Restricted Stock Purchase Agreement With Commentary

Description

How to fill out Sample Restricted Stock Purchase Agreement Between Intermark, Inc. And Purchasers?

Legal document management might be overwhelming, even for skilled experts. When you are searching for a Restricted Stock Purchase Agreement With Commentary and do not get the time to spend looking for the right and updated version, the processes can be nerve-racking. A strong online form catalogue can be a gamechanger for everyone who wants to deal with these situations effectively. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any requirements you could have, from individual to enterprise papers, all in one location.

- Use advanced resources to complete and deal with your Restricted Stock Purchase Agreement With Commentary

- Access a useful resource base of articles, instructions and handbooks and materials related to your situation and needs

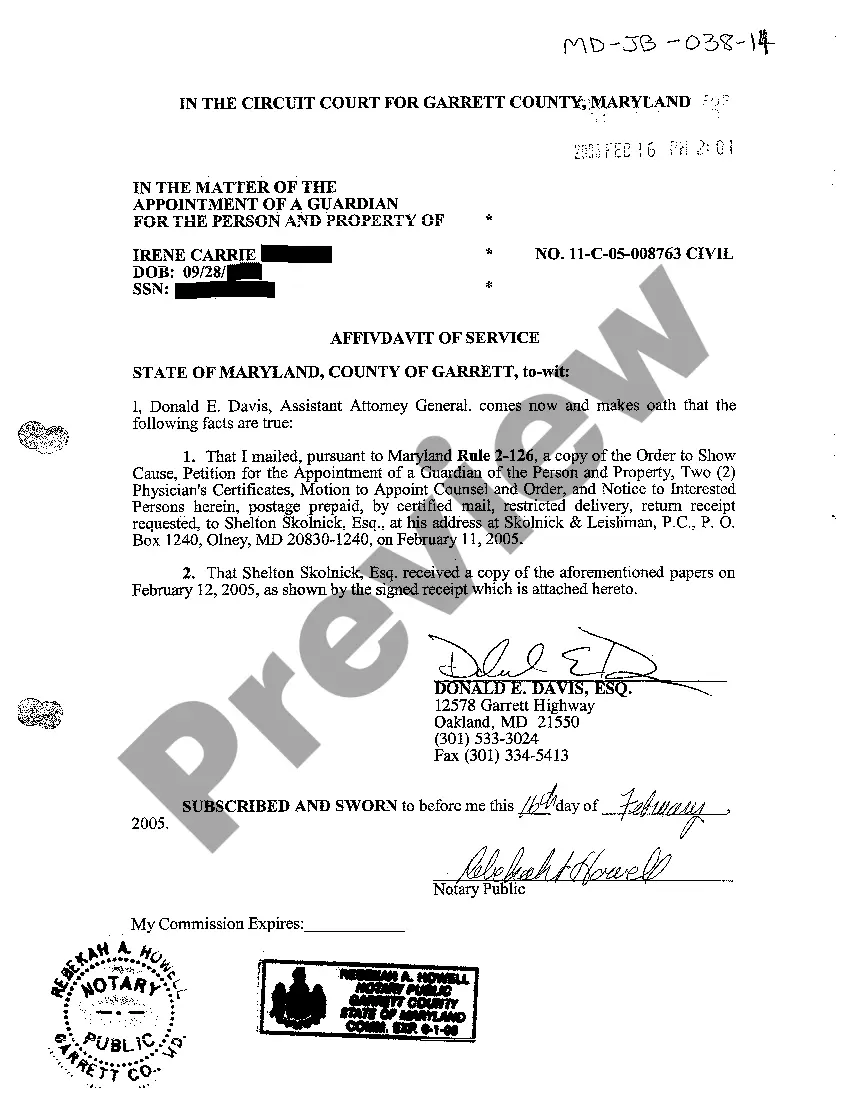

Save time and effort looking for the papers you will need, and use US Legal Forms’ advanced search and Preview tool to discover Restricted Stock Purchase Agreement With Commentary and acquire it. For those who have a monthly subscription, log in in your US Legal Forms account, search for the form, and acquire it. Review your My Forms tab to find out the papers you previously saved and to deal with your folders as you can see fit.

If it is the first time with US Legal Forms, register a free account and obtain unrestricted use of all benefits of the library. Here are the steps to take after accessing the form you want:

- Validate it is the proper form by previewing it and reading through its information.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now once you are all set.

- Choose a subscription plan.

- Pick the formatting you want, and Download, complete, sign, print and send your document.

Enjoy the US Legal Forms online catalogue, supported with 25 years of experience and reliability. Transform your day-to-day document management in a easy and intuitive process right now.

Form popularity

FAQ

Resigning before your RSUs have vested is a tough pill to swallow. Usually, you'll lose all the RSUs that have not yet vested at the time of your resignation. They'll be forfeited back to the company, and you'll walk away with nothing for those unvested units.

A: The most common provisions included in restricted stock purchase agreements are restrictions on when and how stock can be sold or transferred; non-compete agreements; rights of first refusal; and termination clauses which allow either party to terminate the agreement under specified conditions.

Restricted stock tends to have more conditions and restrictions than an RSU. For example, restricted stock may be forfeited if the executive doesn't deliver expected results, whereas RSUs usually only require the employee to stay with the company for a certain period of time before the shares are vested.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.