Agreement Plan Merger With

Description

How to fill out Agreement Plan Merger With?

Bureaucracy requires exactness and correctness.

If you do not manage the completion of documents such as Agreement Plan Merger With daily, it could result in some misunderstanding.

Choosing the right template from the outset will ensure that your document submission proceeds smoothly and avert any troubles of resending a document or repeating the same task entirely from the beginning.

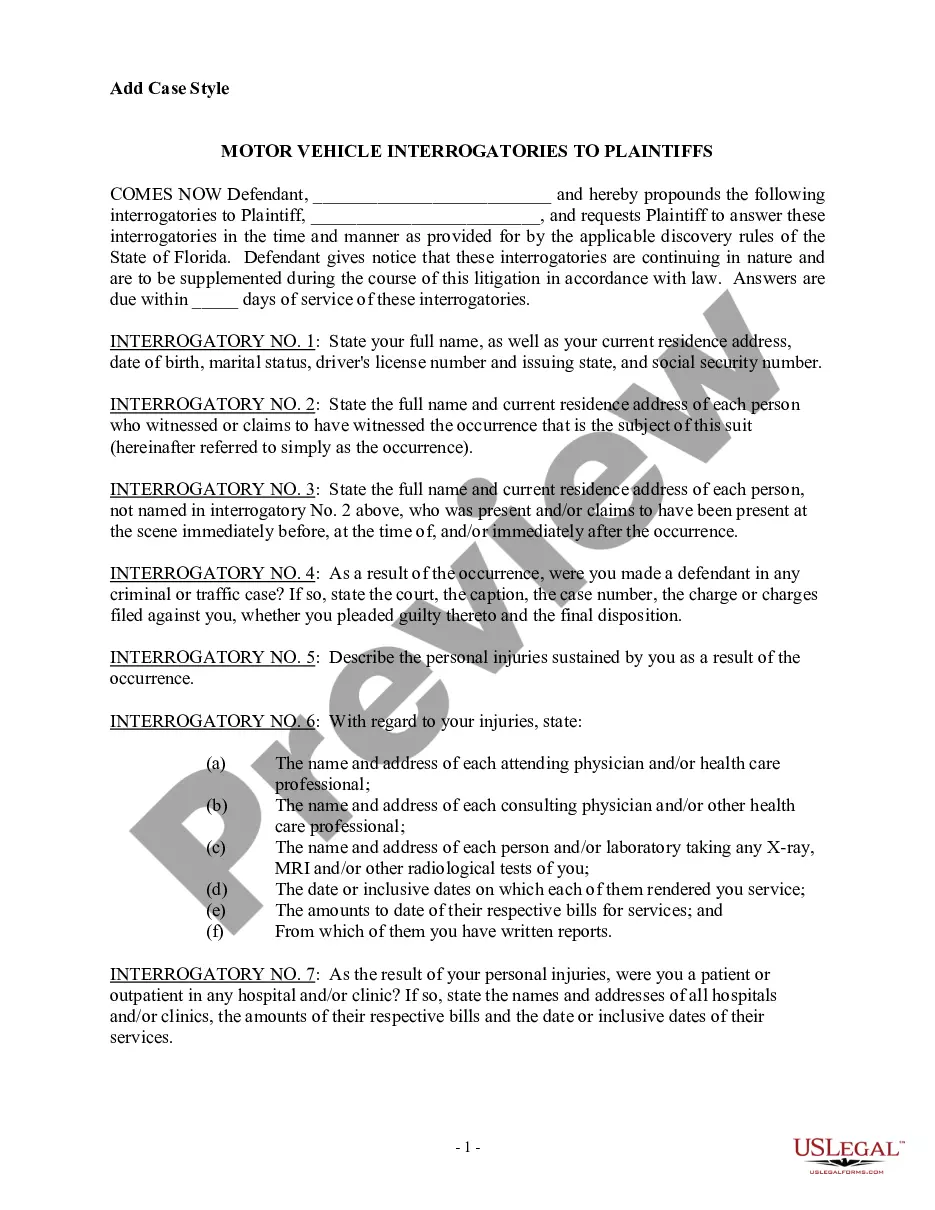

If you are not a subscribed user, finding the necessary template may take a few more steps: Locate the template using the search bar, verify the Agreement Plan Merger With you’ve found is applicable for your state or area, check the preview or read the description that includes the details regarding the utilization of the template. If the result satisfies your inquiry, click the Buy Now button, select the suitable option from the suggested pricing plans, Log In to your account or create a new one, finalize the purchase using a credit card or PayPal option, and download the document in your preferred format. Discovering the right and updated templates for your documentation only takes a few minutes with an account at US Legal Forms. Eliminate the bureaucratic issues and streamline your tasks with paperwork.

- You can consistently locate the suitable template for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms that holds over 85 thousand templates for various domains.

- You can obtain the latest and most suitable version of the Agreement Plan Merger With by simply searching it on the site.

- Find, store, and preserve templates in your account or refer to the description to confirm you have the correct one readily available.

- With an account at US Legal Forms, you can effortlessly acquire, consolidate in one place, and browse through the templates you save to reach them in just a few clicks.

- When on the website, click the Log In button to authenticate.

- Then, proceed to the My documents page, where your document list is maintained.

Form popularity

FAQ

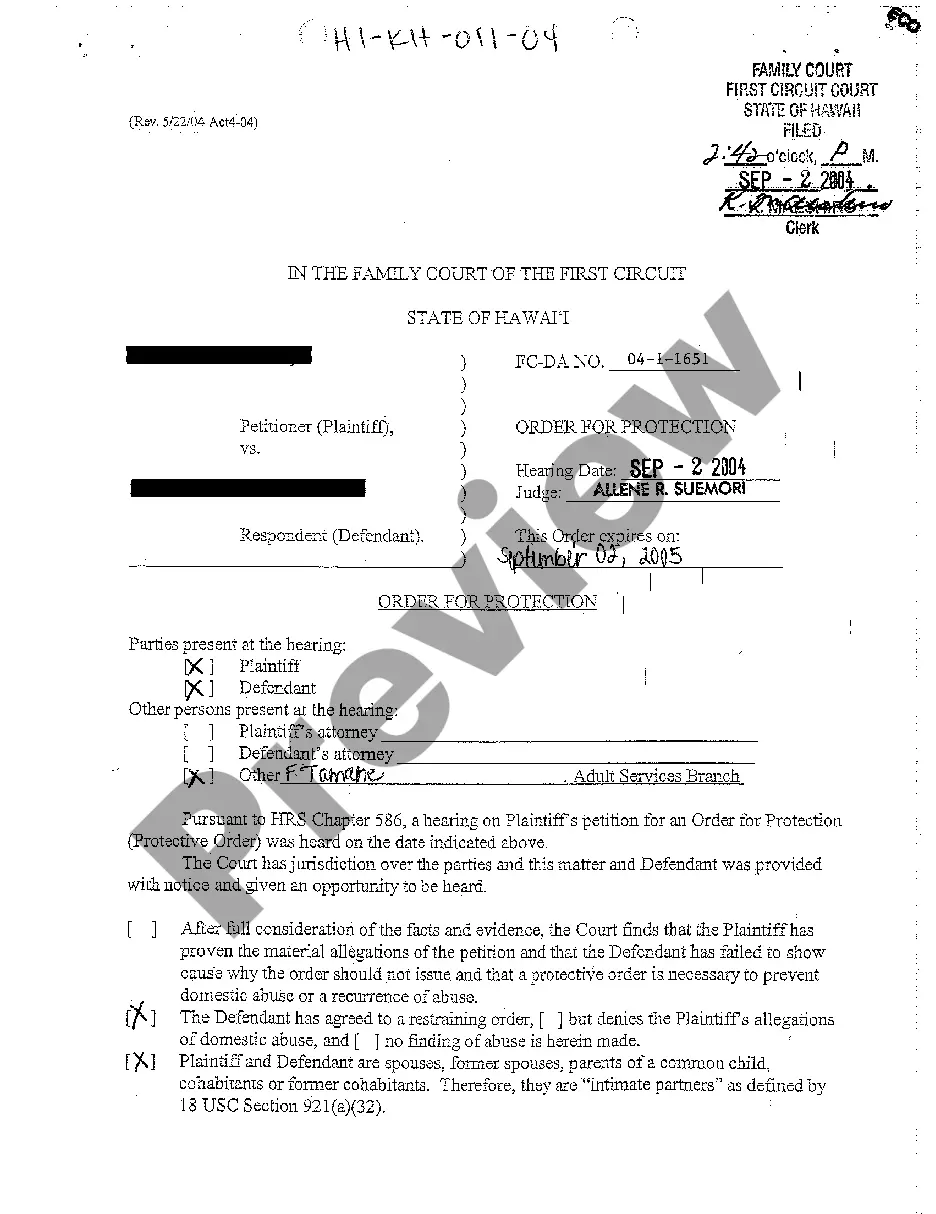

A merger agreement definition is a legal contract governing the combination of two companies into a single business entity.Negotiating a Merger Agreement.Price and Consideration.Holdback or Escrow.Representations and Warranties.

In a stock sale, the agreement is often called the merger agreement, while in an asset sale, it's often called an asset purchase agreement. The agreement lays out the terms of the deal in more detail. For example, the LinkedIn merger agreement details: Conditions that would trigger the break-up fee.

What is a Definitive Agreement?The Buyer and Seller, Price (per share, or lump sum for private companies), and Type of Transaction.Treatment of Outstanding Shares, Options, and RSUs and Other Dilutive Securities.Representations and Warranties.Covenants.Solicitation (No Shop vs.Financing.More items...

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).