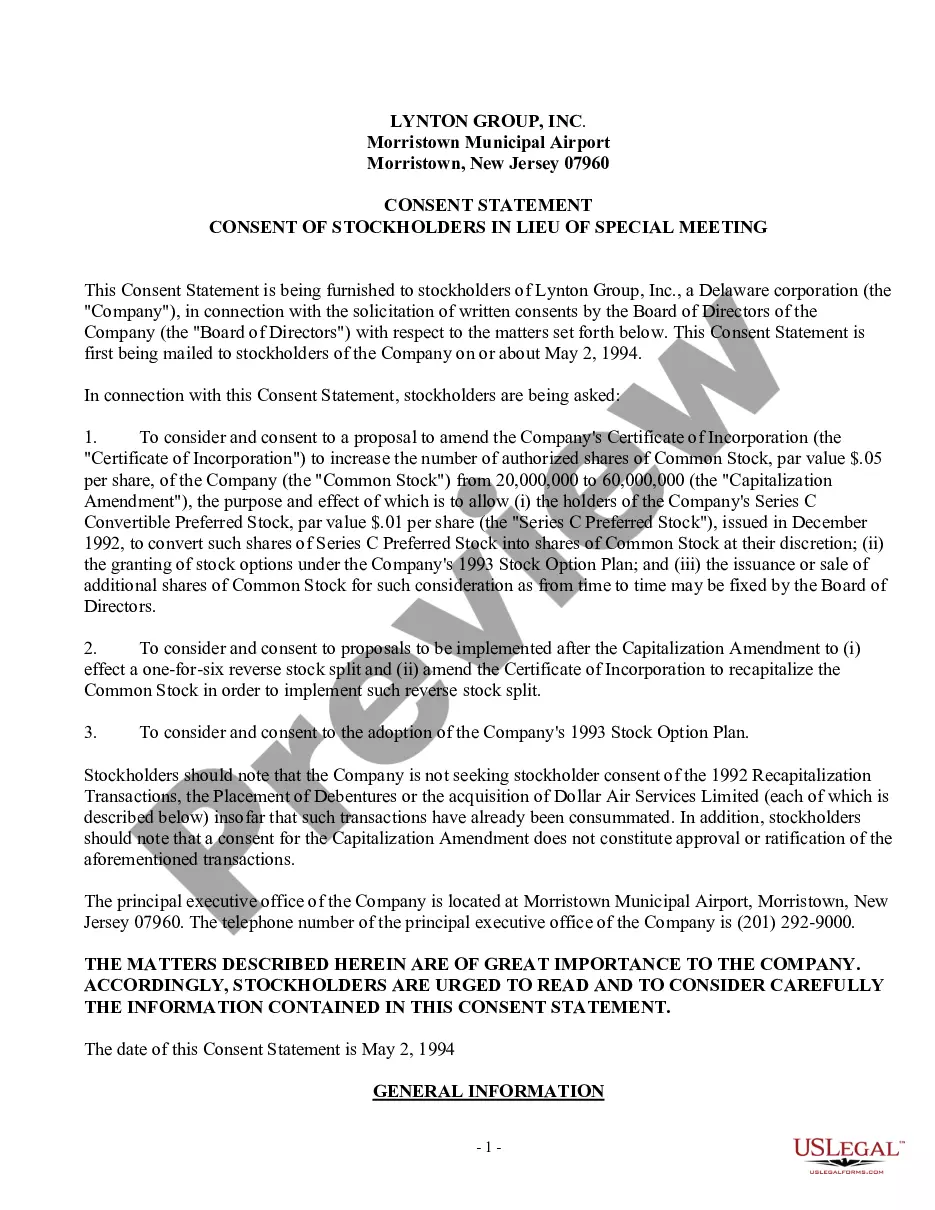

Consent Stockholders With Dividends

Description

How to fill out Consent Statement For Consent Of Stockholders In Lieu Of Special Meetings?

It’s clear that you cannot transform into a legal expert instantly, nor can you learn to swiftly create Consent Stockholders With Dividends without a unique skill set. Developing legal documents is an extensive procedure that demands particular education and expertise. So why not entrust the crafting of the Consent Stockholders With Dividends to the experts.

With US Legal Forms, one of the most extensive legal document repositories, you can discover anything from court records to templates for internal company communication. We recognize how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location-specific and current.

Let’s begin with our website and acquire the form you require in just a few minutes.

You can access your forms again from the My documents section at any time. If you’re an existing client, you can simply Log In, and find and download the template from the same section.

Regardless of the purpose of your forms—whether financial and legal, or personal—our website has you covered. Try US Legal Forms today!

- Locate the form you need by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to ascertain whether Consent Stockholders With Dividends meets your requirements.

- Initiate your search again if you require any other template.

- Sign up for a free account and choose a subscription plan to purchase the template.

- Select Buy now. Once your payment is processed, you can obtain the Consent Stockholders With Dividends, complete it, print it, and send or mail it to the necessary individuals or entities.

Form popularity

FAQ

Even though California does not allow the dividends paid deduction for consent dividends, the entity may still be qualified as a REIT so long as it meets the federal distribution requirements.

Noun. : an arrangement by which stockholders agree to report as income a portion of the corporation's retained profits and to pay taxes thereon.

Section 1.565 - 1(c)(2) of the regulations provides, in part, that the full amounts specified on a consent will be taxable to the shareholder even though a consent dividend deduction may be denied to the corporation because it is determined that it is not a corporation subject to part I, II or III, subchapter G, ...

A qualifying consent dividend is treated as paid to the taxpayer on the last day of the corporation's tax year and immediately contributed by the taxpayer as paid-in capital with expected consequences (see Explanation: §565, Qualified Distribution).

A shareholder who agrees to treat the consent dividend as a taxable dividend must complete and send Form 972 to the corporation that will claim the consent dividend as a deduction.