Corporation Delaware Company Forfeited Status

Description

How to fill out Changing State Of Incorporation?

Finding a reliable source for the latest and pertinent legal templates is part of the challenge when dealing with bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it’s vital to obtain samples of Corporation Delaware Company Forfeited Status only from reputable providers, such as US Legal Forms. A flawed template can squander your time and delay your situation.

Eliminate the hassle associated with your legal paperwork. Explore the vast US Legal Forms library to discover legal templates, assess their applicability to your situation, and download them immediately.

- Utilize the library navigation or search option to find your sample.

- Check the description of the form to determine if it meets the criteria of your state and locality.

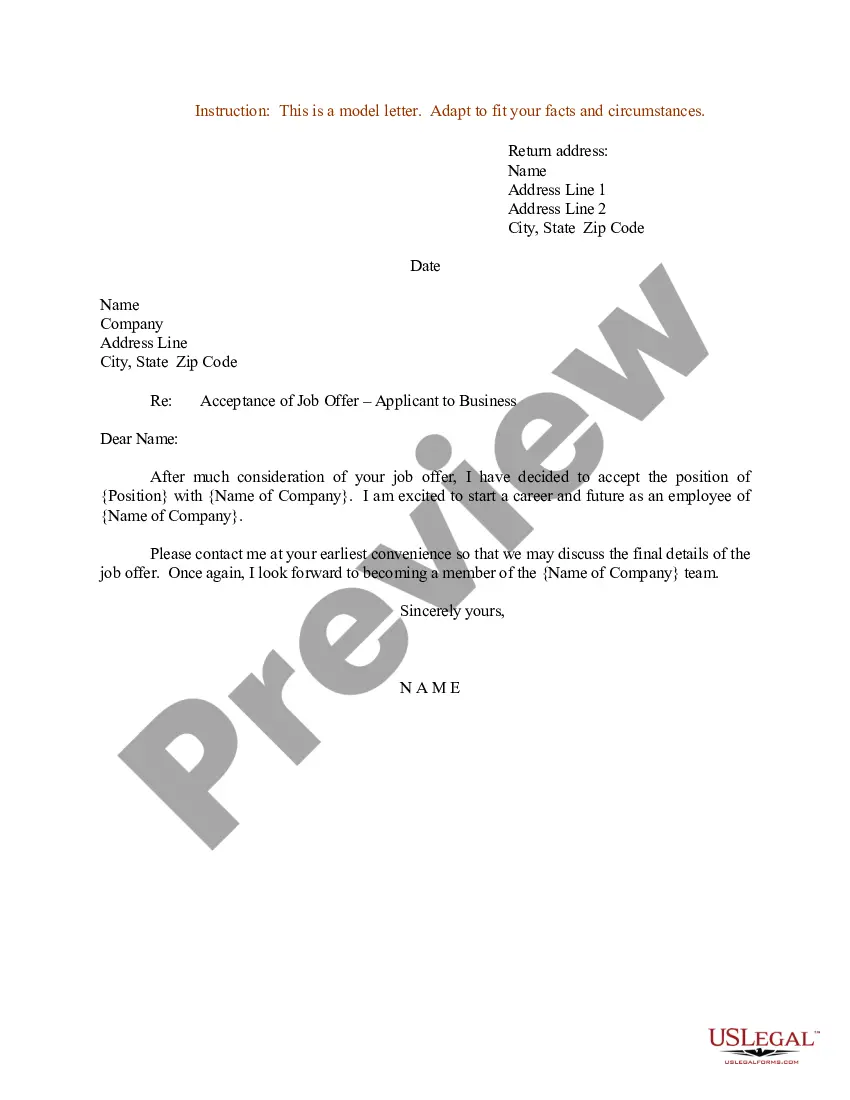

- Examine the form preview, if available, to ensure the document is indeed what you need.

- Continue searching for the correct template if the Corporation Delaware Company Forfeited Status does not match your needs.

- If you are confident in the form’s relevance, download it.

- If you are a registered member, click Log in to verify and access your chosen templates in My documents.

- If you don’t have an account yet, click Buy now to purchase the form.

- Choose the pricing plan that suits your requirements.

- Proceed with the registration to finalize your acquisition.

- Complete your transaction by selecting a payment option (credit card or PayPal).

- Choose the document format for downloading Corporation Delaware Company Forfeited Status.

- After obtaining the form on your device, you can edit it using the editor or print it out to fill it out manually.

Form popularity

FAQ

When a Corporation Delaware company forfeited status occurs, it means the business has lost its good standing with the state. This typically results from failing to comply with state regulations, such as not paying franchise taxes or not filing required reports. As a business owner, it's crucial to understand that a cease good standing can lead to penalties, including difficulties when trying to secure loans or conduct business transactions. USLegalForms offers resources to help you restore your corporation's good standing and navigate the complexities associated with forfeited status.

A void status indicates that your Delaware corporation has faced significant issues, potentially due to failure to comply with statutory requirements. This status prevents your corporation from engaging in legal business activities. It is crucial to address this situation swiftly to prevent further complications. Utilizing resources like USLegalForms can help you understand your options for restoring your company's status.

If you do not dissolve your Delaware corporation, it may remain in a forfeited state. This means the state may view your business as inactive, which can lead to complications with your business obligations. Additionally, you might incur penalties or additional fees. It is essential to address the status of your corporation to avoid long-term issues.

Before a court can award alimony, the requesting spouse must prove a financial need for assistance and that the other spouse can afford to pay. A Connecticut court considering a request for alimony will also evaluate the following factors: the length of the marriage. each spouse's age and health.

Under Connecticut's alimony statute, there is no minimum length of time you must be married to receive alimony. CT alimony laws give a judge discretion to determine the amount of alimony and the duration of payments. To make this decision, a judge will consider a number of factors. Including the length of the marriage.

Fill out the following forms: The Summons Family Actions (JD-FM-3) The Divorce Complaint (Dissolution of Marriage) (JD-FM-159) or, if you are filing to dissolve a civil union, not a marriage, the Dissolution of Civil Union Complaint (JD-FM-159A)

All property obtained during the marriage in CT is considered marital property and subject to equitable distribution. In cases of prenuptial agreements, however, separate property will usually be allocated ing to the agreement.

You follow the same procedure, but you must fill out and file all the legal forms yourself. The Do-It-Yourself Divorce Guide and Do-It-Yourself Guide Supplement (must be used together) are written to help people without legal training use Connecticut State Courts to obtain a divorce without the use of an attorney.

Connecticut is an ?equitable distribution? state. This means that in most cases property will be split approximately 50/50.

Prepare the necessary paperwork. There are two forms that you have to fill out in order to begin the divorce process in Connecticut. These forms are the Summons Family Actions form (form number JD-FM-3) and the Divorce Complaint/Cross Complaint form (form number JD-FM-159).