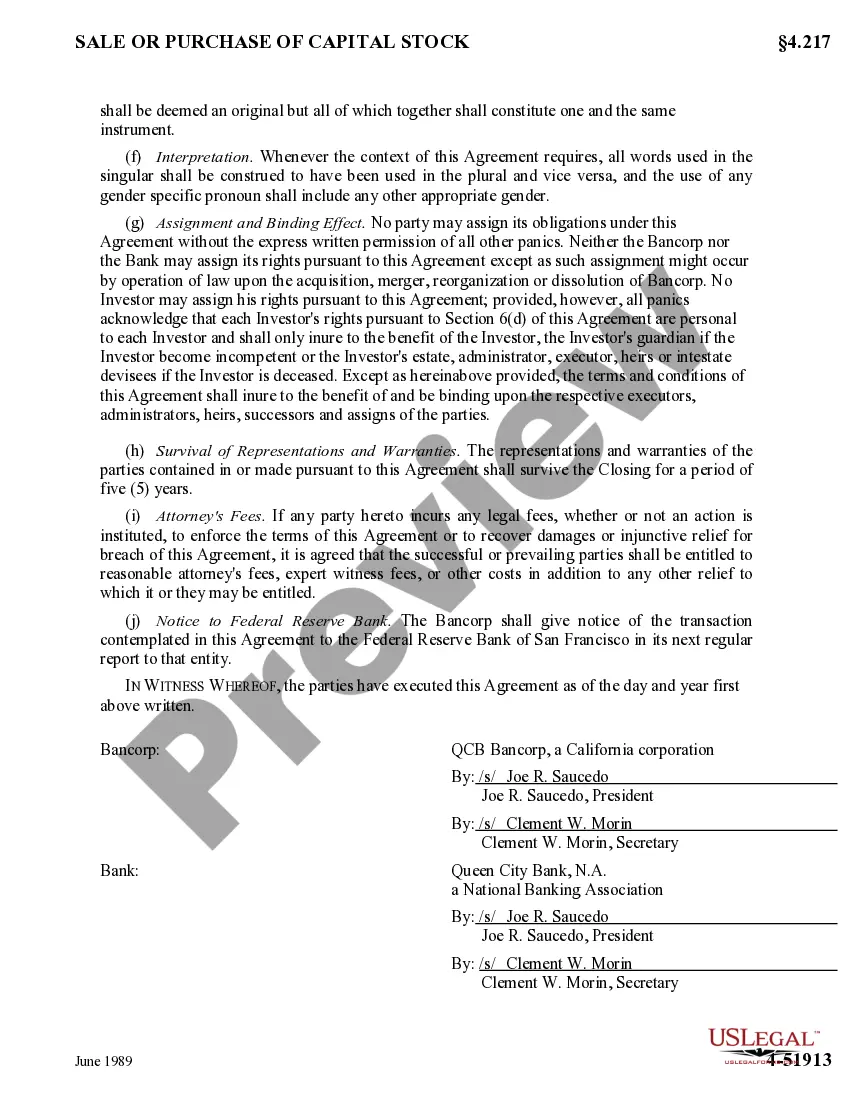

Agreement Purchase Form With Collateral

Description

How to fill out Sample Agreement For Purchase And Sale Of Stock Between QCB Bancorp, Queen City Bank, N.A., And Directors?

Regardless of whether you frequently handle documents or occasionally need to submit a legal document, having a resource with all relevant and current samples is essential.

One important step when using an Agreement Purchase Form With Collateral is to ensure it is the most recent version, as this determines its eligibility for submission.

If you want to streamline your search for the most recent document examples, look no further than US Legal Forms.

To obtain a form without an account, follow these steps: Utilize the search menu to find the desired form. Review the Agreement Purchase Form With Collateral preview and description to ensure it meets your needs. After confirming the form, click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing account. Complete the purchase using your credit card details or PayPal account. Choose the download format for the document and confirm. Say goodbye to confusion when managing legal documents; all your templates will be organized and validated with a US Legal Forms account.

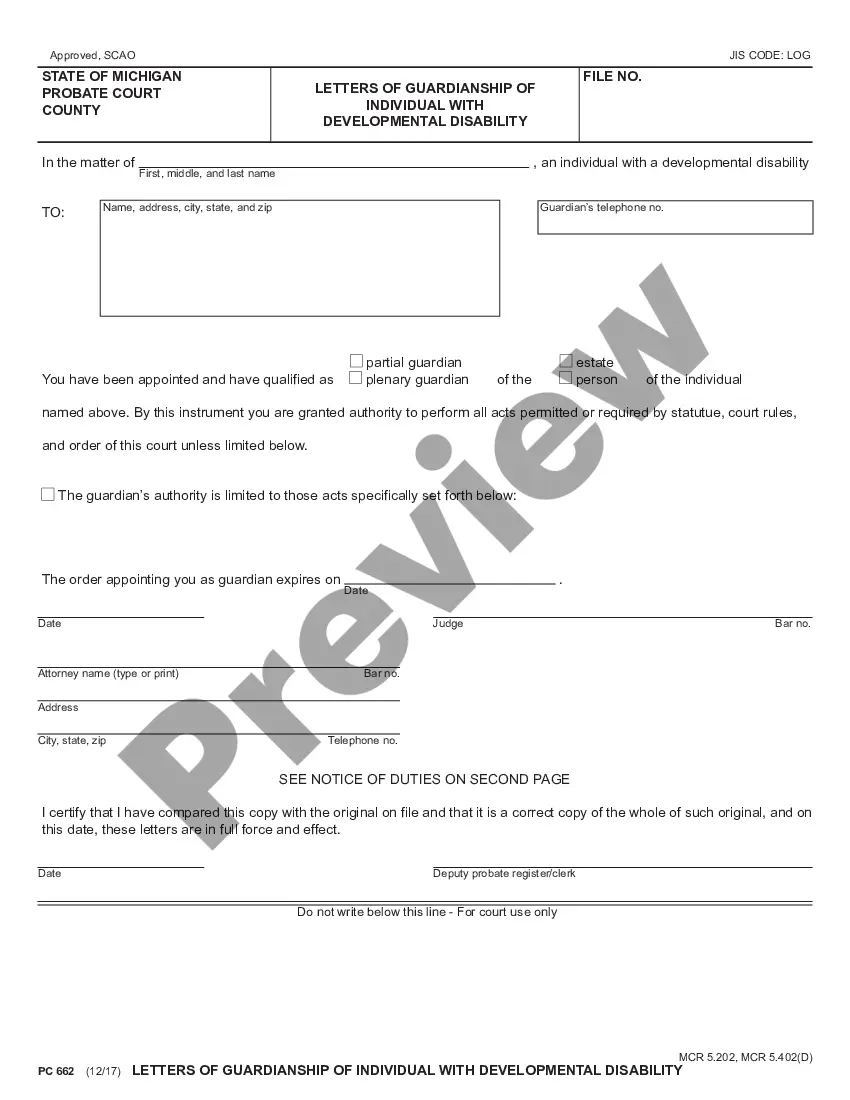

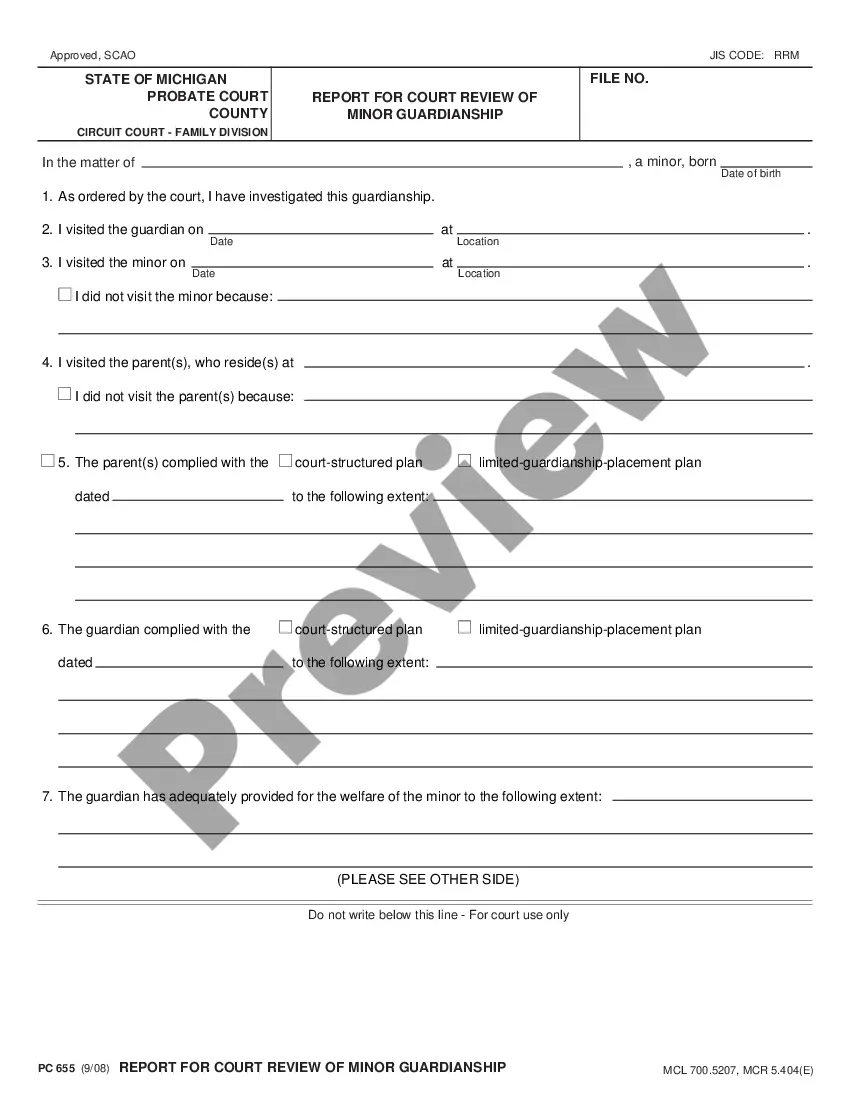

- US Legal Forms is a comprehensive database of legal documents that includes nearly any template you might need.

- Locate the templates you need, assess their relevance immediately, and learn more about their applications.

- With US Legal Forms, you can access approximately 85,000 document templates across a broad range of categories.

- Easily find Agreement Purchase Form With Collateral examples within just a few clicks and save them to your account at any time.

- Having a US Legal Forms account provides you with convenient access to all the samples you require, reducing stress and effort.

- Simply click Log In at the header of the website and navigate to the My documents section where all the necessary forms are available.

- There will be no need to waste time searching for the right template or verifying its authenticity.

Form popularity

FAQ

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

A collateral assignment of life insurance is a conditional assignment appointing a lender as the primary beneficiary of a death benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the life insurance policy and recover what is owed.

If a loan agreement includes collateral, it means that the borrower has agreed to pledge certain assets as security for the loan. In the event the borrower defaults and does not uphold his or her agreement to repay the loan amount plus interest, the lender gets to keep the pledged collateral.

The collateral assignment assigns the rights of the buyer under the asset purchase agreement to a lender as security for a loan from the lender to the buyer.

Writing a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...