Profit Sharing With Contractors

Description

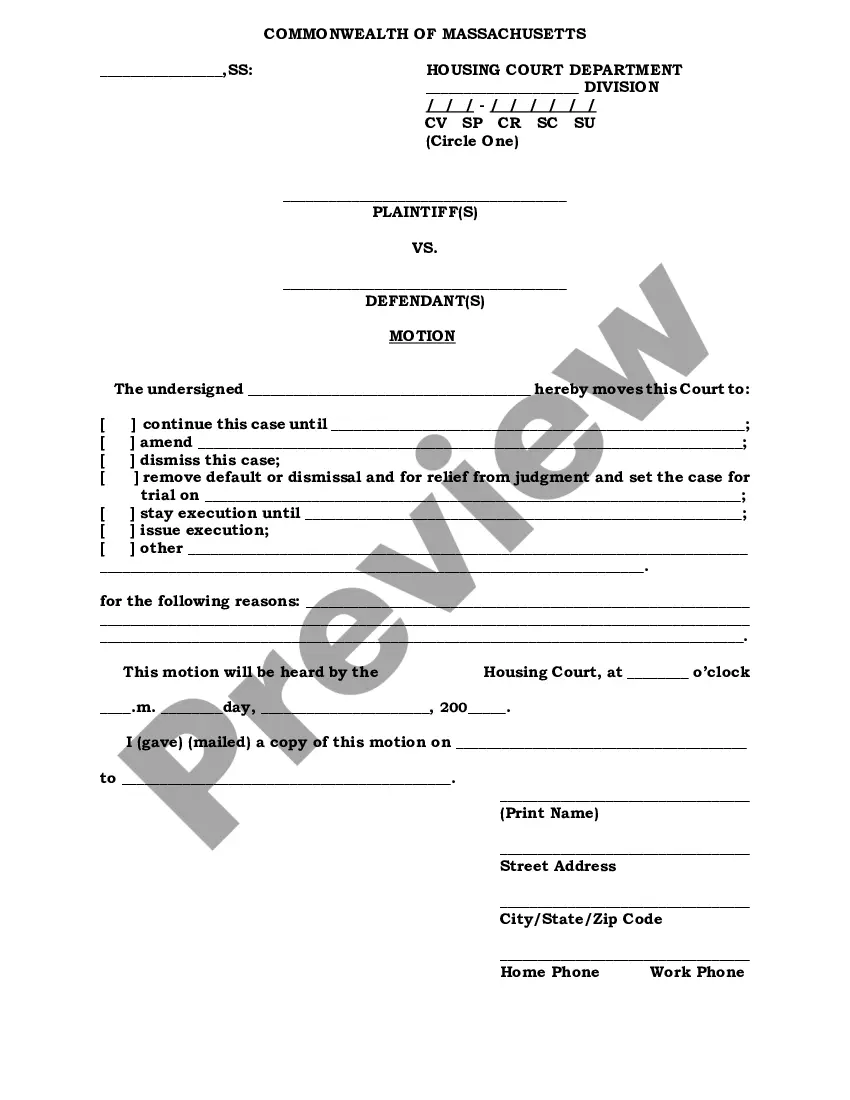

How to fill out Profit Sharing Plan?

Bureaucracy necessitates meticulousness and exactness.

If you do not engage in completing documents like Profit Sharing With Contractors on a daily basis, it could lead to some misunderstanding.

Selecting the correct sample at the outset will guarantee that your document submission proceeds effortlessly and avoids any issues of resubmitting a file or redundant work from the beginning.

If you are not a subscribed user, finding the necessary sample will involve a few extra steps.

- Retrieve the suitable sample for your documentation from US Legal Forms.

- US Legal Forms represents the largest online collection of forms with over 85 thousand samples across various subjects.

- You can access the latest and most applicable version of the Profit Sharing With Contractors by merely searching on the platform.

- Discover, keep, and save templates within your account, or refer to the description to confirm you possess the accurate one.

- By having an account at US Legal Forms, you can effortlessly attain and store all templates in one location to navigate through them with just a few clicks.

- While on the website, click the Log In button to authenticate.

- Next, visit the My documents page, which houses your forms list.

- Review the descriptions of the forms and save those you require anytime.

Form popularity

FAQ

Profit sharing exampleDivide each employee's compensation by the total to get their percentage of the overall compensation. Then give each employee an equivalent percentage of the profit-sharing bonus.

Employers follow a set formula for contributions. There's no required profit-sharing percentage, but experts recommend staying between 2.5% and 7.5%.

If you want your profit-sharing agreement to be rock solid, here are a few clauses that you must include in it.Profit Sharing. Clearly mention the ratio/percentage in which you will be dividing the profits.Termination.Dispute Resolution.Confidentiality.Obligations.Intellectual Property.Indemnities and Liabilities.

You calculate each eligible employee's contribution by dividing the profit pool by the number of employees who are eligible for your company's 401(k) plan. Example: The company profit sharing pool is $10,000 and there are three eligible employees. Each employee would get $3,333, regardless of their salaries.

If you want your profit-sharing agreement to be rock solid, here are a few clauses that you must include in it.Profit Sharing. Clearly mention the ratio/percentage in which you will be dividing the profits.Termination.Dispute Resolution.Confidentiality.Obligations.Intellectual Property.Indemnities and Liabilities.