Revolving Promissory Note With Collateral Template

Description

How to fill out Form Of Revolving Promissory Note?

When you need to present a Revolving Promissory Note With Collateral Template that aligns with your local state's statutes and regulations, there can be several choices to select from.

There's no need to review every document to ensure it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a dependable resource that can assist you in obtaining a reusable and current template on any topic.

Using professionally drafted official documents becomes easy with US Legal Forms. Moreover, Premium users can also leverage the powerful integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the largest online repository with a collection of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state’s laws and regulations.

- Thus, when downloading a Revolving Promissory Note With Collateral Template from our platform, you can trust that you will retain a legitimate and current document.

- Acquiring the necessary sample from our platform is quite simple.

- If you already possess an account, just Log In to the system, verify your subscription to be active, and save the chosen file.

- Later, you can access the My documents tab in your profile to keep access to the Revolving Promissory Note With Collateral Template anytime.

- If this is your first time on our website, please follow the instructions below.

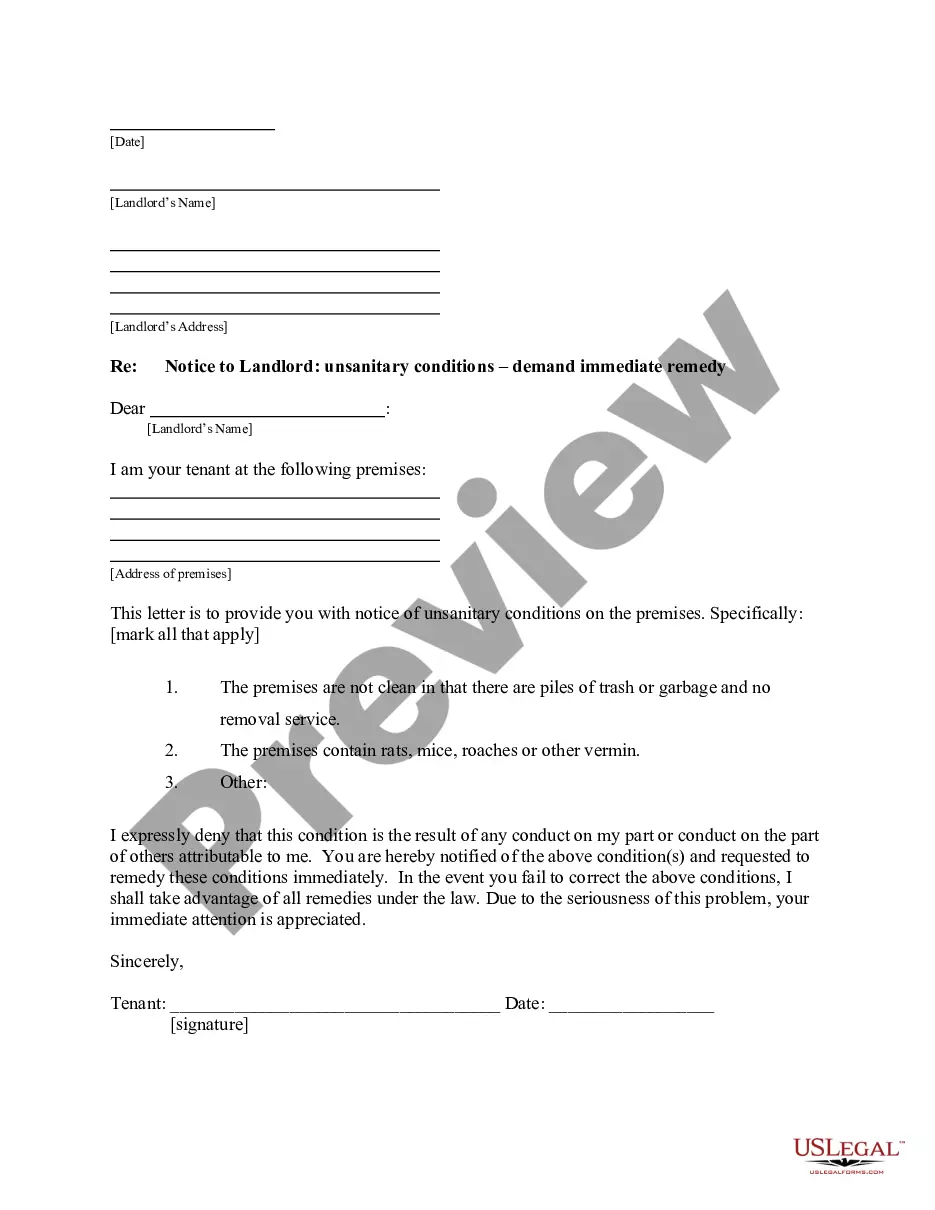

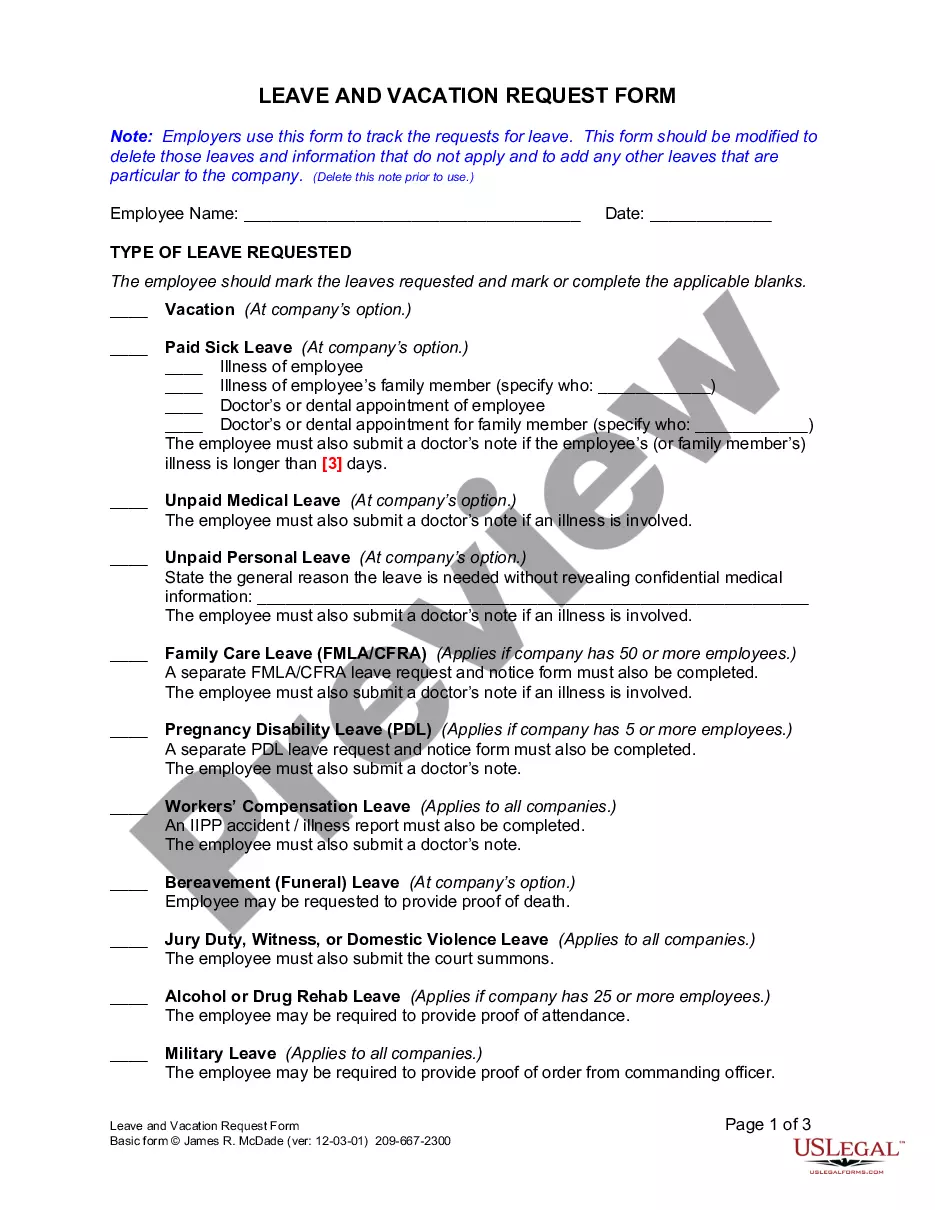

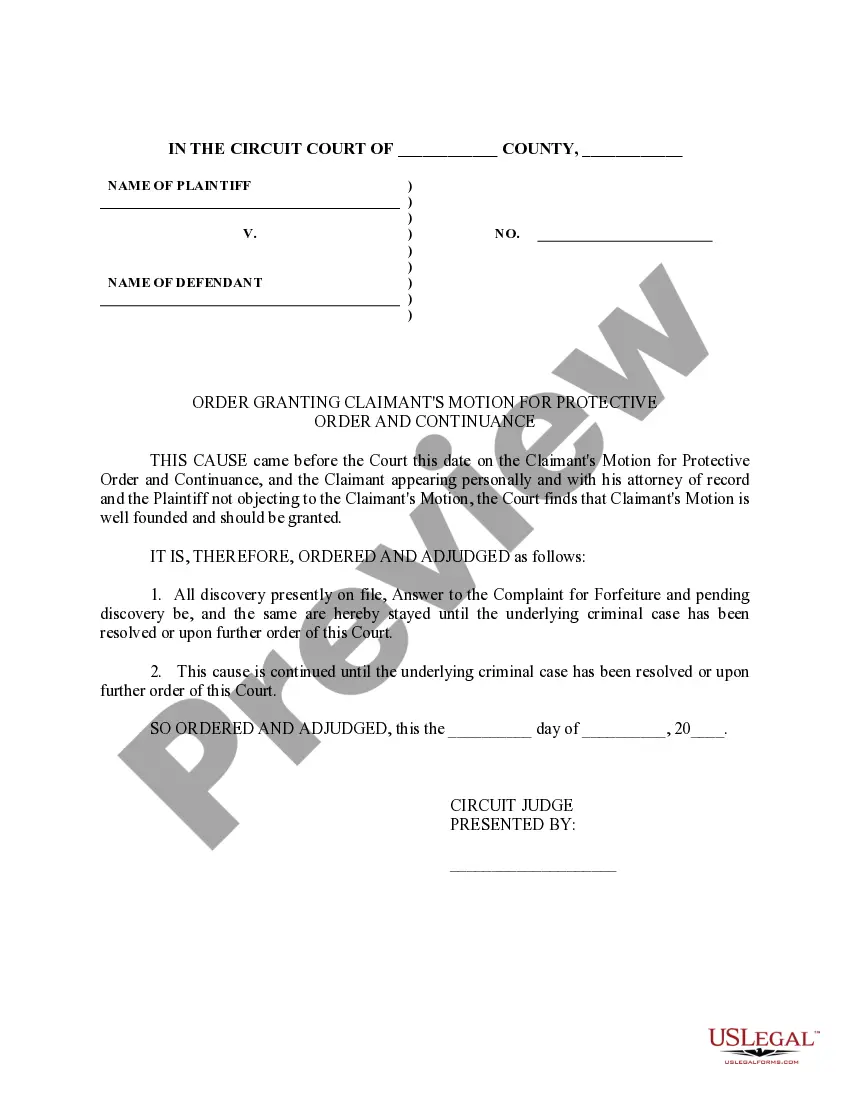

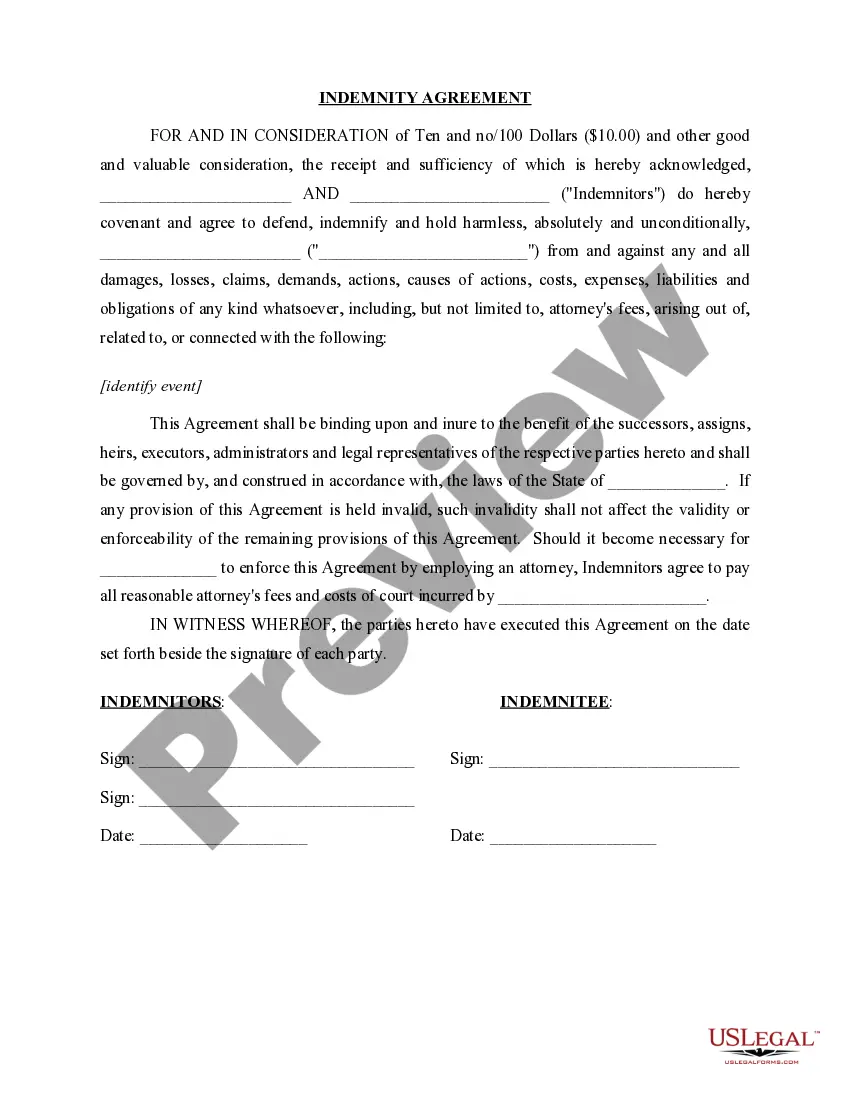

- Visit the suggested page and check it for alignment with your criteria.

Form popularity

FAQ

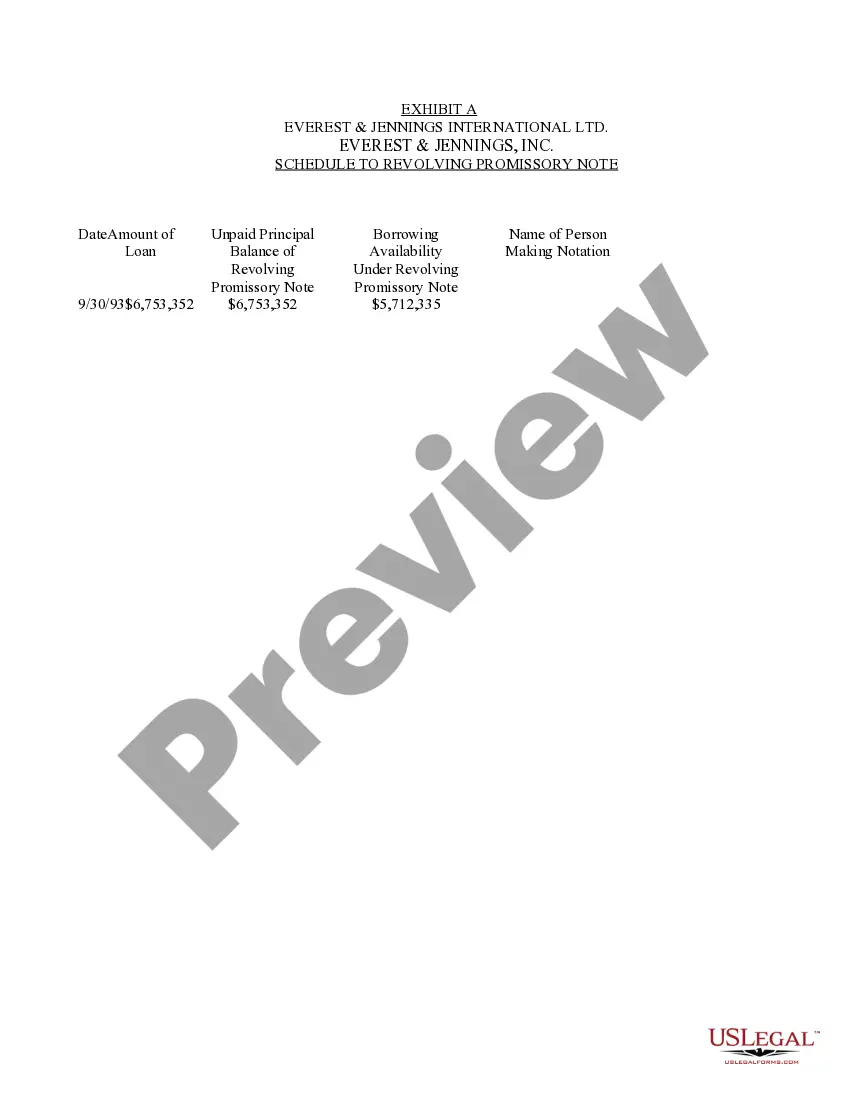

Revolving Credit Promissory Note means a promissory note of the Company payable to the order of any Lender, in substantially the form of Exhibit G, evidencing the aggregate indebtedness of the Company to such Lender resulting from the Revolving Loans made by such Lender.

Revolving Collateral Loan means a Collateral Loan that provides the Obligor thereunder with a revolving credit facility from which one or more borrowings may be made up to the stated principal amount of such revolving credit facility and which provides that borrowed amounts may be repaid and reborrowed from time to

You can create a Promissory Note as a lender or borrower by following these steps:Select the location. Our Promissory Note template will customize your document specifically for the laws of your location.Provide party details.Establish the terms of the loan.Include final details.Sign the document.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.