Schedule C Form Fill With Irs

Description

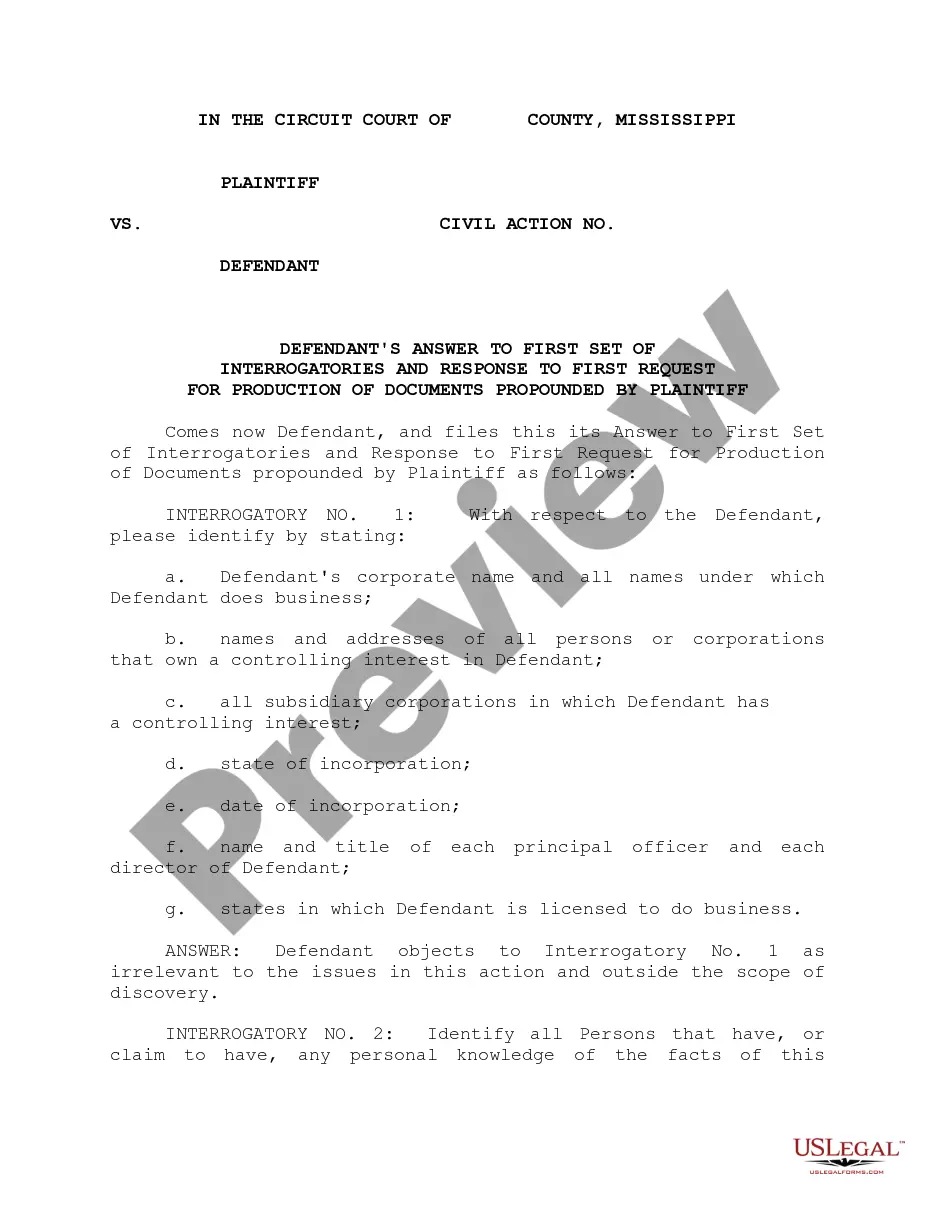

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Obtaining legal document samples that comply with federal and local laws is a matter of necessity, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the right Schedule C Form Fill With Irs sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by lawyers for any business and life case. They are easy to browse with all papers collected by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when obtaining a Schedule C Form Fill With Irs from our website.

Getting a Schedule C Form Fill With Irs is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, follow the instructions below:

- Analyze the template utilizing the Preview option or via the text outline to ensure it meets your requirements.

- Look for another sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Schedule C Form Fill With Irs and download it.

All templates you find through US Legal Forms are reusable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C is typically for people who operate sole proprietorships or single-member LLCs. A Schedule C is not the same as a 1099 form.

You will need to file Schedule C annually as an attachment to your Form 1040. The quickest, safest, and most accurate way to file is by using IRS e-file either online or through a tax professional that is an authorized IRS e-file provider.

How to complete and file Schedule C for your small business Prepare your financial statements. ... File Forms 1099 for all contractors. ... Report cost of goods sold. ... Report income. ... Report business expenses. ... Report the business use of your vehicle. ... Add other expenses. ... Calculate net profit or loss and report on schedules 1 and SE.

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

How do you fill out the Schedule C form? Your business' income for the tax year. Receipts or lists of your business expenses. Inventory information including detailed costs (if applicable to your business) Mileage records and expenses for the business use of your vehicle.