Capital Distributions From A Trust

Description

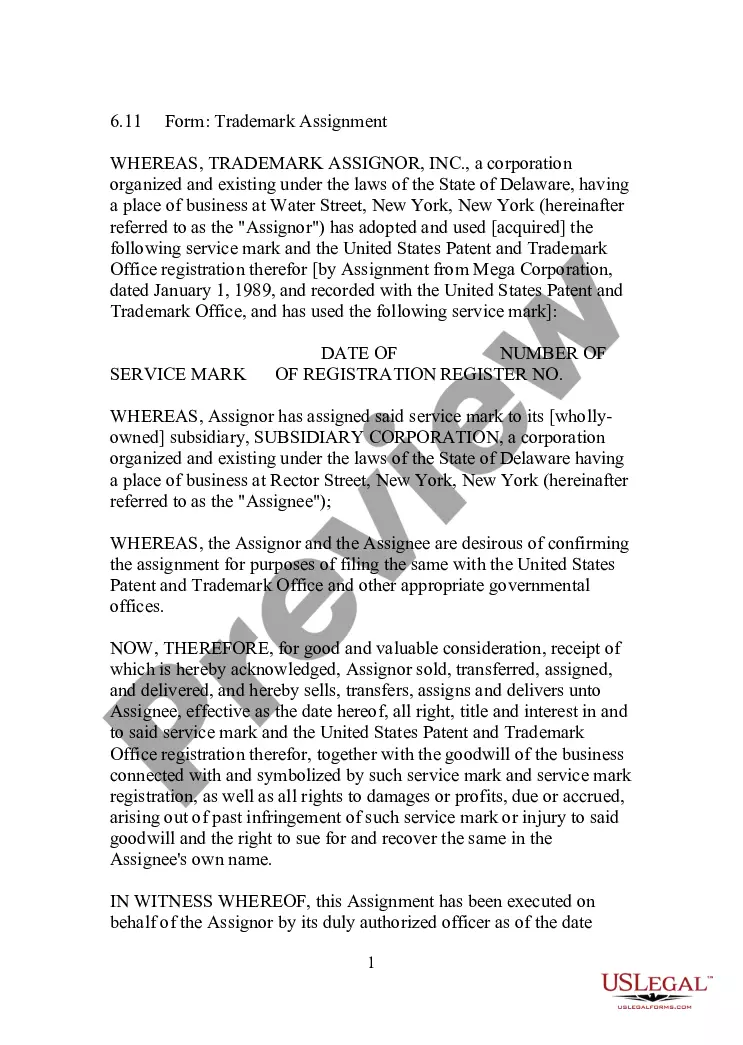

How to fill out Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

Managing legal documents can be perplexing, even for the most seasoned professionals.

When you need a Capital Distributions From A Trust and lack the time to search for the correct and most recent version, the process can be overwhelming.

Access legal and organizational forms tailored to specific states or counties.

US Legal Forms addresses all your requirements, from personal to business paperwork, all in one convenient location.

If this is your first experience with US Legal Forms, create a free account and enjoy unlimited access to all the platform's features. Here are the steps to take after downloading the desired form.

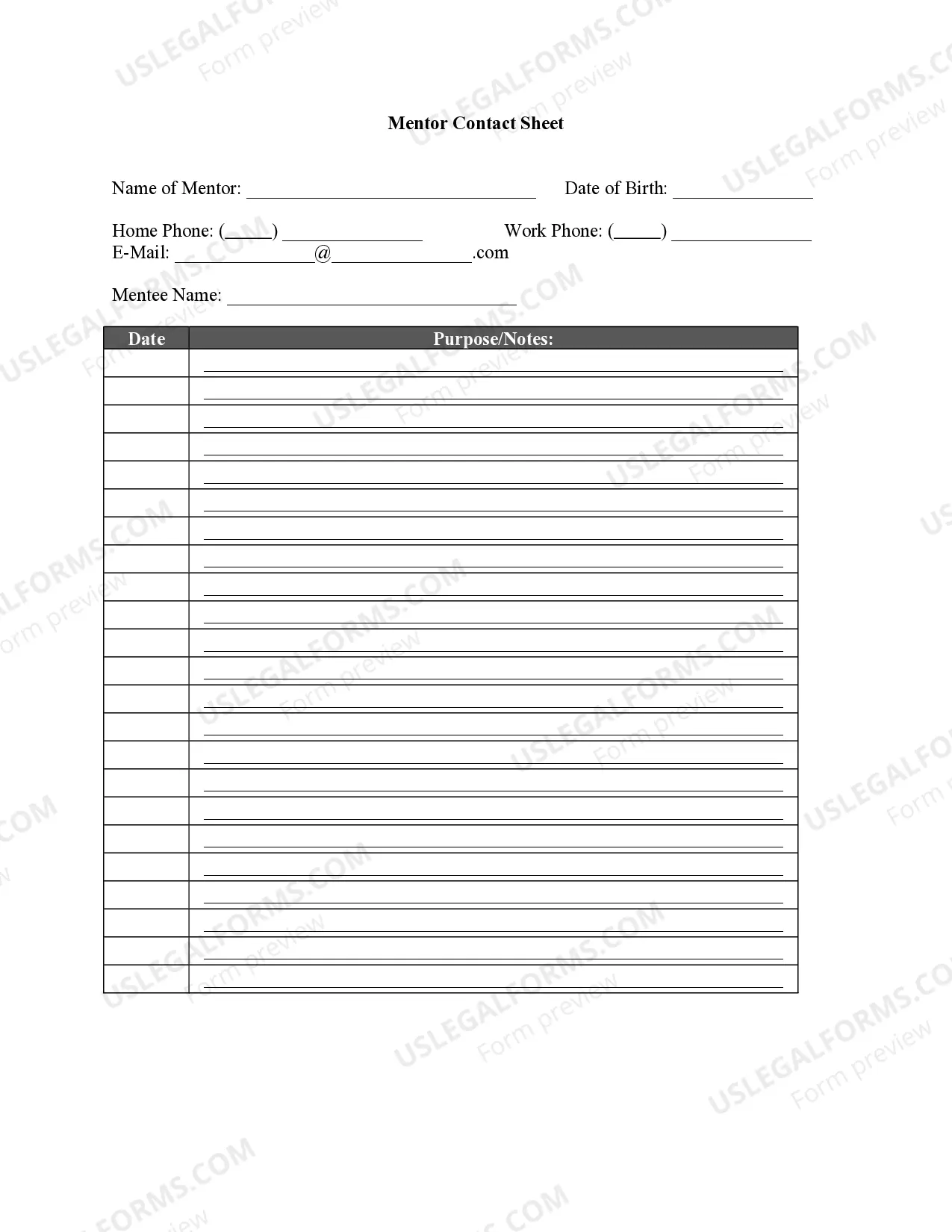

- Utilize advanced features to prepare and manage your Capital Distributions From A Trust.

- Access a collection of articles, guides, handbooks, and resources pertinent to your situation.

- Save valuable time and energy searching for the documents you require while leveraging US Legal Forms’ sophisticated search and Review tool to find Capital Distributions From A Trust.

- If you have a subscription, Log In to your US Legal Forms account, locate the form, and obtain it.

- Check your My documents tab to see the documents you have saved and organize your folders as you prefer.

- A robust online form library could significantly benefit anyone aiming to handle these matters effectively.

- US Legal Forms is a frontrunner in web-based legal forms, offering more than 85,000 state-specific legal forms available to you around the clock.

- With US Legal Forms, you can.

Form popularity

FAQ

Withdrawing from a trust involves following the procedures outlined in the trust agreement. Typically, you'll need to submit a request to the trustee, detailing the amount and purpose of the capital distributions from the trust. Trustees must adhere to the trust’s rules and may ask for necessary documentation to support your request. For streamlined processes, US Legal Forms provides useful templates and guidance for navigating trust withdrawals.

To transfer ownership from the deceased owner, the surviving owner must bring in the original title and original death certificate of deceased owner for transfer of title. If the names are joined on the title with ?and? or nothing separating the names, it is presumed by the state to be ?AND?.

Affidavit of Heirship Same as affidavit, but specifically establishing heirs of a decedent.

Step 1: ? Verify that the estate is eligible. This will include identifying and valuing all of the decedent's property to make sure it falls below the state maximum. ... Step 2 ? Contact all the Heirs. ... Step 3 ? Settle any remaining obligations. ... Step 4 ? Fill out, sign, and file the affidavit form.

What Is An Affidavit Of Heirship in Oklahoma. Under Oklahoma law, successors (usually children) can file an affidavit of heirship if the deceased individual's estate qualified as a ?small estate.? The affidavit of heirship must contain specific information if its to be used to avoid the probate process.

AFFIDAVIT OF HEIRS For purposes of this document, you must list ALL RELATIVES of the decedent, including yourself, if applicable. If the relative was deceased at the time of the decedent's death, please provide the deceased relative's name, indicate deceased, and date of death.

Heirs who inherit land intestate (without a will) own it as tenants in common. 5 Tenants in common each own an undivided interest in the whole parcel of land, which means that none of the heirs can claim any specific piece of land. As tenants in common, each heir has equal rights to use and occupy the land.

If you pass away without a last will and testament and did not own your home with your spouse as joint tenants with right of survivorship, your children and your spouse inherit the property and co-own it together as tenants-in-common (aka heirs property).

?then all of your assets will automatically pass through the Alabama Intestate Succession Laws. Essentially, the Intestate Succession laws divide up and pass down your assets through your closest living relatives, beginning with your immediate family and then your surviving parents and siblings.