Share Merger Stock With Bandhan Bank

Description

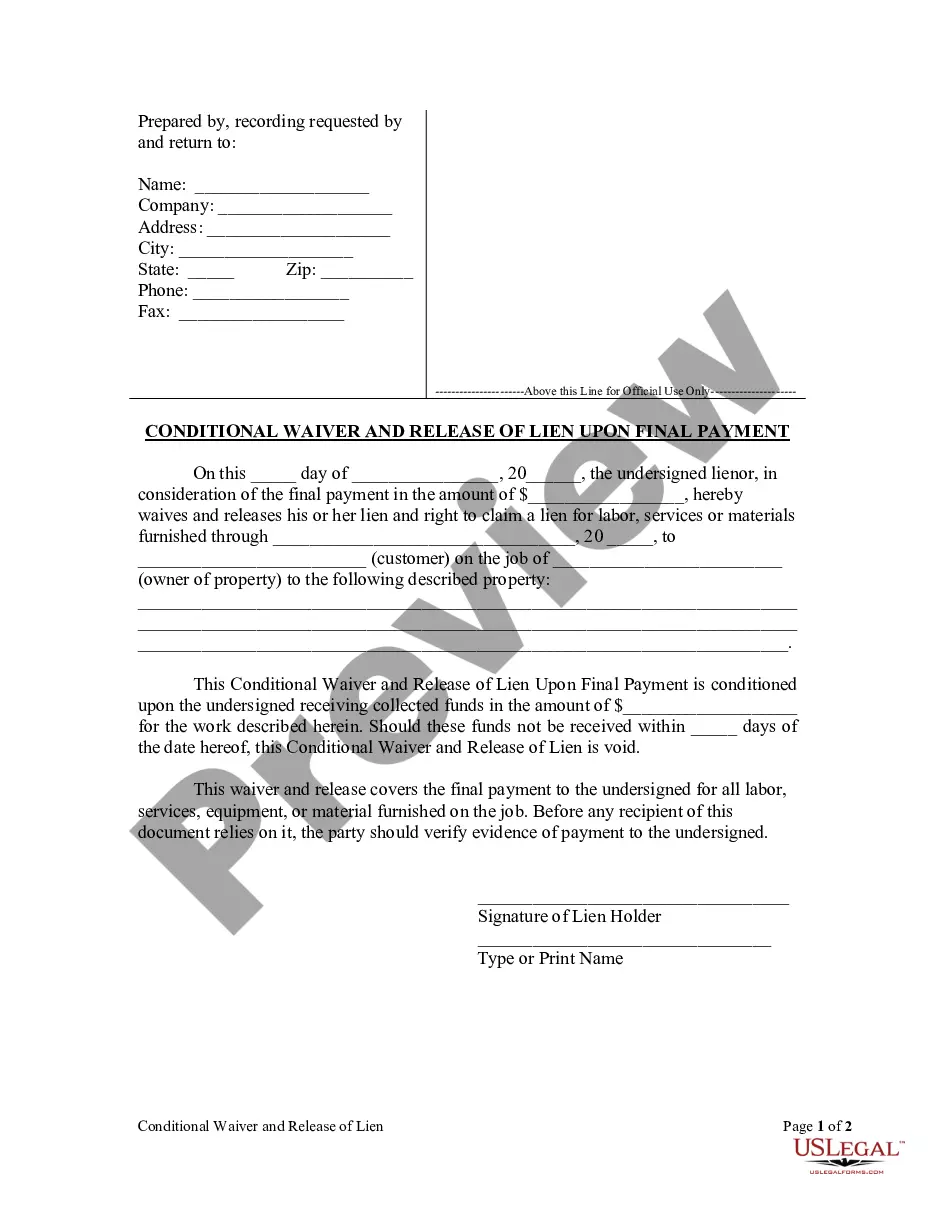

How to fill out Proposed Merger With The Grossman Corporation?

Drafting legal documents from scratch can sometimes be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more affordable way of creating Share Merger Stock With Bandhan Bank or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our online library of over 85,000 up-to-date legal forms covers virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific forms carefully prepared for you by our legal experts.

Use our website whenever you need a trustworthy and reliable services through which you can easily find and download the Share Merger Stock With Bandhan Bank. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes little to no time to register it and explore the library. But before jumping directly to downloading Share Merger Stock With Bandhan Bank, follow these tips:

- Check the document preview and descriptions to make sure you have found the document you are looking for.

- Make sure the template you choose complies with the regulations and laws of your state and county.

- Choose the right subscription option to buy the Share Merger Stock With Bandhan Bank.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and transform document execution into something easy and streamlined!

Form popularity

FAQ

Consequences and Beneficiaries of the Merger The share exchange ratio was decided at 500, which means shareholders of GRUH Finance will receive 568 shares of Bandhan Bank for every 1000 shares that they hold of GRUH Finance.

Overall, the merger between Bandhan Bank and Gruh Finance is a strategic move that aligns with both companies' growth plans and expansion.

The Price Trend analysis by MoneyWorks4Me indicates it is Semi Strong which suggest that the price of Bandhan Bank Ltd is likely to Rise-somewhat in the short term. However, please check the rating on Quality and Valuation before investing.

In January 2019, Bandhan Bank, one of India's leading private sector banks, announced the acquisition of Gruh Finance, a subsidiary of the erstwhile Housing Development Finance Corporation Ltd. (HDFC). The merger brought together two companies with complementary strengths and expertise.

The bank's board had fixed October 17 as the record date, on the effectiveness of the scheme, for the purpose of determining the shareholders of Gruh, who shall be entitled to receive the equity shares of the bank, as consideration pursuant to the scheme.