Claims Chapter 13 Withholding

Description

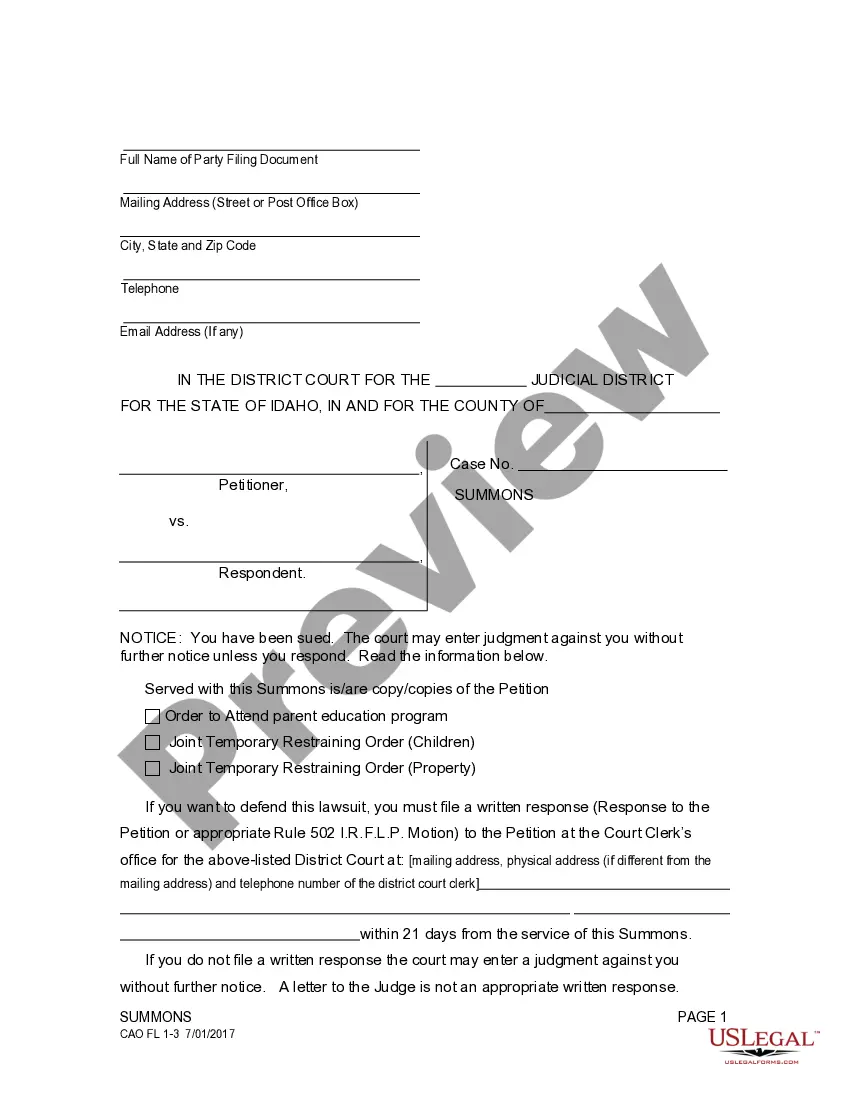

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

The Claims Chapter 13 Withholding displayed on this page is a reusable formal format created by skilled attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal practitioners with over 85,000 authenticated, state-specific documents for any business and personal situation. It’s the fastest, simplest, and most reliable method to acquire the papers you require, as the service ensures bank-level data security and anti-malware safeguards.

Choose the format you desire for your Claims Chapter 13 Withholding (PDF, Word, RTF) and save the document on your device.

- Search for the document you require and evaluate it.

- Browse through the file you searched and preview it or examine the form description to verify it meets your needs. If it does not, use the search bar to find the correct one. Click Buy Now once you have located the template you need.

- Register and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Receive the fillable template.

Form popularity

FAQ

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

If you still owe taxes at the end of your repayment plan, you will be responsible for paying them in full. Any remaining tax debts will not be discharged, and you will still be liable for paying them.

Personal expense: Bankruptcy payments are considered personal expenses and are not eligible for tax deductions. Debt repayment: Payments made under a Chapter 13 bankruptcy plan are essentially repayments of your debts, which are not tax deductible.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

In Chapter 13 and Chapter 11, some trustee payments can potentially be deducted when filing taxes. It's in your best interest to consult with a proven bankruptcy tax professional and lawyer to learn what deductions you are eligible for.