Secured Creditors With A Floating Charge

Description

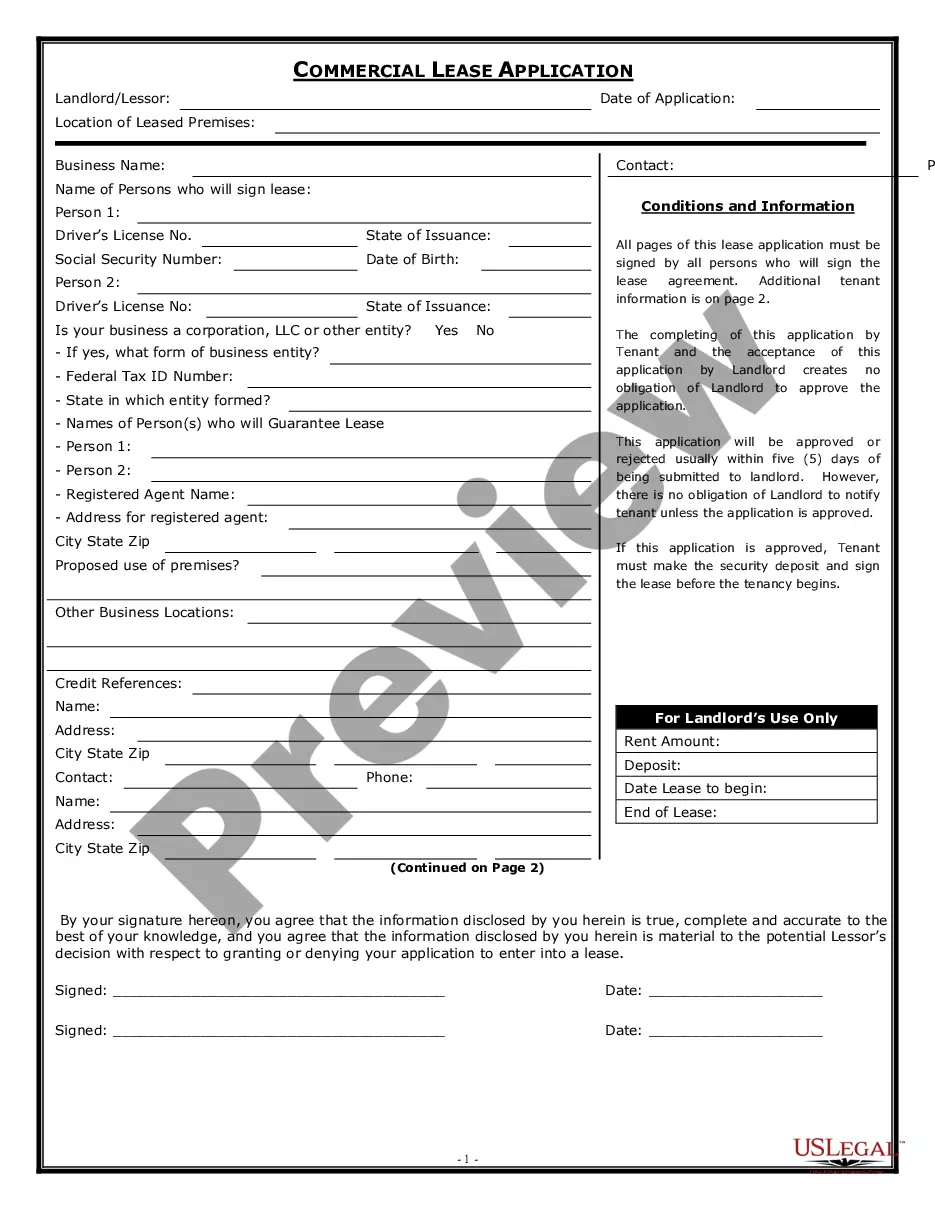

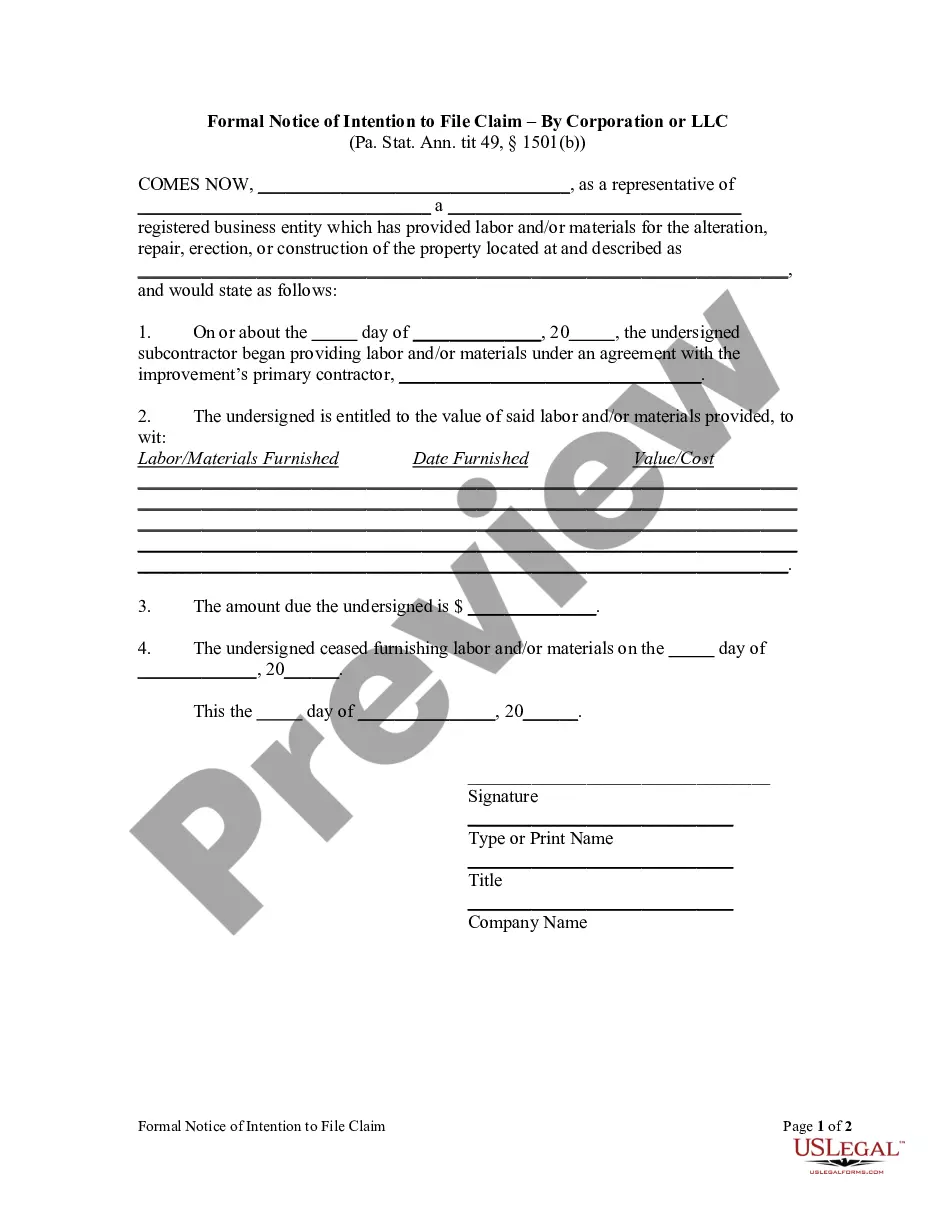

How to fill out Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and substantial expenses.

If you're seeking a more straightforward and cost-effective method for preparing Secured Creditors With A Floating Charge or other documents without unnecessary complications, US Legal Forms is always available to you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs.

Review the document preview and descriptions to ensure you have located the form you are looking for. Confirm that the template you choose aligns with the regulations of your state and county. Select the appropriate subscription plan to acquire the Secured Creditors With A Floating Charge. Download the file, then complete, certify, and print it out. US Legal Forms boasts a solid reputation and over 25 years of expertise. Join us today and make document execution effortless and efficient!

- With just a few clicks, you can immediately obtain state- and county-compliant templates carefully crafted for you by our legal specialists.

- Utilize our website whenever you require a dependable and trustworthy service to swiftly locate and download Secured Creditors With A Floating Charge.

- If you are familiar with our services and have previously registered an account with us, just Log In to your account, choose the template, and download it or re-download it anytime in the My documents section.

- Don't have an account? No problem. It only takes a few minutes to sign up and explore the library.

- But before you dive into downloading Secured Creditors With A Floating Charge, consider these suggestions.

Form popularity

FAQ

When it comes to a liquidation, both fixed charge and floating charge holders are classed as secured lenders. That means they take priority over unsecured creditors who must wait until all other costs and creditors have been paid before they receive any of the money they are owed.

Unlike a fixed charge, which is created over ascertained and definite property, a floating charge is created over property of an ambulatory and shifting nature, such as receivables and stock.

A floating charge is a security interest or lien over a group of assets, which are non-constant or change in quantity and value. Collateralization is the use of a valuable asset to secure a loan against default. The collateral can be seized by the lender to offset any loss.

A floating charge, also known as a floating lien, is a security interest or lien over a group of non-constant assets that may change in quantity and value. Companies will use floating charges as a means of securing a loan.

It involves using a group of assets, such as inventory or accounts receivable, as collateral. The assets can change in quantity and value over time, but the lien remains in place to assure the creditor that their loan is secured by valuable assets. For example, a clothing store may use a floating lien to obtain a loan.