Loan Promissory Note With Payment Schedule

Description

How to fill out Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

There’s no further justification to spend countless hours searching for legal documents to comply with your local state laws.

US Legal Forms has assembled all of them in one location and streamlined their accessibility.

Our site provides over 85k templates for various business and personal legal situations categorized by state and usage area. All forms are properly drafted and verified for accuracy, ensuring you can confidently obtain an up-to-date Loan Promissory Note With Payment Schedule.

Print your form to fill it in by hand or upload the sample if you prefer to do it in an online editor. Creating legal documents in accordance with federal and state regulations is quick and easy with our library. Experience US Legal Forms today to keep your documentation organized!

- If you are acquainted with our service and have an account already, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all acquired documents anytime needed by accessing the My documents tab in your profile.

- If you haven't used our service before, the process will require a few more steps to finalize.

- Here's how new users can find the Loan Promissory Note With Payment Schedule in our collection.

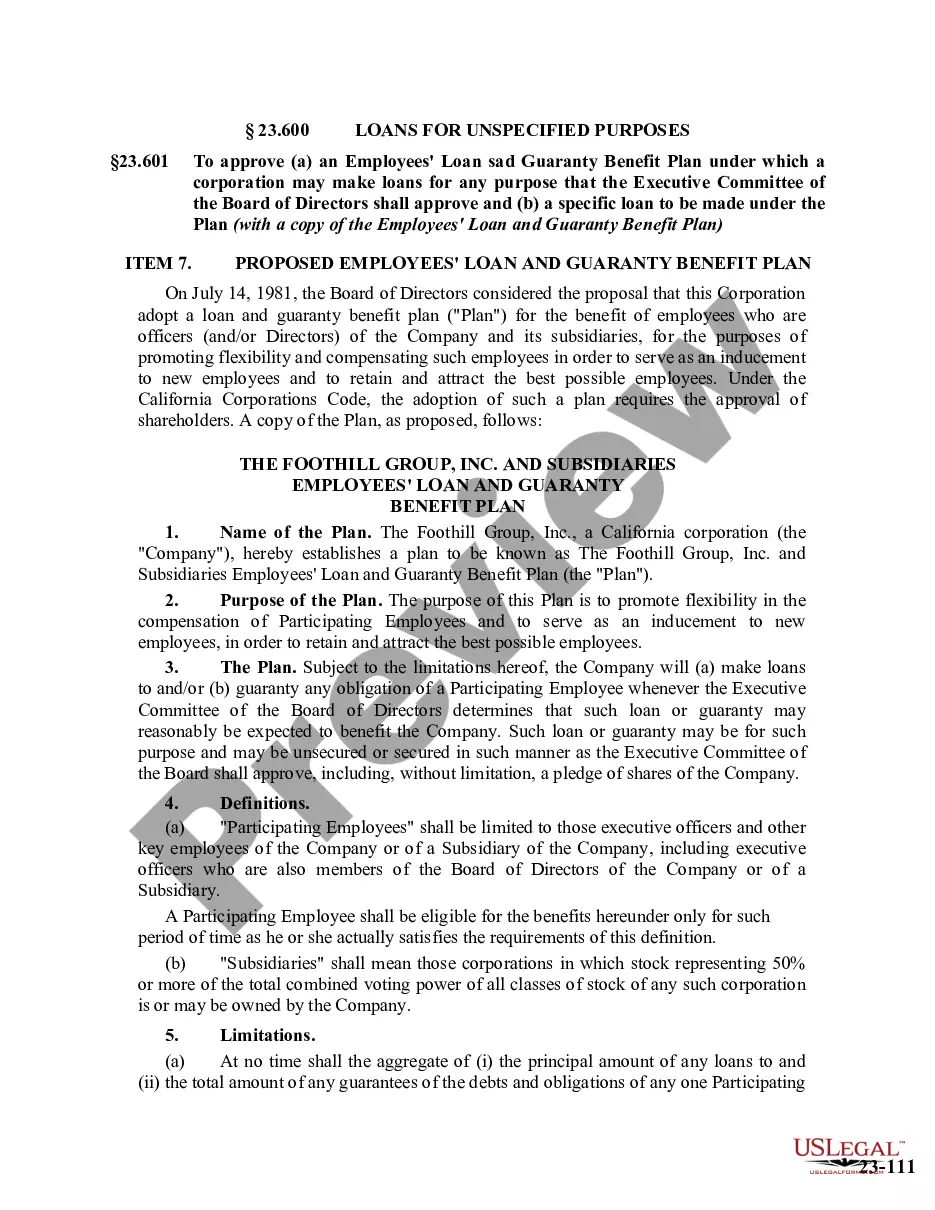

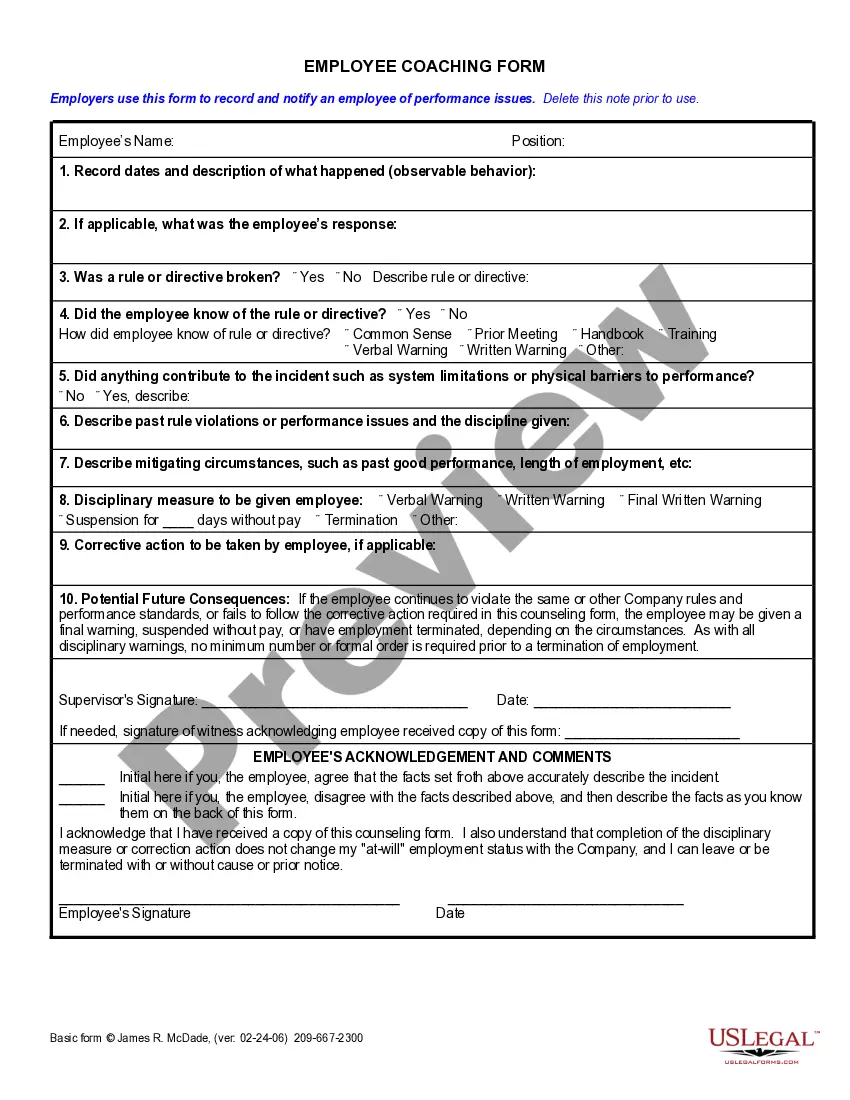

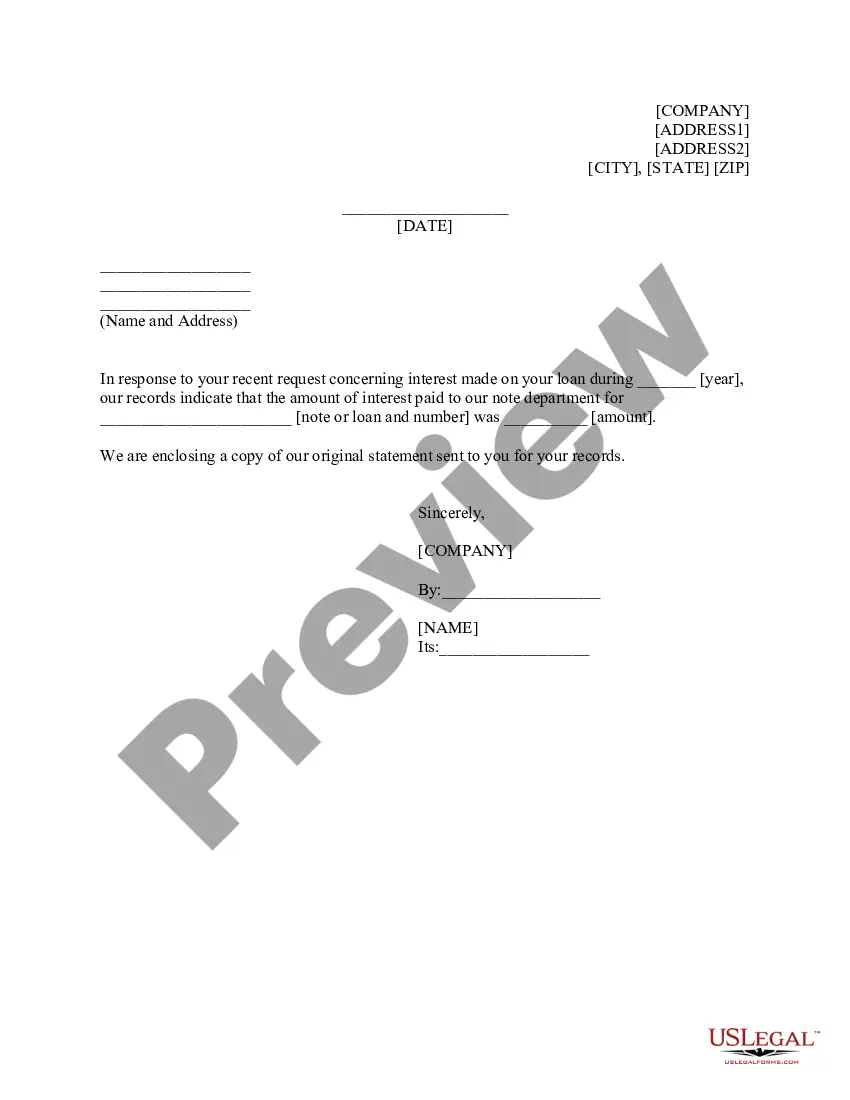

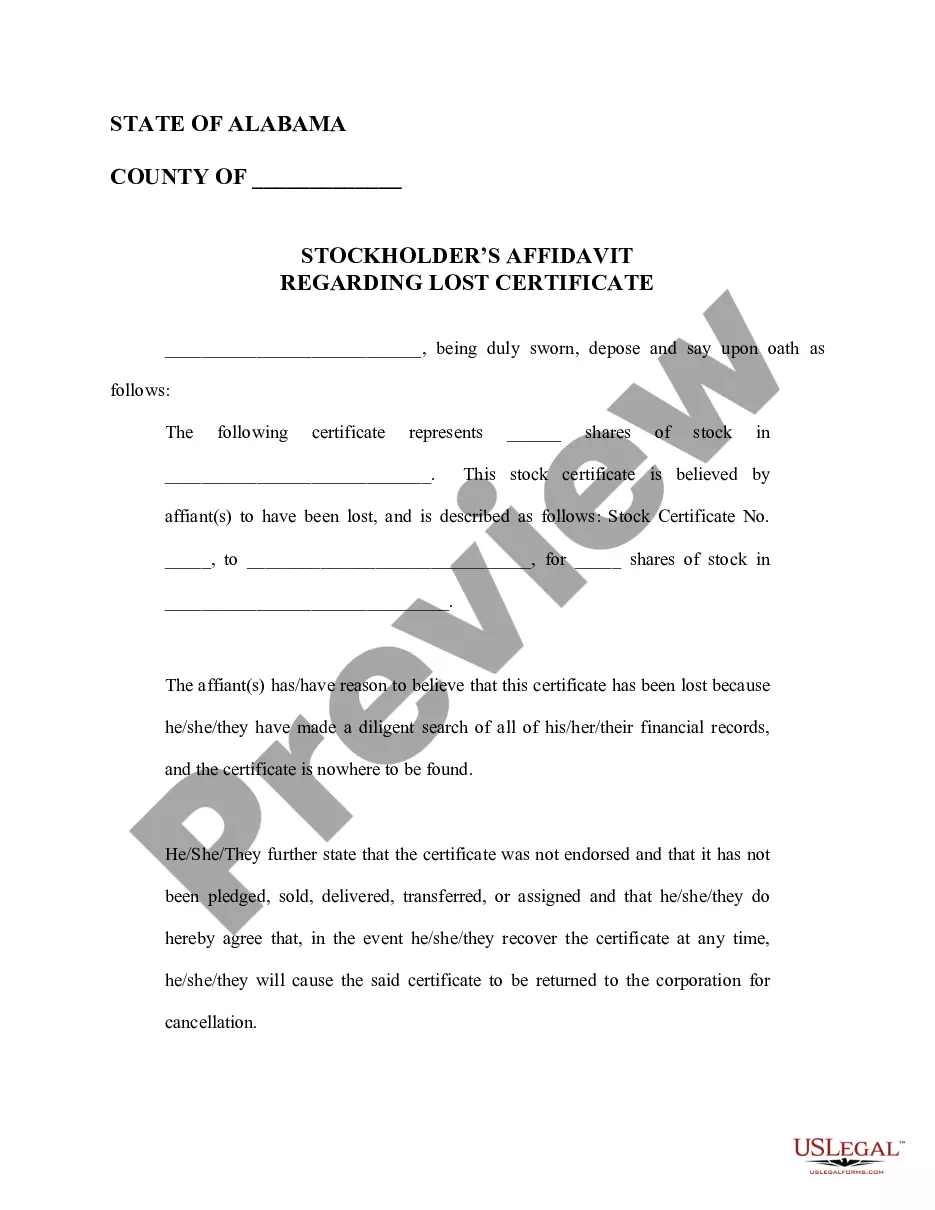

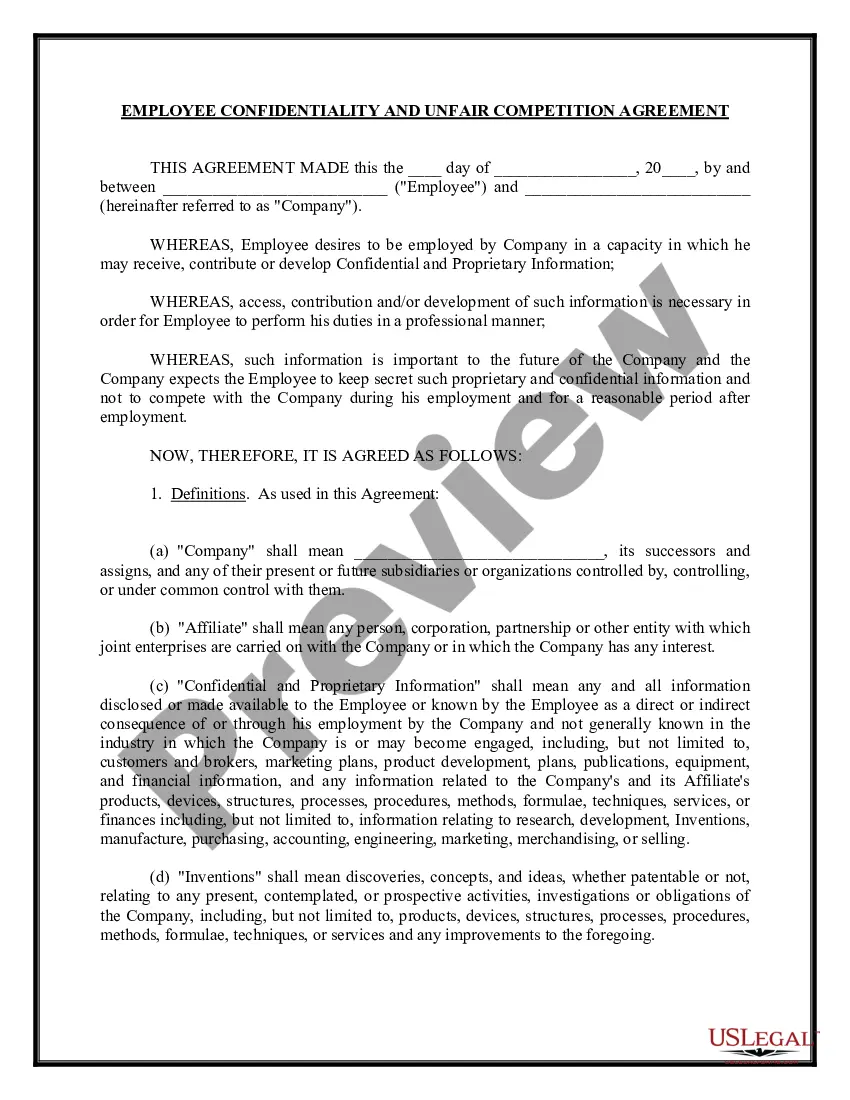

- Examine the page content thoroughly to ensure it includes the sample you need.

- To assist, use the form description and preview options, if available.

- Employ the Search bar above to look for another sample if the previous one was not suitable.

- Click Buy Now next to the template title when you identify the right one.

- Select your desired pricing plan and create an account or Log In.

- Make payment for your subscription with a card or via PayPal to continue.

- Choose the file format for your Loan Promissory Note With Payment Schedule and download it to your device.

Form popularity

FAQ

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...