Amend Articles Of Organization

Description

How to fill out Proposal To Amend Articles Of Incorporation To Effect A Reverse Stock Split Of Common Stock And Authorize A Share Dividend On Common Stock?

Securing a reliable location to obtain the most up-to-date and suitable legal forms is a significant part of navigating bureaucracy.

Obtaining the appropriate legal documents demands precision and careful attention, which is why it’s crucial to acquire samples of Amend Articles Of Organization solely from trustworthy providers, such as US Legal Forms.

Eliminate the hassles associated with your legal documentation. Explore the comprehensive US Legal Forms collection to locate legal templates, verify their applicability to your circumstance, and download them instantly.

- Utilize the library navigation or search option to find your template.

- Examine the form’s details to verify if it aligns with your state and region’s requirements.

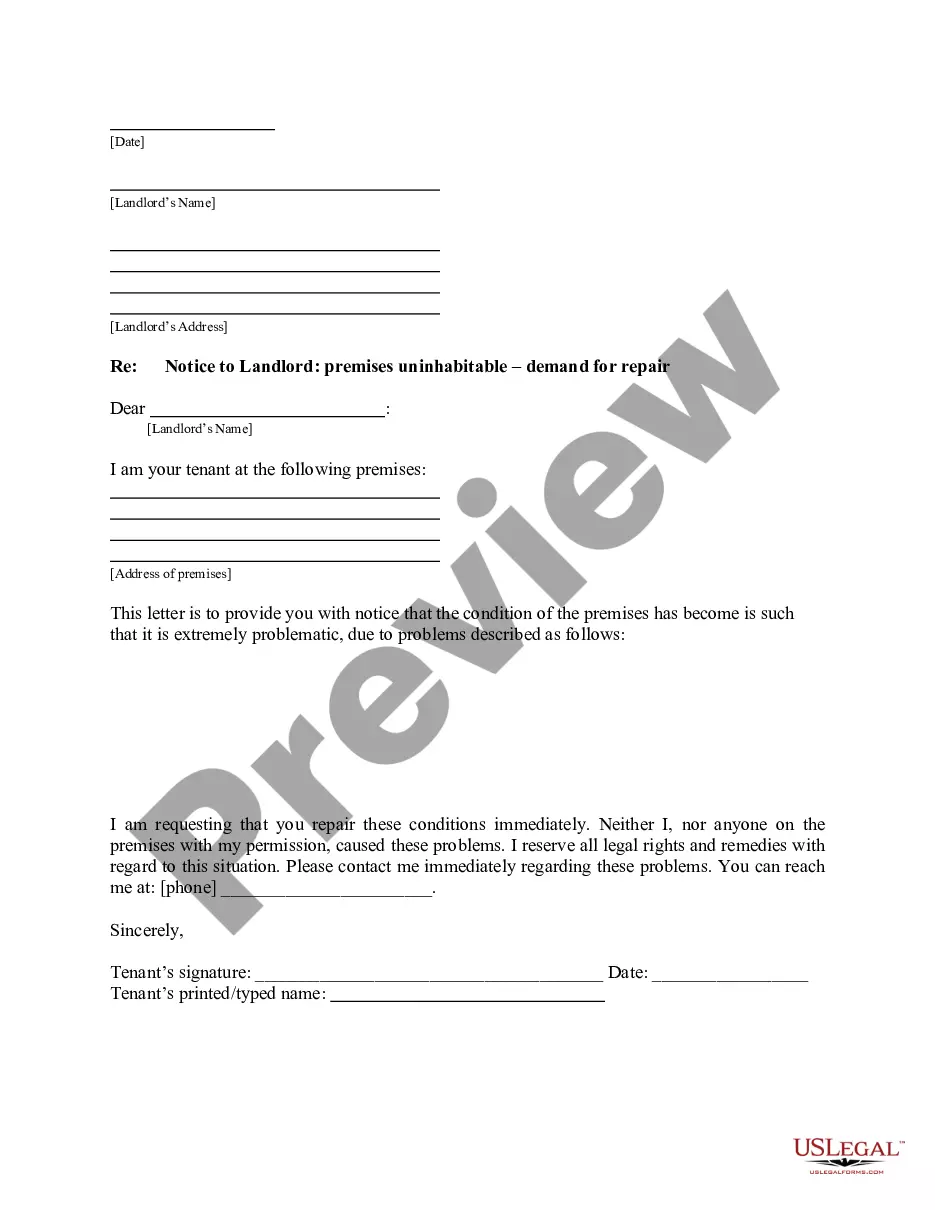

- If available, view the form preview to ensure the template meets your needs.

- Return to the search and find the correct document if the Amend Articles Of Organization does not fulfill your requirements.

- If you are confident about the form’s relevance, proceed to download it.

- If you are an authorized user, click Log in to verify your identity and access your chosen templates in My documents.

- If you haven’t created an account yet, click Buy now to purchase the template.

- Select the pricing plan that best meets your needs.

- Proceed with the registration to complete your order.

- Finalizing your purchase requires choosing a payment method (credit card or PayPal).

- Select the document format for downloading the Amend Articles Of Organization.

- After obtaining the form on your device, you can edit it using the editor or print it out to fill it in manually.

Form popularity

FAQ

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

In real estate wholesaling, an assignment fee is a financial obligation from one party (the ?assignor?) who agrees to transfer their contractual obligations to another party (the ?assignee.?) In layman's terms, the assignment fee is the fee paid by the end buyer to the real estate wholesaler.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

The difference between assignment and transfer is that assign means it's legal to transfer property or a legal right from one person to another, while transfer means it's legal to arrange for something to be controlled by or officially belong to another person.

A transfer of mortgage is the reassignment of an existing mortgage, usually on a home, from the current holder to another person or entity. Not all mortgages can be transferred; if they are, the lender has the right to approve the person assuming the loan.

Assignment fees are calculated by taking the difference between what the seller was promised and what the buyer is paying. For example, if a wholesaler has a contract to purchase a property for $100,000 and they assign that contract to a cash buyer for $120,000, then their assignment fee would be $20,000.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.