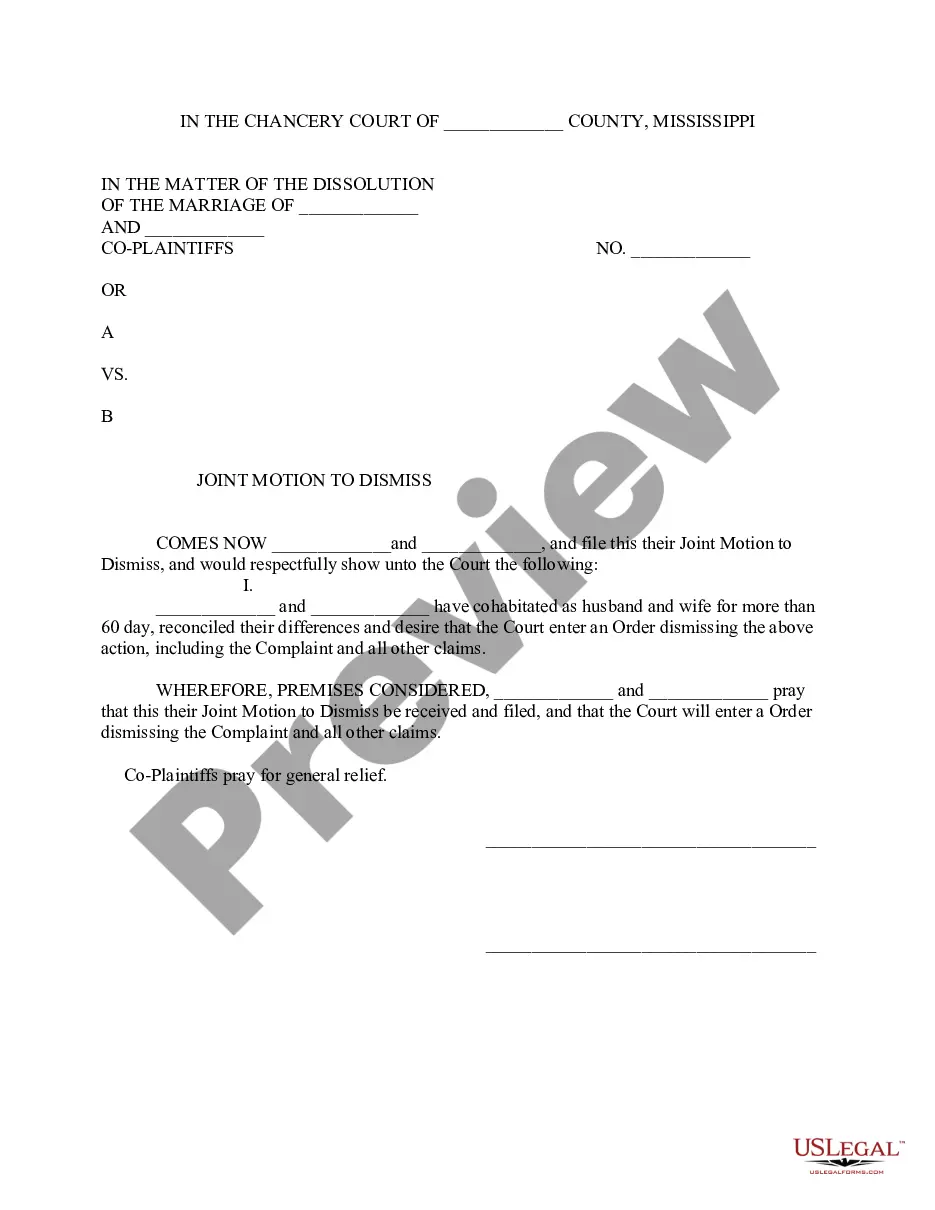

Sale Home Form With 2 Points

Description

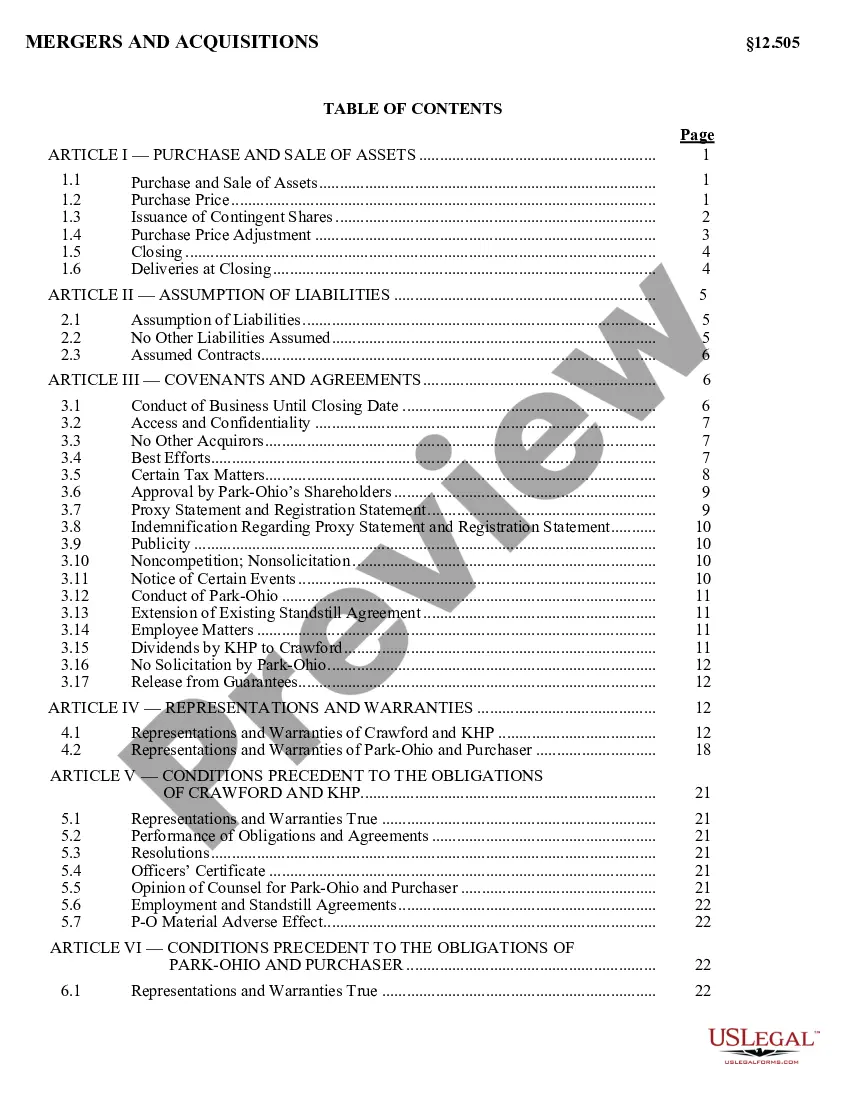

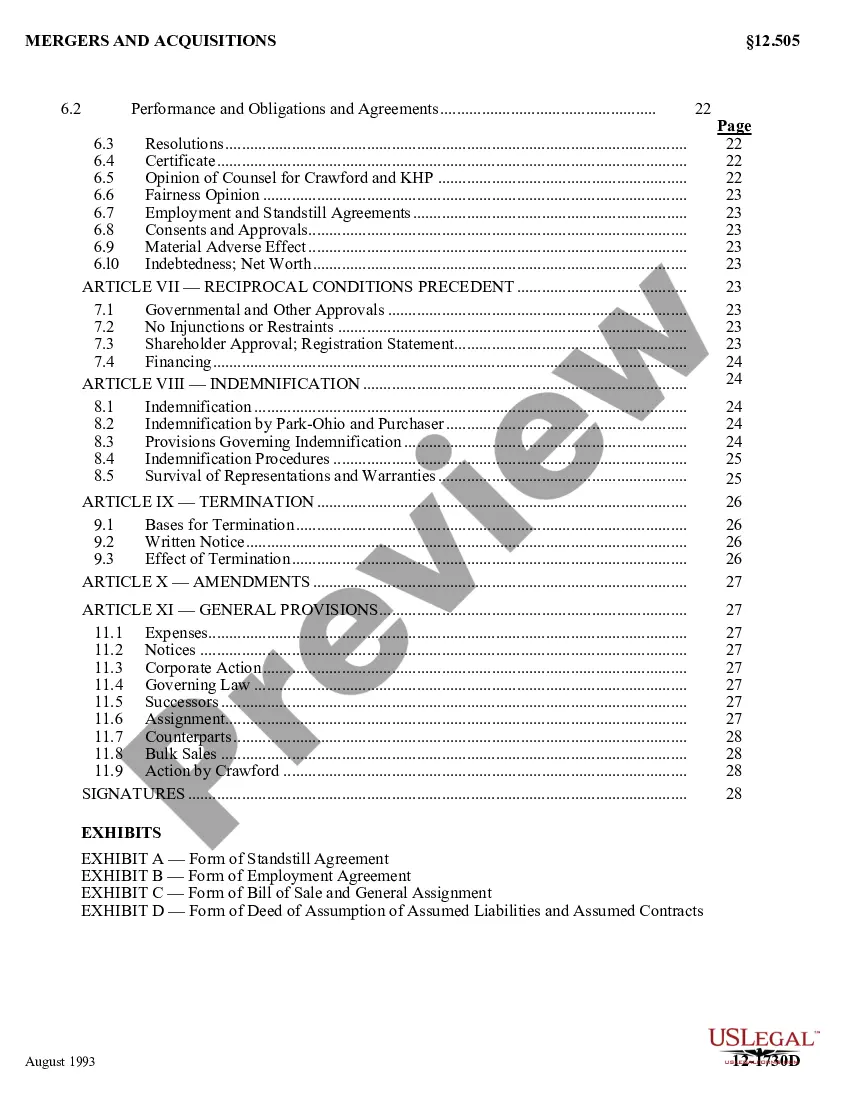

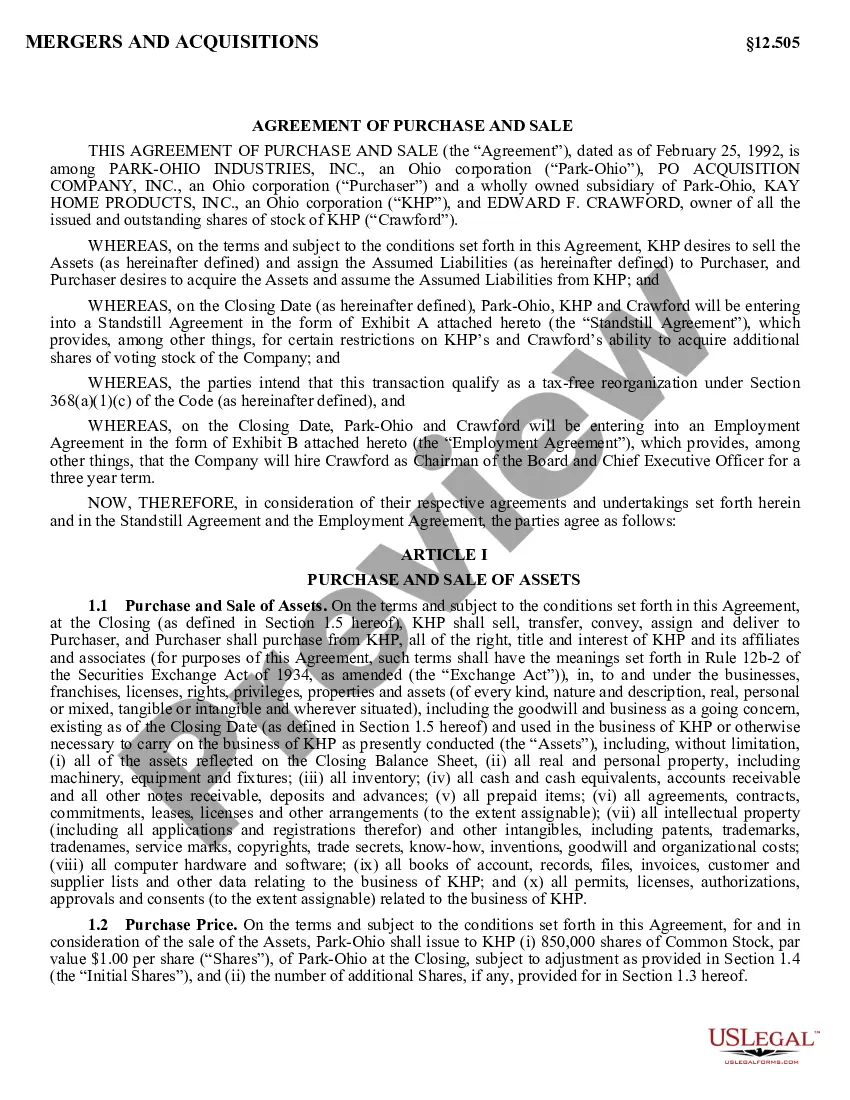

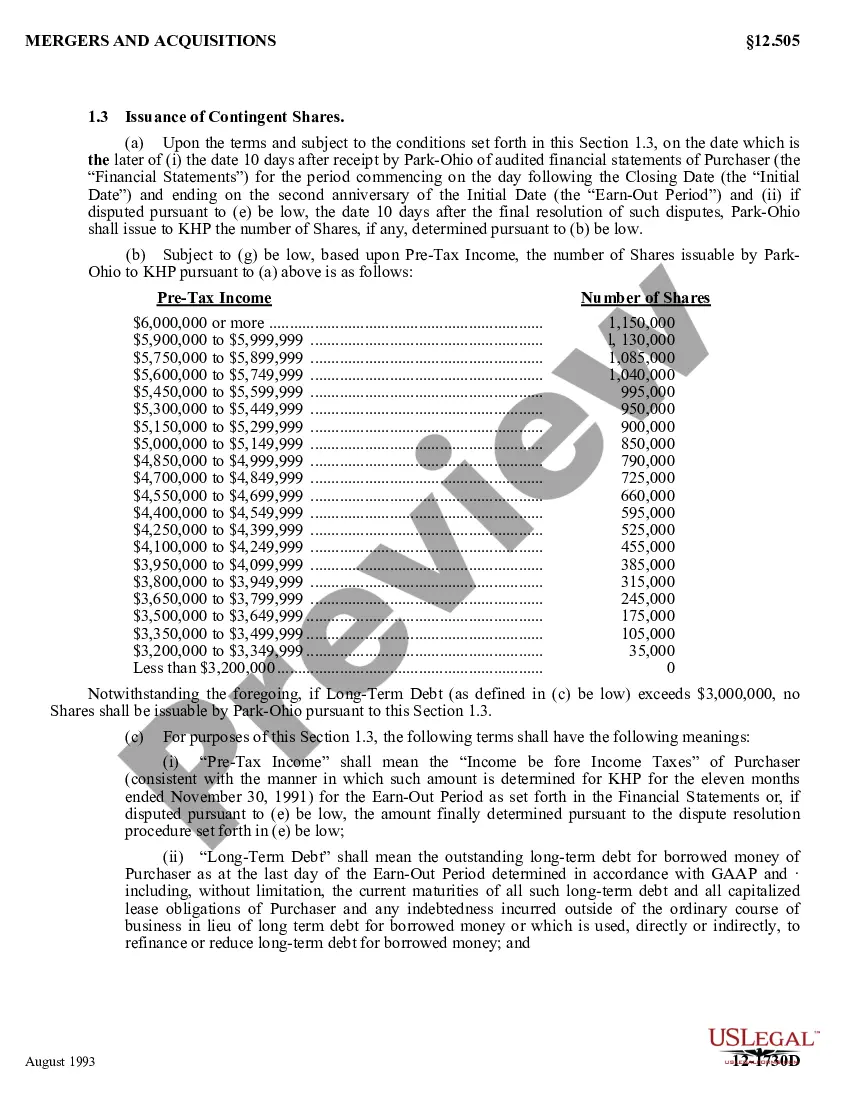

How to fill out Sample Agreement Of Purchase And Sale By Park - Ohio Industries, Inc., PO Acquisition Company, Inc., Kay Home Products, Inc., And Edward F. Crawford?

The Sale Residence Document With 2 Points you observe on this site is a reusable official template prepared by professional attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, entities, and legal experts with more than 85,000 verified, state-specific documents for any business and personal situation. It’s the fastest, simplest, and most dependable way to acquire the records you require, as the service ensures the utmost level of data protection and anti-malware security.

Register for US Legal Forms to have verified legal templates for all of life’s circumstances at your fingertips.

- Explore the document you require and examine it.

- Navigate through the file you searched and preview it or read the form description to confirm it meets your requirements. If it does not, use the search feature to find the correct one. Click Buy Now once you have located the template you need.

- Subscribe and Log In.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the fillable template.

- Select the format you prefer for your Sale Residence Document With 2 Points (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the document.

- Print the template to finish it by hand. Alternatively, utilize an online multifunctional PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature.

- Re-download your documents.

- Utilize the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously saved documents.

Form popularity

FAQ

If you still don't file your LLC Annual Report by the 4th Friday in September, the Florida Division of Corporations will administratively dissolve (shut down) your Florida LLC.

Reinstate a Florida Corporation There is a $600 reinstatement fee, as well as a $150 for every missed Corporation Annual Report. You are required to file an Annual Report and pay the $150 fee, even if your company has only been dissolved for a few months. Thus, the absolute minimum fee for reinstatement is $750.

To make amendments to your Florida Corporation, you must provide the completed Cover Letter and Articles of Amendment to Articles of Incorporation forms with the filing fee to the Department of State by mail or in person. You cannot file amendments online.

Business entities that were administratively dissolved or revoked for more than one calendar year: Allow 2-3 business days for the reinstatement to post if paid by credit card or Prepaid Sunbiz E-File Account. Florida law requires our office to check the entity's name for availability.

LLC ? The reinstatement fee for dissolved LLCs is $100. The annual report fee costs $138.75 per year since your company's administrative dissolution. Corporation ? The filing fee for reinstating Florida corporations is $600. Each missed annual report costs $150 per year since the administrative dissolution.

If the entity is a corporation or LLC, you may file an amended annual report. If the entity is a limited partnership or limited liability limited partnership, download and complete an amendment form. Mail the form and fee to the Division of Corporations.

To reinstate a Florida LLC, you must file a Limited Liability Company Reinstatement with the Division of Corporations. There is a a $100 reinstatement fee, as well as a $138.75 Annual Report fee for each year or portion of a year in which your LLC was dissolved.

Reinstate a Florida Corporation There is a $600 reinstatement fee, as well as a $150 for every missed Corporation Annual Report. You are required to file an Annual Report and pay the $150 fee, even if your company has only been dissolved for a few months. Thus, the absolute minimum fee for reinstatement is $750.