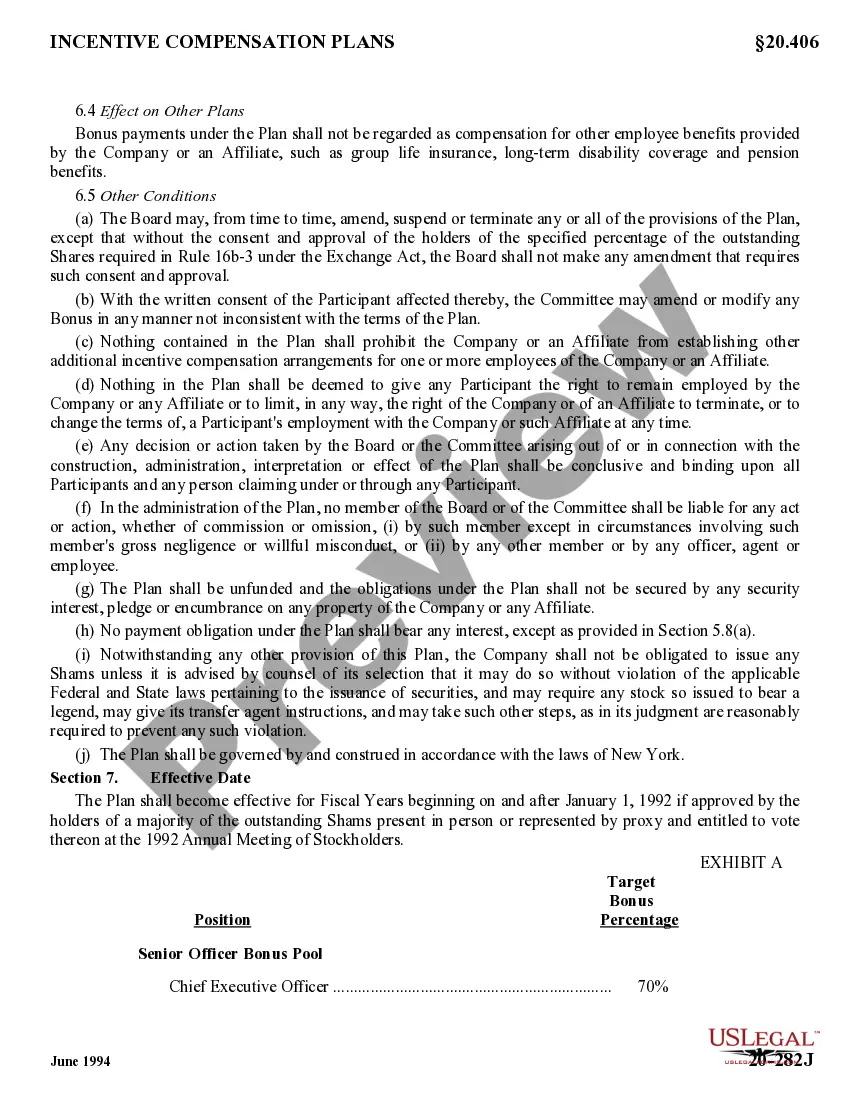

Bonus Year Per For Employees

Description

How to fill out Restated Employee Annual Incentive Bonus Plan With Attachments?

Managing legal paperwork and processes can be a lengthy addition to your whole day. Bonus Year Per For Employees and similar forms often necessitate you to locate them and figure out how to fill them out properly.

For this reason, whether you are handling financial, legal, or personal issues, having a comprehensive and practical online library of forms readily available will greatly assist.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms along with various resources that will help you complete your documents with ease.

Explore the collection of relevant documents available to you with just a simple click.

Then, follow the instructions below to finalize your form: Ensure you have the correct form by utilizing the Review function and examining the form details. Select Buy Now when ready, and choose the subscription plan that fits your requirements. Click Download then fill out, sign, and print the form. US Legal Forms has 25 years of experience assisting users in managing their legal documents. Obtain the form you need today and simplify any process without breaking a sweat.

- US Legal Forms offers state- and county-specific forms available at any time for download.

- Safeguard your document management tasks with a high-quality service that allows you to prepare any form in minutes without extra or hidden costs.

- Simply Log In to your account, search for Bonus Year Per For Employees, and obtain it instantly within the My documents section.

- You can also access forms you have previously downloaded.

- Is it your first time using US Legal Forms? Register and create an account in a few minutes, and you will gain entry to the form library and Bonus Year Per For Employees.

Form popularity

FAQ

A typical yearly bonus often ranges between 10% to 15% of an employee's annual salary, depending on the company's performance and the individual’s contributions. This bonus can serve as a motivator for employees, encouraging them to exceed performance expectations. Establishing a clear understanding of what constitutes a typical yearly bonus helps employees gauge their potential earnings. To navigate bonus structures effectively, US Legal Forms offers valuable tools and documentation to support businesses and employees alike.

The 2.5 month rule for bonuses refers to a guideline suggesting that a company should aim to allocate a bonus amount equivalent to 2.5 months of an employee's salary. This rule can serve as a benchmark for businesses when determining bonus distributions. By applying this rule, companies can enhance employee satisfaction and retention through effective bonus year per for employees. US Legal Forms provides templates and resources to assist in establishing fair bonus structures.

The average annual bonus can vary significantly based on industry, company size, and individual performance. Typically, bonuses can range from 5% to 20% of an employee's annual salary. Understanding the average can help employees set realistic expectations regarding their bonus year per for employees. For detailed insights tailored to specific industries, consider exploring resources from US Legal Forms.

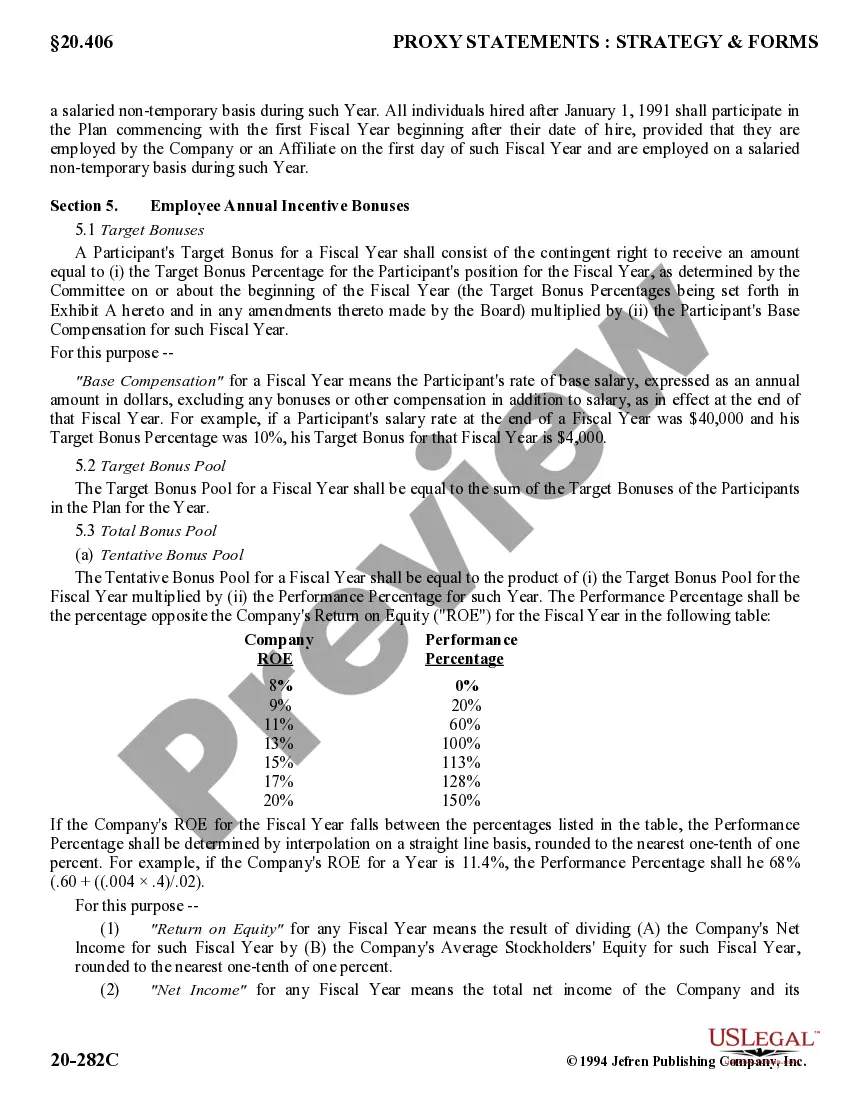

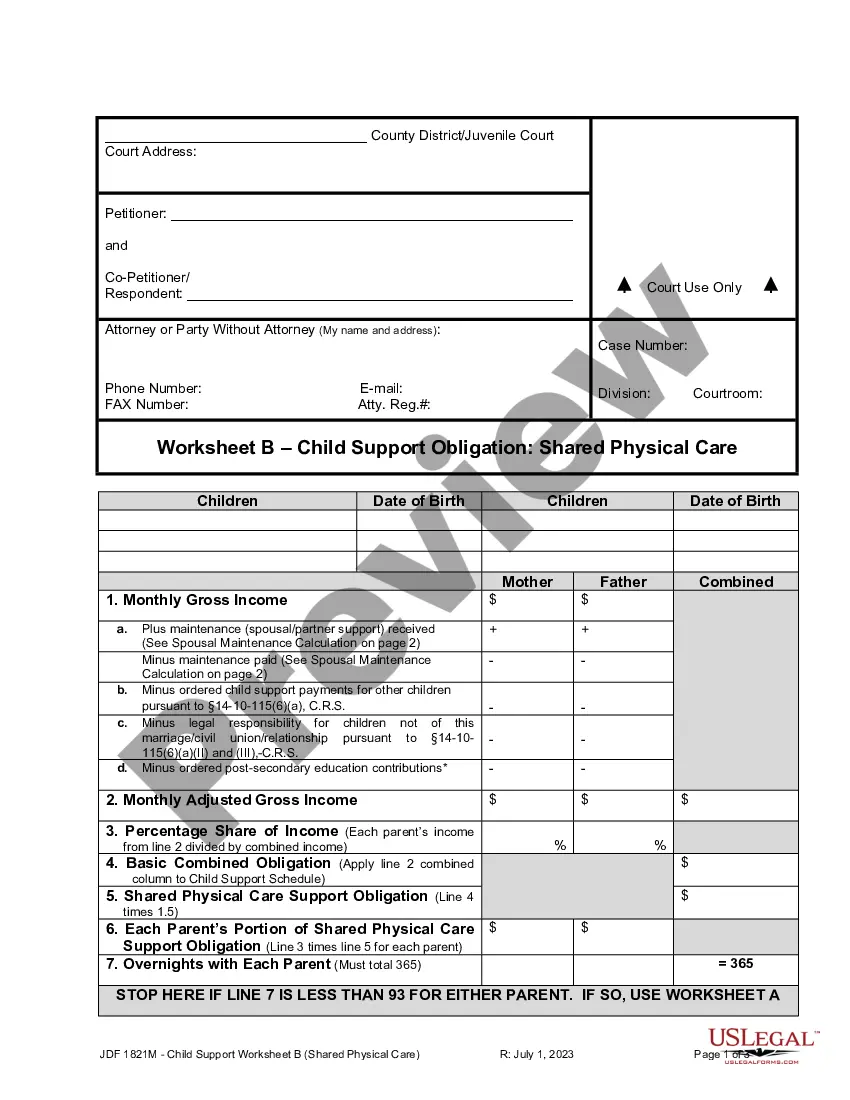

To calculate the bonus per year for employees, first determine the total compensation package, which includes base salary and additional performance incentives. Next, assess the company's bonus policy, which may be based on individual performance, company performance, or a combination of both. Finally, apply the relevant percentage or formula to the total compensation to arrive at the bonus amount. Using tools from US Legal Forms can help streamline this calculation and ensure accuracy.

When reporting bonus income on your taxes, it is essential to include it with your regular wages on your tax return. The IRS treats bonuses as supplemental income, meaning they may be taxed at a higher withholding rate. Understanding how this affects the bonus year per for employees is crucial for accurate tax planning. Utilize tax preparation software or consult with a tax professional to ensure compliance and optimize your tax situation.

Calculating a year-end bonus for employees involves assessing company performance and individual contributions. Begin by determining the total amount available for bonuses and then allocate based on criteria such as performance metrics or length of service. This approach aligns with the bonus year per for employees, making the process fair and transparent. You may also consider using performance review data to guide your calculations.

When considering the bonus year per for employees, one effective strategy is to defer income to a later tax year if possible. This allows you to potentially lower your tax liability by moving into a lower tax bracket. Additionally, consider contributing to retirement accounts, which can also reduce taxable income. Using tax-advantaged accounts can maximize your financial benefits.

To calculate your annual bonus, review your company’s bonus policy and determine the percentage of your salary designated for the bonus. Then, multiply your annual salary by this percentage to find the total bonus amount. Remember, the bonus year per for employees is often tied to performance metrics, so ensure you meet the criteria outlined by your employer.

A typical end-of-year (EOY) bonus can range from 5% to 20% of an employee’s annual salary, depending on factors such as company size and performance. Some organizations also offer flat-rate bonuses for all employees. Understanding the bonus year per for employees can help you set competitive bonuses that attract and retain talent.

To calculate the yearly bonus for employees, first determine the total amount allocated for bonuses. Then, distribute this amount based on individual performance metrics or company-wide results. This approach ensures that the bonus year per for employees is both fair and motivating. Tools like US Legal Forms can streamline this calculation process.