Partnership With Financial Services

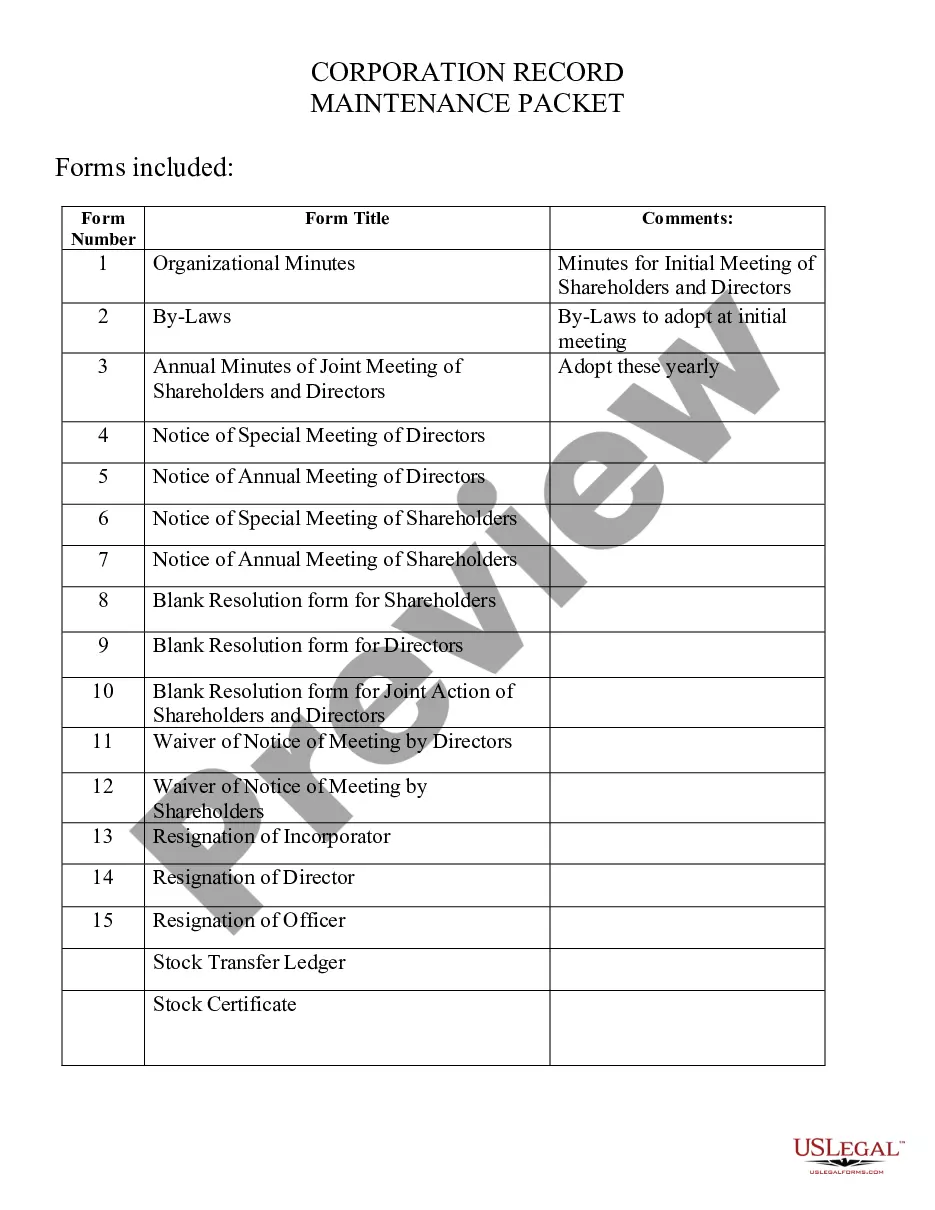

Description

How to fill out Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

Dealing with legal documents and processes can be a lengthy addition to your entire schedule.

Associations With Financial Services and similar forms often require you to search for them and find the optimal way to fill them out accurately.

As a result, if you are managing financial, legal, or personal issues, having a comprehensive and user-friendly online collection of forms at your disposal will be very beneficial.

US Legal Forms is the premier online platform of legal documents, boasting over 85,000 state-specific templates and various tools to help you complete your paperwork effortlessly.

Is this your first time using US Legal Forms? Sign up and create an account in just a few minutes, granting you access to the form library and Partnership With Financial Services. Then, follow the steps below to complete your form.

- Explore the library of pertinent documents available with just one click.

- US Legal Forms provides you with state- and county-specific templates accessible at any time for downloading.

- Safeguard your document management processes with a high-quality service that allows you to create any form in minutes without incurring extra or hidden costs.

- Simply Log In to your account, find Partnership With Financial Services, and obtain it immediately within the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

There are four main types of entities that are required to file a K-1: Business partnerships. LLCs that have at least two partners or elect to be taxed as corporations. S corporations. Trusts and estates.

Schedule K-1 serves a similar purpose as Form 1099. A Schedule K-1 is issued to taxpayers who have invested in limited partnerships (LPs) and some exchange-traded funds (ETFs). There are also K-1 forms for shareholders in S-Corporations and beneficiaries of estates or trusts.

Each partner reports their share of the partnership's income or loss on their personal tax return. Partners are not employees and shouldn't be issued a Form W-2. The partnership must furnish copies of Schedule K-1 (Form 1065) to the partner.

IRS Form 1065 Instructions Fill in Boxes A Through J. Once you have all the documents handy, it'll be time to fill out boxes A through J, which are located on the very top of 1065 Form. ... Complete the Remainder of Page 1. ... Fill Out Schedule B. ... Complete Schedule K. ... Fill Out the Remaining Sections. ... Review and File with the IRS.

The partnership files a copy of Schedule K-1 (Form 1065) with the IRS to report your share of the partnership's income, deductions, credits, etc.