Incorporation Articles Amendment Withholding Tax

Description

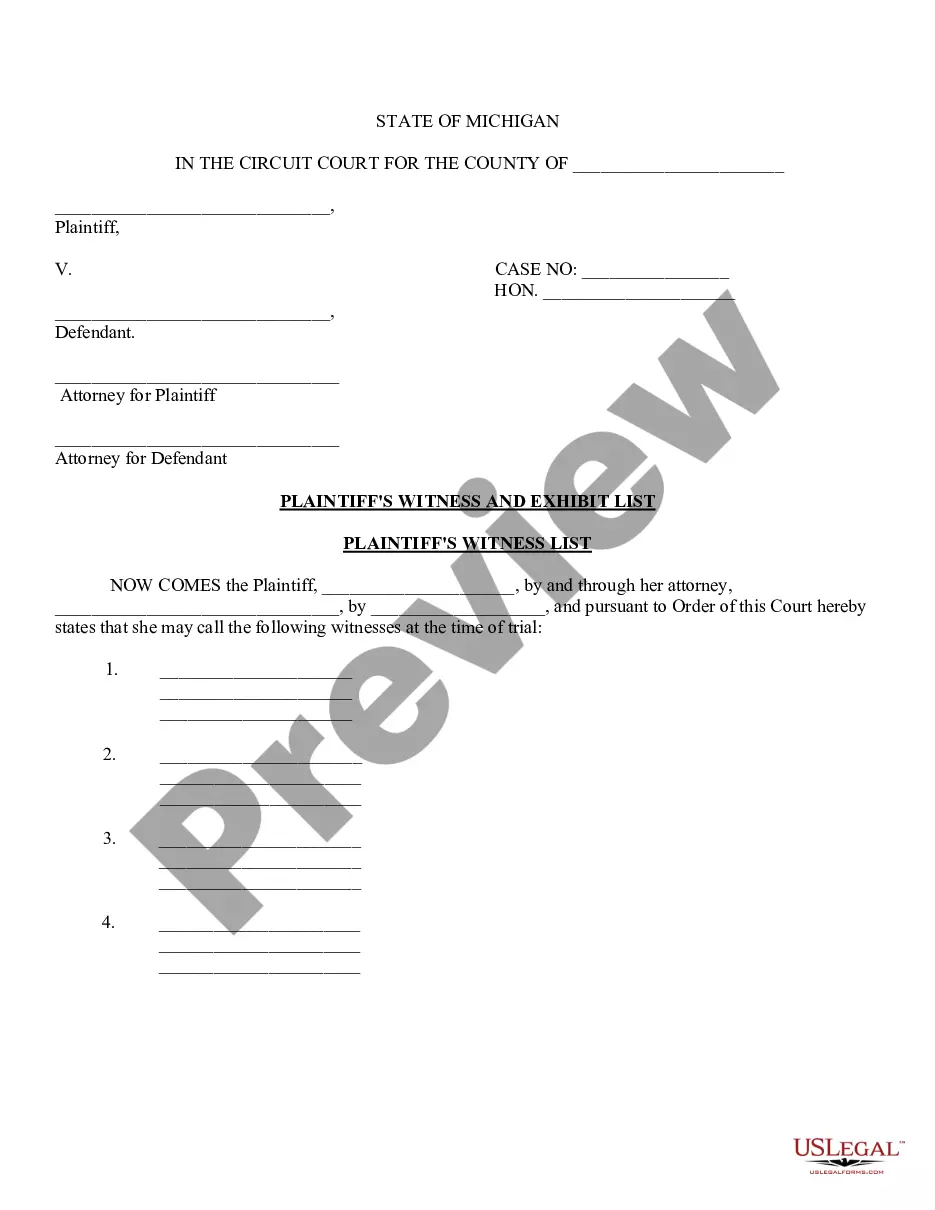

How to fill out Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

Creating legal documentation from the ground up can occasionally be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re in search of a more straightforward and economical method for preparing Incorporation Articles Amendment Withholding Tax or other documents without the hassle, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

Before proceeding to download the Incorporation Articles Amendment Withholding Tax, please adhere to these suggestions: Review the document preview and descriptions to ensure you are on the correct form, confirm that the template you select aligns with the applicable regulations and laws of your state and county, choose the most suitable subscription option for purchasing the Incorporation Articles Amendment Withholding Tax, and download the file. Then fill it out, certify it, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make form execution a seamless and straightforward process!

- With just a few clicks, you can quickly obtain state- and county-specific forms meticulously assembled for you by our legal professionals.

- Utilize our site whenever you need dependable and trustworthy services through which you can effortlessly find and obtain the Incorporation Articles Amendment Withholding Tax.

- If you’re already familiar with our offerings and have set up an account, simply Log In to your account, find the template, and download it easily or re-download it at any time in the My documents section.

- Not registered yet? That’s not an issue. It requires minimal time to sign up and explore the library.

Form popularity

FAQ

To fill out an Articles of Amendment template, start by providing the name of your corporation and the specific amendments. Clearly state the changes you wish to make, such as changes to the company's name or structure. For detailed guidance, consider using US Legal Forms, which offers a straightforward solution to help you accurately complete your Articles of Amendment and adhere to Incorporation articles amendment withholding tax requirements.

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

How is Form 1099-NEC completed? Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.

New Hampshire tax law defines an independent contractor as one who (a) exercises an independent employment; (b) contracts to do work for multiple business organizations that are not related parties; (c) holds himself or herself out to the public as an independent contractor in the regular course of business; and (d) ...

Prepare and File a 1099 Obtain a blank 1099 form (which is printed on special paper) from the IRS or an office supply store. Fill out the 1099. Each Form 1099 comes with 5 copies, so make sure to write or type on the top copy so it transfers down onto each copy, like carbon paper.

Many small business owners prefer to send 1099s through email or an online service. The IRS has several requirements for furnishing Form 1099 electronically. You can include this information in their contract or via email. Some online services may handle this for you.

Here are the steps to follow to prepare a Form 1099-NEC. Collect personal information from independent contractors with a W-9 Form. All independent contractors need to complete Form W-9. ... Confirm payment amount. ... Complete the details submit Copy A to IRS. ... Provide Copy B to the independent contractor. ... Keep a copy for yourself.

If you work for a person or a company and earn $600 or more paid to you in cash (again that means paid to you by cash, check, trade, credit card payment?just no taxes taken out) within a year they are required by law to send you a 1099-MISC.