their life. Completing legal documents demands careful attention, starting with choosing the correct form sample. For instance, if you choose a wrong edition of the Malpractice Insurance Tail Coverage Cost, it will be declined when you send it. It is therefore essential to have a reliable source of legal papers like US Legal Forms.

If you have to obtain a Malpractice Insurance Tail Coverage Cost sample, follow these simple steps:

- Find the template you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it fits your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect document, get back to the search function to locate the Malpractice Insurance Tail Coverage Cost sample you require.

- Download the file when it matches your requirements.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- In the event you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Finish the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Select the file format you want and download the Malpractice Insurance Tail Coverage Cost.

- Once it is downloaded, you can complete the form with the help of editing software or print it and complete it manually.

With a large US Legal Forms catalog at hand, you don’t need to spend time seeking for the right template across the web. Take advantage of the library’s straightforward navigation to find the right template for any occasion.

Form popularity

FAQ

Enacted in 1970, the FCRA grants to consumers strong rights regarding information that companies like Defendant trade about them. Specifically, Congress has emphasized that ?the consumer has a right . . . to correct any erroneous information in his credit file.? S. Rep.

In summary, federal and state laws, including the FCRA, FCCPA, and FDUTPA, apply to Florida's credit reporting and debt collection practices.

Some states limit the time a conviction can be reported to seven years, despite the lack of any such limit under the FCRA. The seven-year states include California, Kansas, Maryland, Massachusetts, Montana, Nevada, New Hampshire, New Mexico, New York, and Washington.

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies. There are many types of consumer.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.

Federal Legislative Activity in 2023 Amend Section 604(c) of the FCRA to address the treatment of pre-screening report requests. Section 604(c) governs the furnishing of reports in connection with credit or insurance transactions that are not initiated by the consumer. [1]