Employee Stock Option

Description

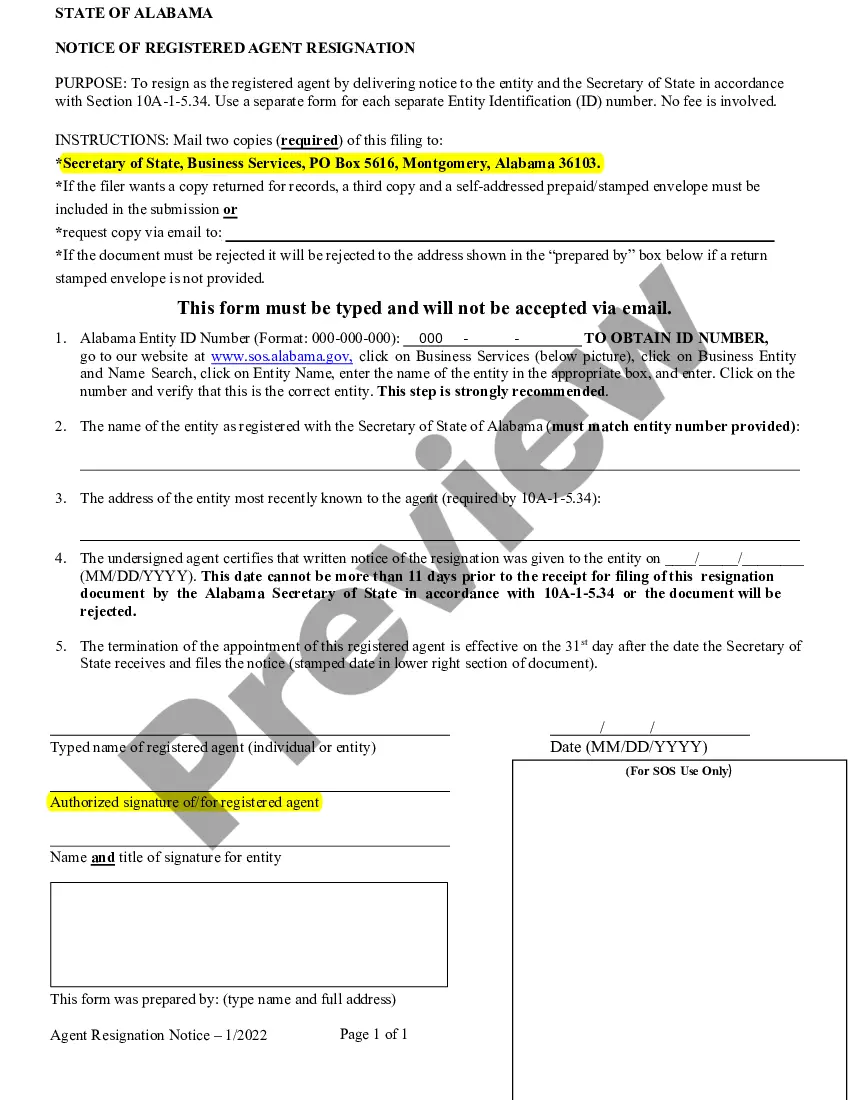

How to fill out Amended And Restated Employee Stock Purchase Plan?

- If you are a returning user, log in to your account and select the Employee Stock Option form. Ensure that your subscription is active; if not, renew it as per your plan.

- For first-time users, begin by previewing the available templates. Confirm that your chosen document aligns with your needs and local jurisdiction requirements.

- Should you require a different form, utilize the Search feature to find the appropriate document that meets your specifications. Once satisfied, proceed to the next phase.

- Purchase your selected document by clicking the Buy Now button and opting for a suitable subscription plan. Registration is required to unlock the full library.

- Complete your transaction by entering your payment information or using your PayPal account. Ensure your purchase is confirmed to gain access to the forms.

- Finally, download your document to your device and save it for completion. Access it later from the My Forms section in your profile.

Utilizing US Legal Forms not only saves time but also ensures that you have access to legally sound documents. Their extensive library, exceeding 85,000 templates, makes it easy to find precisely what you require.

Take control of your legal documentation today and streamline your experience with US Legal Forms.

Form popularity

FAQ

The $100,000 rule for stock options limits the value of options you can exercise in any given calendar year. Specifically, it applies to incentive stock options (ISOs) under IRS regulations. If the fair market value of your options exceeds $100,000 when granted, the excess will be treated as non-qualified stock options, losing the favorable tax treatment. Thus, staying within this limit is crucial for maximizing the tax advantages of your employee stock options.

The appropriate amount of stock options to give employees varies based on company size, industry, and individual employee contributions. Typically, startups might offer more substantial equity to attract talent, while established companies may provide smaller percentages. It's crucial to align your stock option offerings with business goals and employee expectations to maintain motivation and commitment.

To report an Employee Stock Ownership Plan (ESOP) on your tax return, include any distributions received during the year. You'll generally report these distributions as income on your tax return. Additionally, be aware of any tax deferrals or specific deductions allowable. For accurate reporting, seek assistance or templates from US Legal Forms which specialize in these areas.

Filing an Employee Stock Ownership Plan (ESOP) requires several steps including determining the type of plan you wish to set up. You must file Form 5500 annually with the Department of Labor to report the plan’s financial activity. However, the process can be complicated, so consulting with a legal or financial advisor can simplify the filing process significantly. Consider using US Legal Forms for professional templates and guidance.

To report stock options exercised, you need to include the details on your tax return. Generally, you'll report this information on IRS Form 8949 and Schedule D. If you have received a Form 1099-B from your broker, it will provide details of the transactions. Make sure to calculate the gain or loss from the sale of the shares when filing your taxes.

To set up an employee stock option (ESOP), you must first establish a clear plan that defines the terms, conditions, and eligibility requirements. It's essential to consult with financial and legal advisors to ensure that the plan complies with regulations and meets your company's goals. A well-planned ESOP can motivate employees and align their interests with the company's success. For expert assistance in drafting your ESOP, uslegalforms is a valuable resource.

If you get laid off, your employee stock option (ESOP) usually remains intact, but the circumstances may vary by employer. Employers often allow you to exercise your vested options within a set timeframe after layoff. Your unvested options might be forfeited, depending on the company's policy. To navigate this situation effectively, consider consulting uslegalforms for expert insights.

If you quit your job, your employee stock option (ESOP) can still hold value, but it may come with specific conditions. You typically have a designated period to exercise any vested options, meaning you must act quickly if you want to buy shares. Understanding these conditions is crucial because, after a certain point, unexercised options can expire. For detailed guidance on your ESOP rights upon quitting, uslegalforms provides helpful resources.

When you resign, your employee stock option (ESOP) may be impacted based on your company's policy. Generally, you will have a limited time to exercise your options, which means you need to decide whether to buy the shares or let the options expire. It's important to check your company's specific terms, as different plans can have varying rules regarding resignation. If you need assistance understanding your options, consider using the services offered by uslegalforms.

Employee Stock Options can be a good idea for many, as they provide a potential financial benefit linked to the company’s success. However, it is important to consider your financial situation and risk tolerance. Using resources available through platforms like US Legal Forms can help you make informed decisions about ESOPs.