Agreement Investment Trust With Largest Discount

Description

How to fill out Advisory Agreement Between Real Estate Investment Trust And Corporation?

Individuals frequently link legal documentation with something complicated that only an expert can manage.

In a way, this is accurate, as crafting Agreement Investment Trust With Largest Discount requires comprehensive knowledge of subject criteria, including state and county laws.

However, thanks to US Legal Forms, the process has become simpler: a collection of ready-to-use legal templates for any personal and business situation, tailored to state regulations, is now consolidated in an online library accessible to all.

All templates in our library are reusable: once obtained, they remain stored in your profile. You can access them whenever required via the My documents tab. Explore all the benefits of utilizing the US Legal Forms platform. Subscribe now!

- US Legal Forms offers over 85k current forms categorized by state and area of use, making the search for Agreement Investment Trust With Largest Discount or any specific template take only a few minutes.

- Existing registered users with an active subscription must sign in to their account and click Download to retrieve the form.

- New users to the platform need to create an account and subscribe before they can download any documentation.

- Here is a simple guide on how to get the Agreement Investment Trust With Largest Discount.

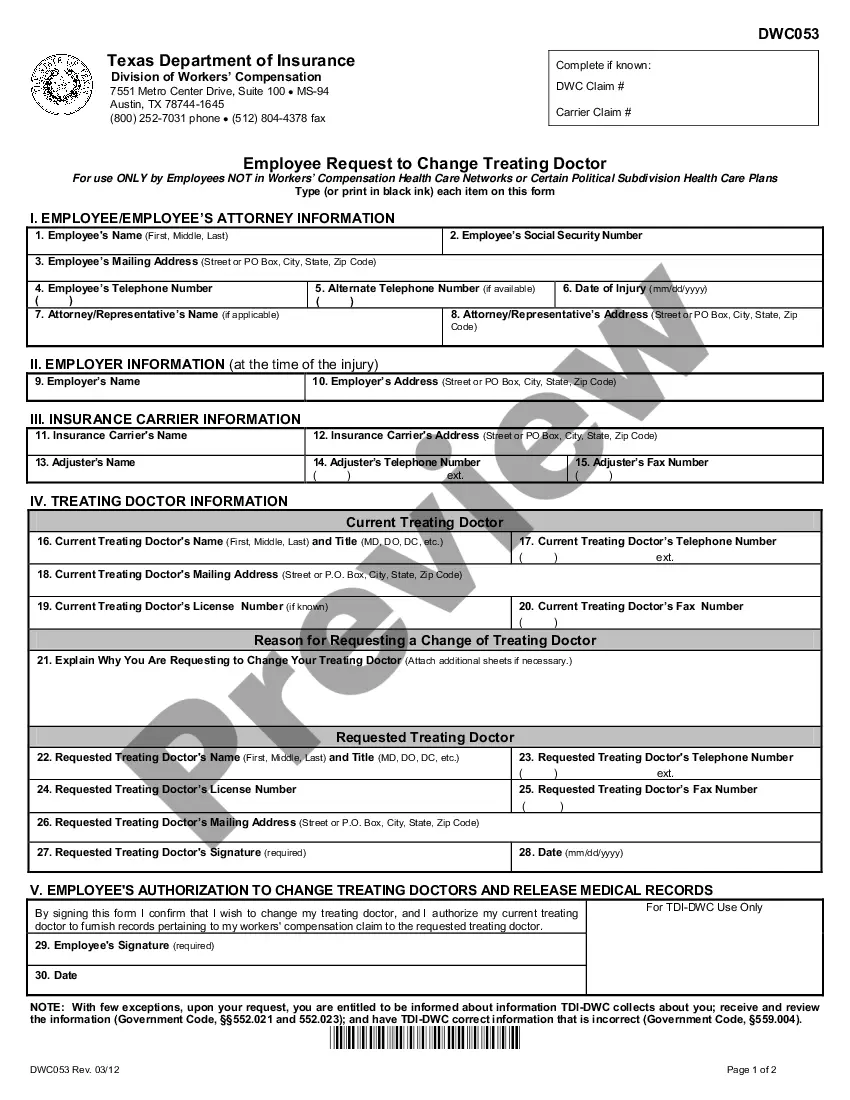

- Carefully examine the page content to ensure it meets your requirements.

- Review the form description or check it through the Preview feature.

- If the previous example does not meet your needs, search for another template using the Search field above.

- Once you locate the suitable Agreement Investment Trust With Largest Discount, click Buy Now.

- Select a subscription plan that aligns with your needs and financial capability.

- Proceed by registering for an account or logging in to access the payment page.

- Complete your subscription payment using PayPal or your credit card.

- Choose the format for your document and click Download.

- Print your form or upload it to an online editor for faster completion.

Form popularity

FAQ

Unlike open-ended funds, investment trust shares can trade below the value of their investments. This is known as a discount and basically means the shares are cheap. Investment trust share prices can also trade above the value of their assets. This is known as a premium and means the shares are expensive.

A new Morningstar Associates analysis, sponsored by Nareit, found that the optimal portfolio allocation to REITs ranges between 4% and 13%.

Breakpoint discounts are volume discounts to the front-end sales load charged to investors who purchase Class A mutual fund shares. The extent of the discount depends on the amount invested in a particular family of funds.

A breakpoint is the dollar amount for the purchase of a load mutual fund's shares that qualifies the investor for a reduced sales charge. Breakpoints allow for reduced fees for large purchases, which often benefit institutional investors.

B. A maximum aggregate sales charge of 7.50% on purchases of $15,000 or more and a maximum aggregate sales charge of 6.25% on purchases of $25,000 or more.