Employee Equity

Description

How to fill out Executive Employee Stock Incentive Plan?

- If you are a returning user, log in to your account to download the required form by clicking the Download button. Make sure your subscription is still active; renew if needed.

- For first-time users, start by reviewing the form previews and descriptions. Confirm that you've selected the appropriate document that fits your specific needs and complies with local jurisdiction laws.

- If you need a different template, utilize the Search functionality to find the right one. Once you locate the correct document, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan. You will need to create an account to gain access to the form library.

- Complete your transaction by entering your credit card information or using PayPal for payment.

- Once your purchase is confirmed, download the selected form to your device and find it in the My documents section of your profile whenever you need it again.

In conclusion, US Legal Forms provides a comprehensive suite of legal templates designed to empower users in managing employee equity documents effectively. With a vast and editable library, you can ensure that your legal documents meet all necessary standards.

Explore US Legal Forms today and take control of your legal documentation process!

Form popularity

FAQ

The amount of equity employees should receive varies based on factors like their position, company stage, and industry standards. Typically, key roles might receive between 0.5% to 2% in startups. For larger, established companies, the percentage is often lower, averaging around 0.1% to 0.5%. Engaging legal and financial resources can help clarify these figures and the implications of employee equity.

Receiving 1% employee equity in a startup can be a solid opportunity, especially if the company grows significantly. This equity can yield substantial returns if the startup succeeds or goes public. However, assess the company's growth trajectory and your contribution to ensure the equity aligns with your career goals. Remember, the value of employee equity is often tied to the company's performance.

As you evaluate how much employee equity to ask for, consider the role and company size. It’s wise to research industry standards for similar positions. In startups, you may ask for a higher percentage, while established companies may offer smaller amounts. You should focus on long-term potential and how your contributions can enhance value.

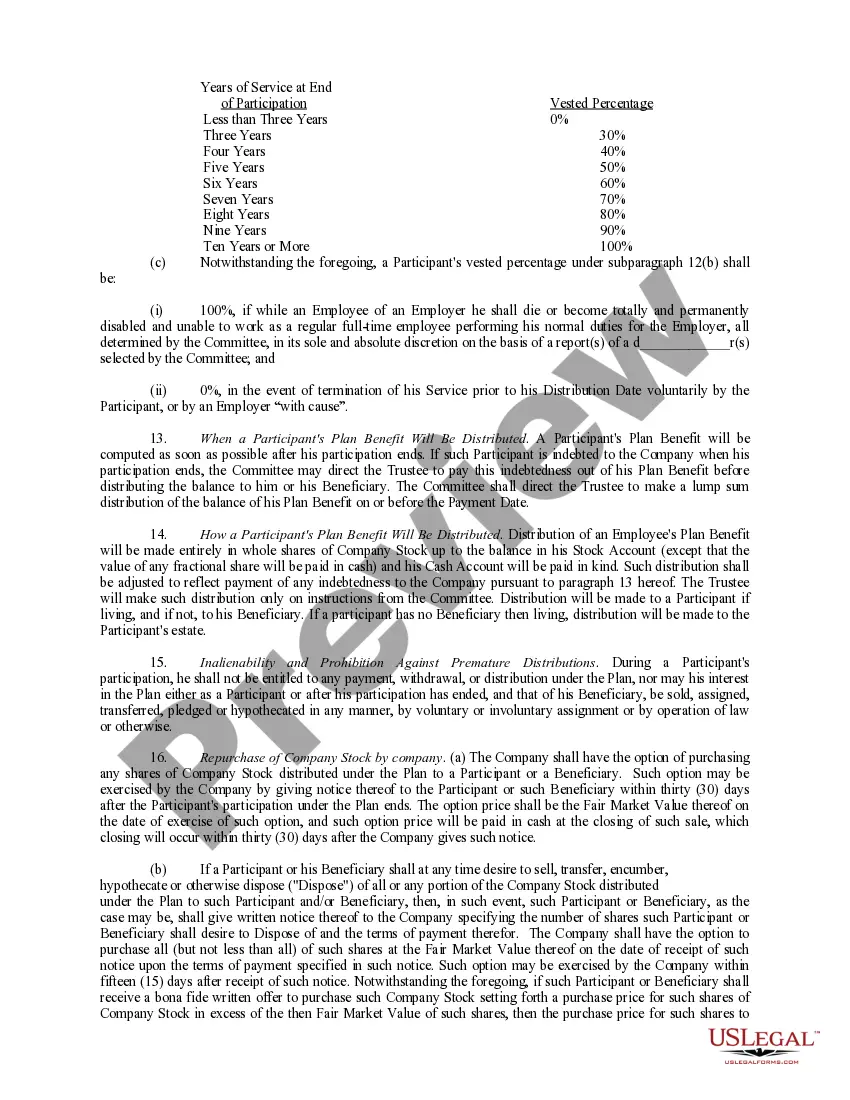

Employee equity provides you with ownership in your company, usually through stock options or restricted stock units. As you work and the company grows, your equity can become more valuable. Typically, you need to stay with the company for a certain period to earn your equity fully. Understanding your rights and potential gains is crucial in navigating employee equity.

When considering employee equity, a reasonable amount largely depends on your role and the company's stage. For early-stage startups, asking for 0.5% to 2% is common for key positions. However, in more established firms, the percentage might range from 0.1% to 0.5%. It's essential to weigh your contributions against the company's valuation.

You can acquire employee equity through various methods, typically included in job offers as part of your compensation. Common paths include stock options, restricted stock units, or direct stock purchases. Engaging with your HR team or understanding the specific policies of your company can clarify how you can earn equity. Platforms like UsLegalForms can provide essential documentation and resources to help you understand and navigate equity options in your workplace.

Holding 20% equity in a company means you own 20% of the company’s total shares. This ownership stake can provide you with significant influence in company decisions, along with a share of the profits if the company performs well. For you, this can translate into financial rewards when the company grows or is sold. Essentially, this percentage represents both your investment and your commitment to the company’s future.

Several factors influence employee equity, including the company’s valuation, the total amount of equity available, and the role of the employee within the organization. Startups often grant more equity to attract talent, while established firms may provide less. Additionally, the terms of the equity grant, such as vesting schedules, also play a significant role in determining how and when you can access that equity. Knowing these elements can help you navigate your compensation package effectively.

Employee equity refers to the ownership interest an employee has in a company. This typically comes in the form of stock options or shares that employees can acquire, often as part of their compensation package. By receiving equity, you may benefit from the company's growth and success, aligning your interests with those of the business. Understanding employee equity is key, as it can impact your financial future.

The formula for equity income typically involves calculating the dividends received from shares plus any gains realized from selling equity. Specifically, it can be expressed as: Equity Income = (Dividends + Capital Gains) / (Shares Owned). This formula helps investors evaluate their returns linked to employee equity.