Revolving Promissory Note With Balloon Payment

Description

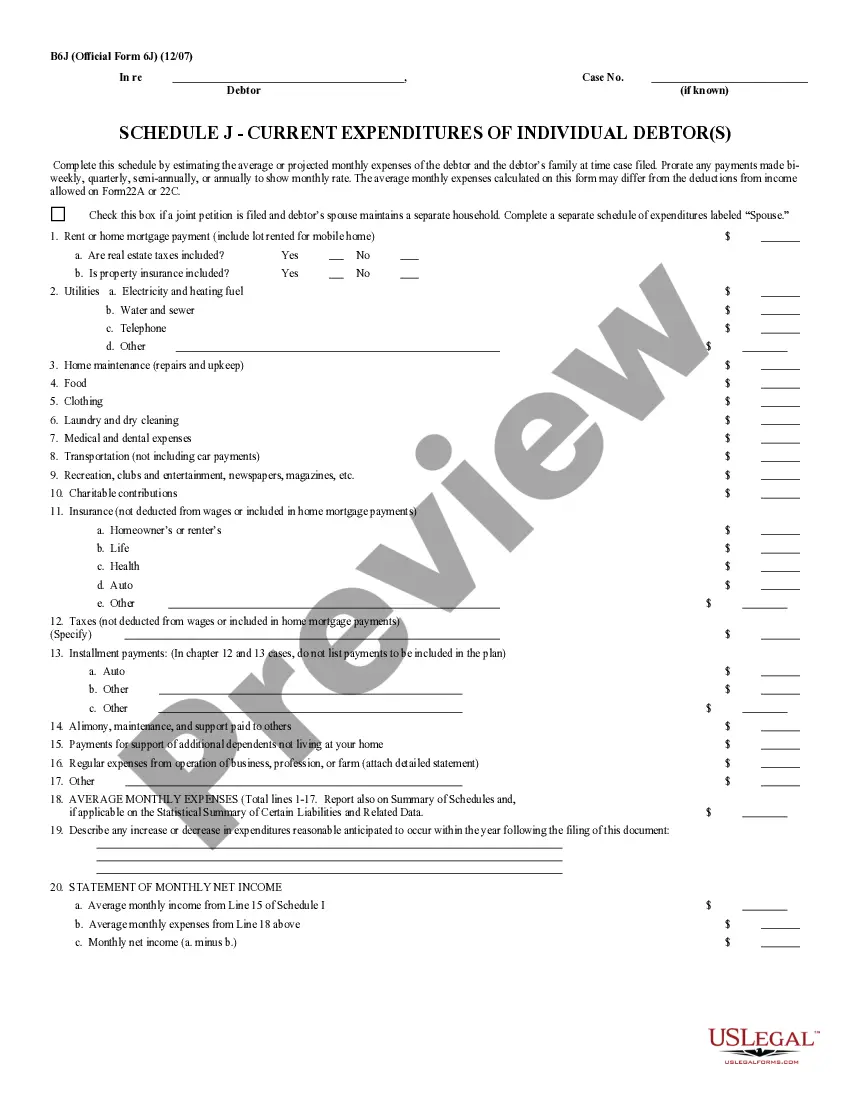

How to fill out Form Of Revolving Promissory Note?

There's no longer a necessity to invest time searching for legal documents to comply with your local state requirements.

US Legal Forms has compiled all of them in one location and streamlined their availability.

Our website provides over 85,000 templates for any business and personal legal matters categorized by state and area of use.

Using the search bar above to look for another template if the current one doesn't suit your needs.

- All forms are professionally prepared and confirmed for accuracy, ensuring you receive an up-to-date Revolving Promissory Note With Balloon Payment.

- If you are acquainted with our platform and already possess an account, make sure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documentation at any moment by opening the My documents tab in your profile.

- If you haven't interacted with our platform previously, the procedure will require a few additional steps to complete.

- Here’s how new users can find the Revolving Promissory Note With Balloon Payment in our database.

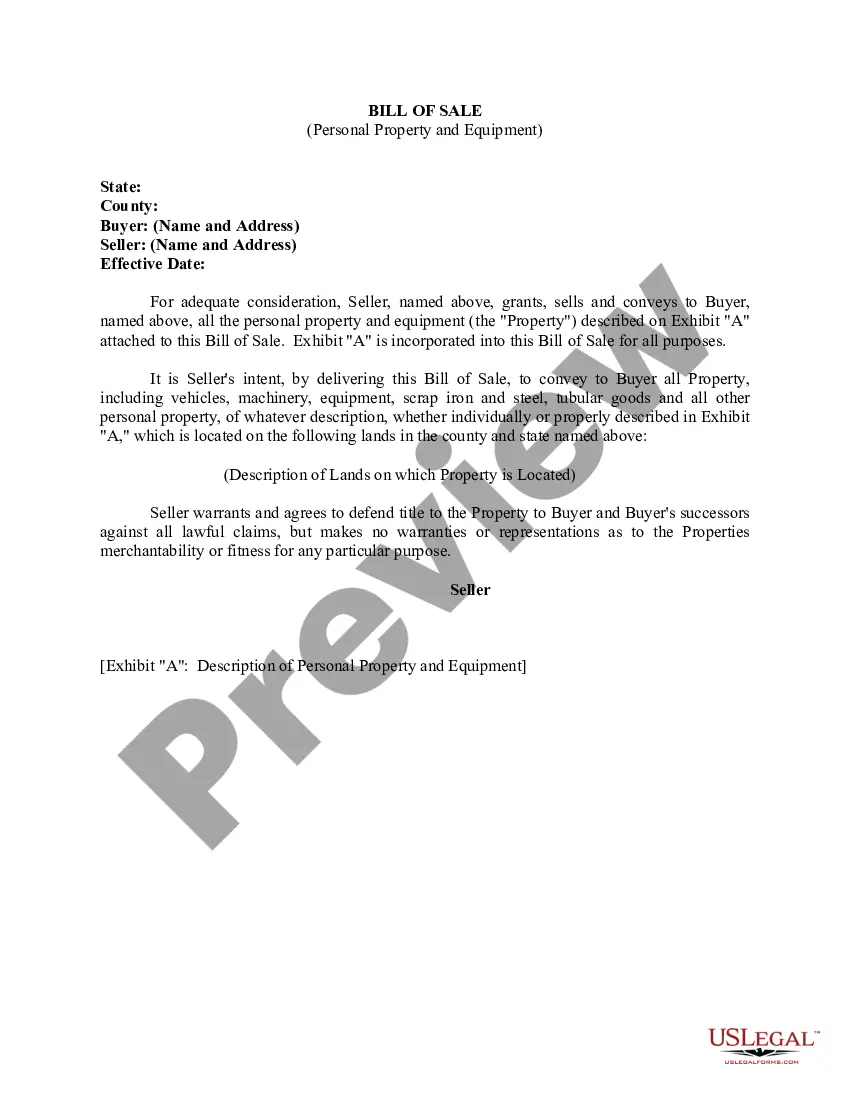

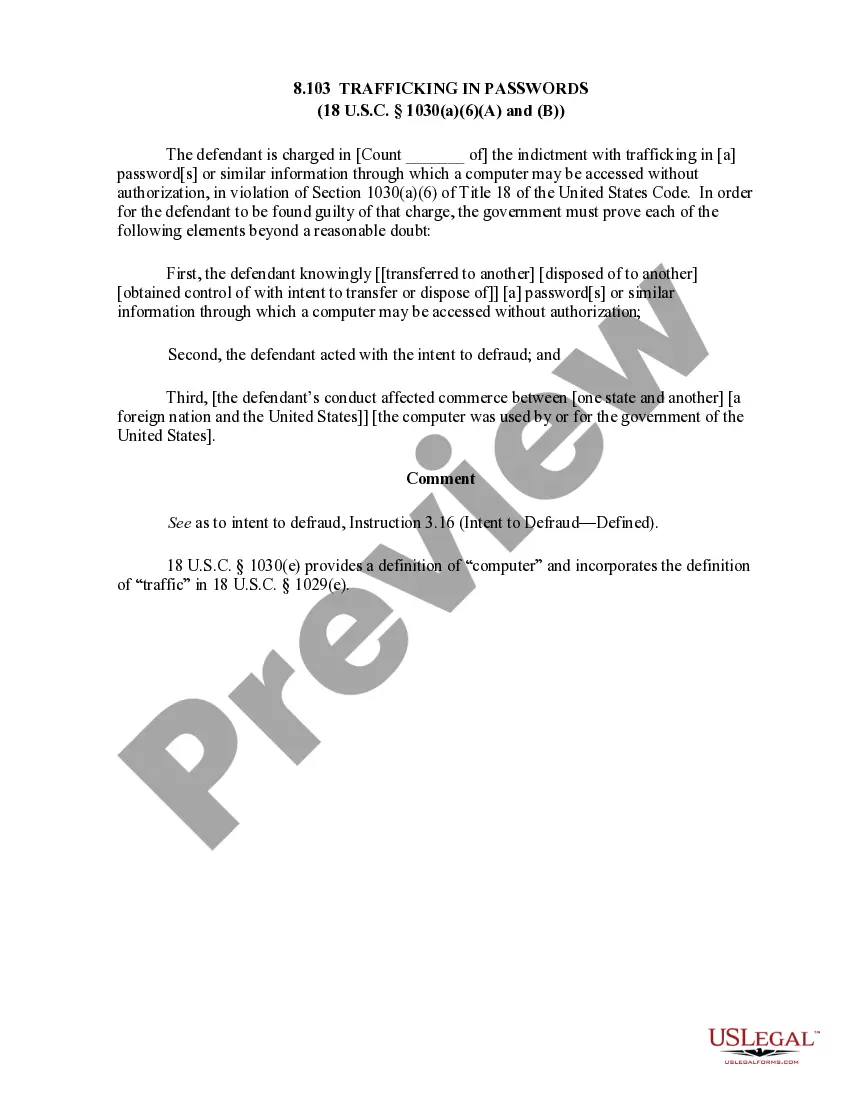

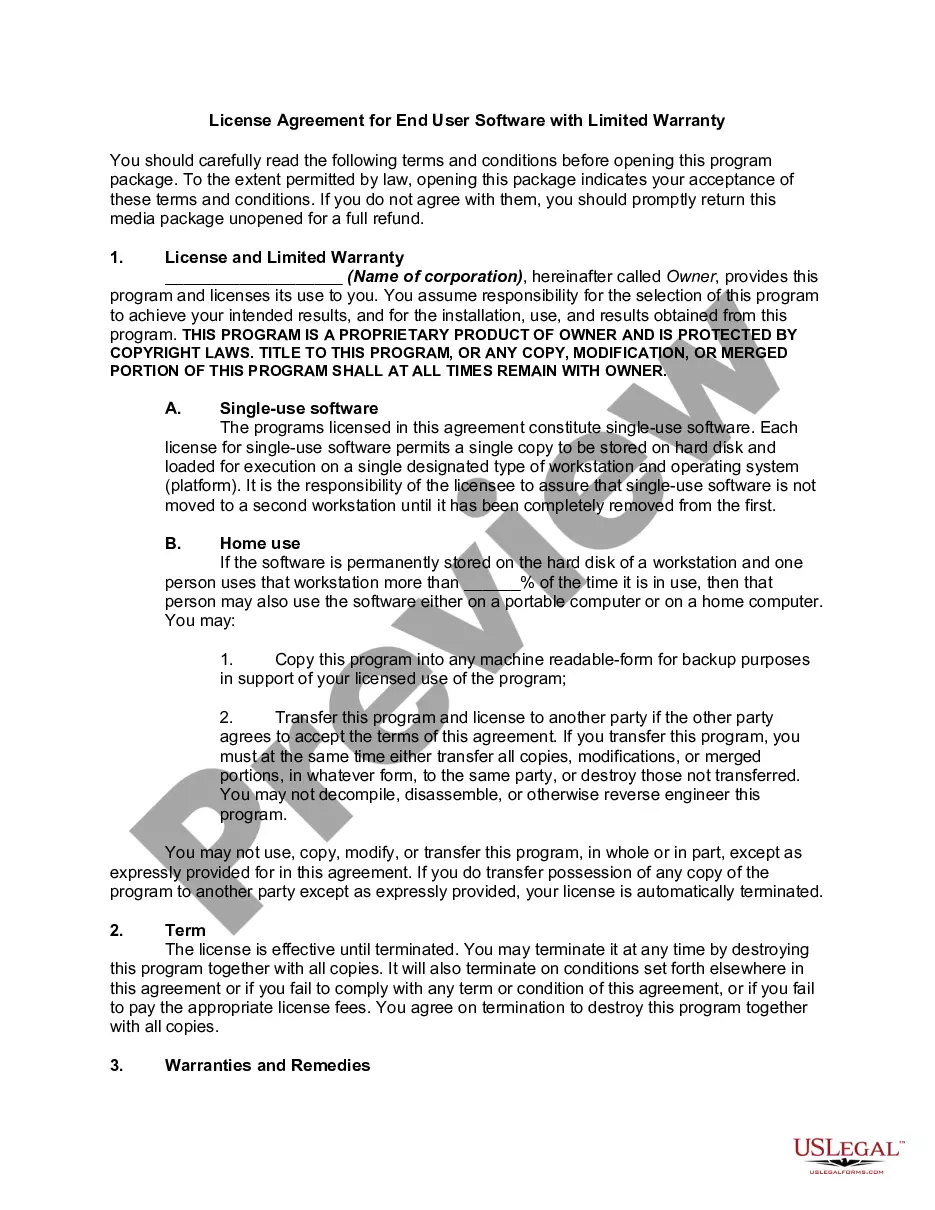

- Review the page content carefully to ensure it contains the sample you need.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.

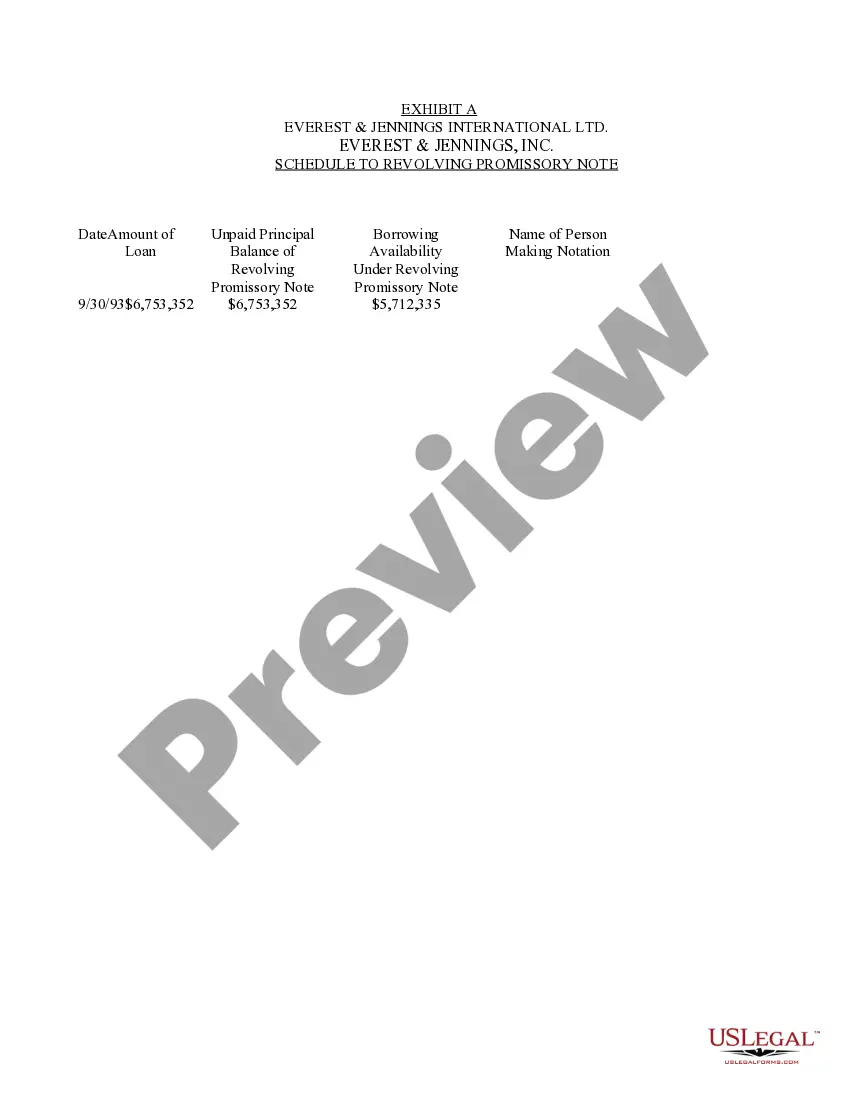

Revolving Credit Promissory Note means a promissory note of the Company payable to the order of any Lender, in substantially the form of Exhibit G, evidencing the aggregate indebtedness of the Company to such Lender resulting from the Revolving Loans made by such Lender.

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.

A bullet repayment is a lump sum payment made for the entirety of an outstanding loan amount, usually at maturity. It can also be a single payment of principal on a bond. In terms of banking and real estate, loans with bullet repayments are also referred to as balloon loans.

A Promissory Note with Balloon Payments is a loan contract that enables a lender set loan terms with one or more larger payments at the end. This lending document helps you to clarify the terms of a loan, define the payment schedule, and provide an amortization table, if the loan includes interest.