Certificate Of Incorporation For Sole Proprietorship

Description

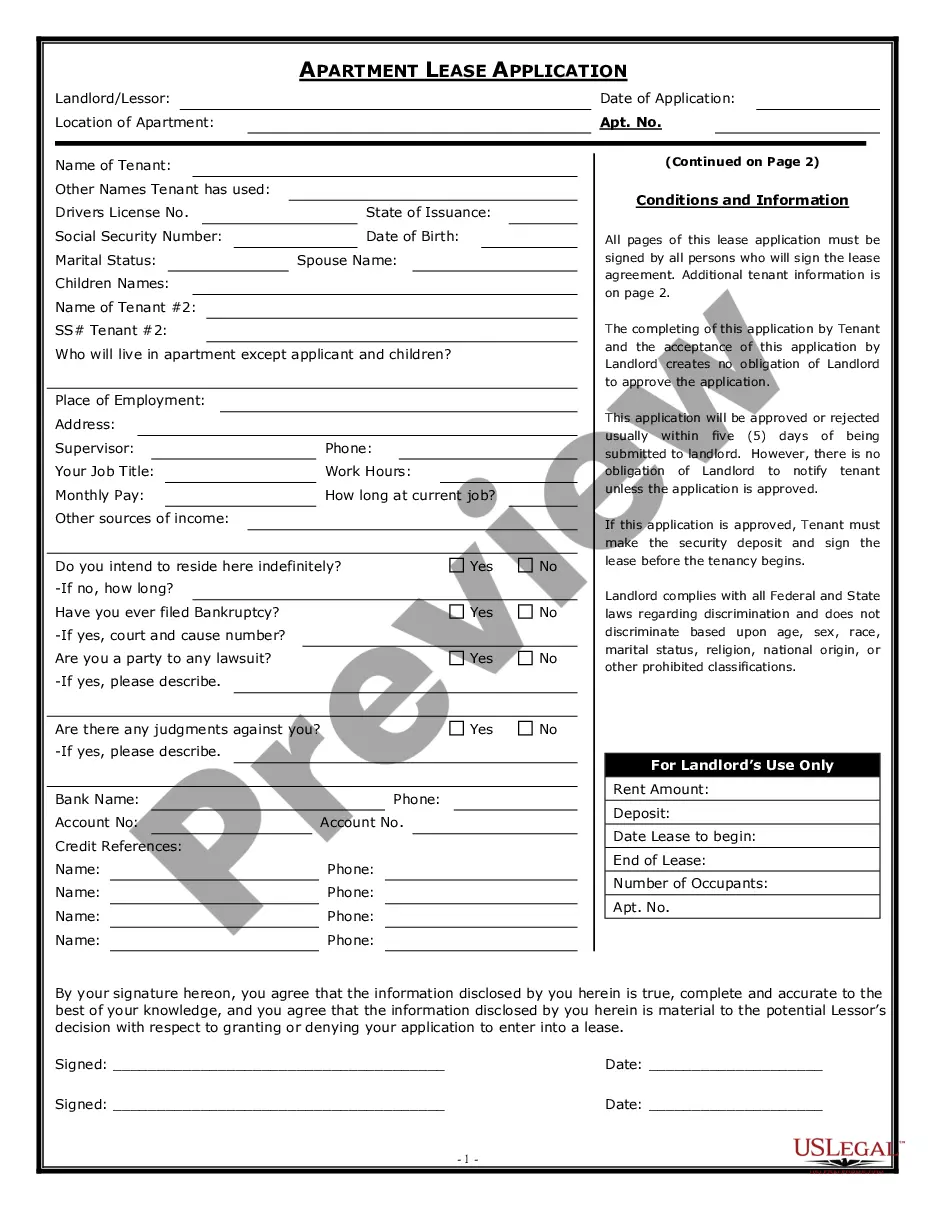

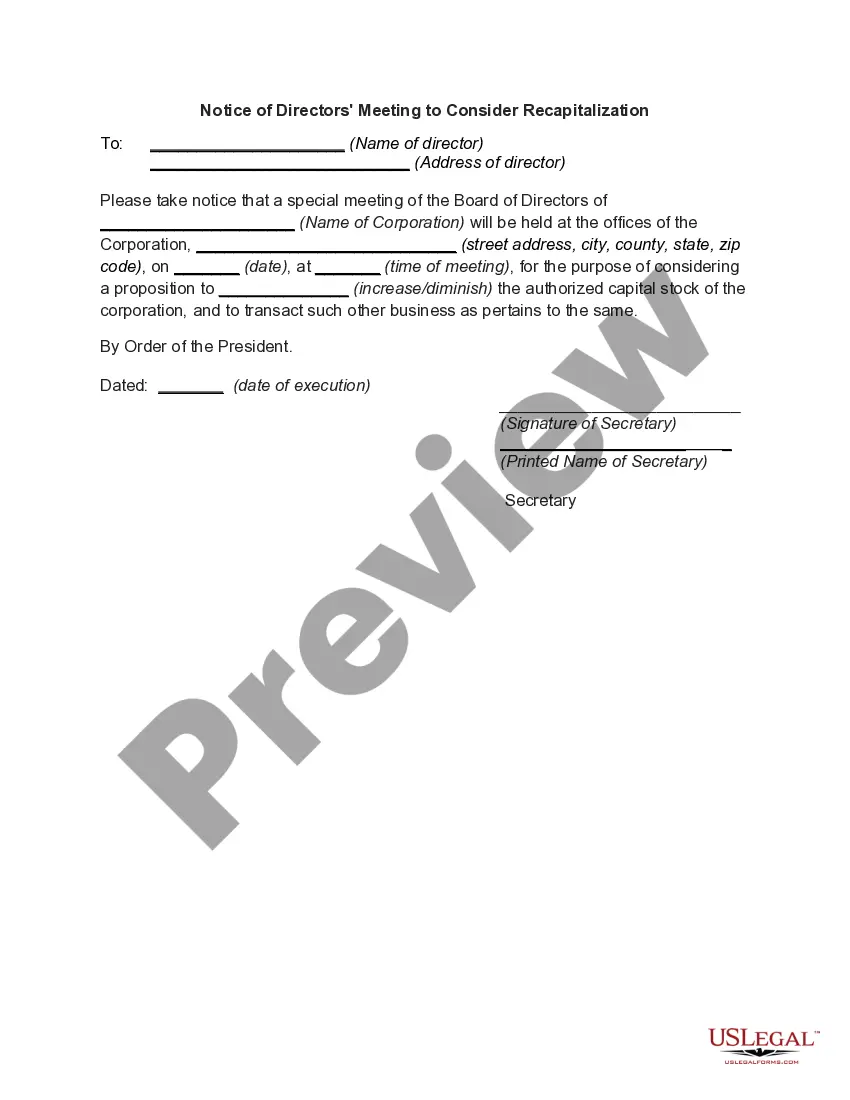

How to fill out Proposed Amendment To The Restated Certificate Of Incorporation To Authorize Preferred Stock?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active before proceeding.

- For first-time users, visit the platform and explore the Preview mode to familiarize yourself with the form descriptions. Confirm that you select the appropriate template for your jurisdiction.

- If the form doesn’t meet your needs, utilize the Search tab to find a more suitable document before moving ahead.

- Select the desired certificate by clicking on the Buy Now button and choose your preferred subscription plan, creating an account if necessary.

- Complete the purchase by entering your payment information via credit card or PayPal.

- Once your transaction is confirmed, download the template onto your device. Access it anytime through the My Forms menu in your profile for future reference.

Using US Legal Forms gives you access to a wealth of over 85,000 readily fillable legal forms and packages, far surpassing competitors. Additionally, premium experts are at your service to assist in ensuring your documents are completed accurately and legally.

Take the first step towards legal business establishment today. Start your journey with US Legal Forms and ensure your sole proprietorship is compliant and properly documented!

Form popularity

FAQ

The primary document that indicates you are a sole proprietor is your business tax return, specifically the Schedule C form. This form details your income and expenses as a sole proprietor, and it is filed alongside your personal tax return. Although no specific incorporation document exists for sole proprietorships, creating a Certificate of incorporation for sole proprietorship can provide you with formal recognition and enhance credibility with clients and suppliers.

Establishing yourself as a sole proprietor is a straightforward process. Start by choosing a business name and, if necessary, register it with your state. Next, obtain any required licenses or permits and ensure you have an organized accounting system in place. To further legitimize your business, consider obtaining a Certificate of incorporation for sole proprietorship, which can provide additional benefits and protect your personal assets.

To determine if you are a sole proprietor, consider how your business is structured. If you operate independently and report your income on your personal tax return without formally registering a business entity, you are likely a sole proprietor. It's important to understand that you assume full responsibility for all business debts and liabilities. If you’re seeking better organization, a Certificate of incorporation for sole proprietorship may help clarify your business status.

As a sole proprietor, you can show proof of income through various documents such as bank statements, profit and loss statements, or tax returns. Typically, your Schedule C form filed with your annual tax return serves as a strong evidence of your earnings. Additionally, maintaining detailed records of all transactions can help validate your income. If you plan to apply for financing or establish credibility, consider creating a Certificate of incorporation for sole proprietorship, which can enhance your professional image.

A DBA, or doing business as, is not the same as a business license. A DBA allows you to operate your business under a different name than your personal name or business structure. However, a business license is a government requirement that permits you to conduct business legally in your area.

A Certificate of Incorporation for an LLC, or Limited Liability Company, is a legal document that establishes the entity as a separate entity. This certificate outlines essential details like the LLC's name, address, and registered agent. While a sole proprietorship does not require this document, LLCs benefit from limited liability protection, which is essential for many business owners.

To prove you are a sole proprietor, you can use documents such as a business registration or a DBA (doing business as) certificate. These documents demonstrate your ownership and operation of the business. Maintaining clear records of business income and expenses also supports your status as a sole proprietor.

Incorporation and sole proprietorship are fundamentally different structures. A sole proprietorship is unincorporated, meaning that it doesn't require a separate legal entity for operations. Therefore, you cannot have an incorporation if you are a sole proprietor, since incorporation involves forming a corporation.

No, a Certificate of Incorporation is not a business license. A Certificate of Incorporation legally establishes a corporation, while a business license allows you to operate your business in a specific area. If you are running a sole proprietorship, you typically need a business license and not a certificate of incorporation.

The equivalent to a Certificate of Incorporation is often a business registration document or an operating agreement. These documents establish your business structure and are crucial for legal recognition. In the case of a sole proprietorship, however, you may not need a Certificate of Incorporation since this structure does not require formal incorporation.