Claims Chapter 13 With Answers

Description

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

It’s clear that you can’t become a legal authority instantly, nor can you determine how to swiftly prepare Claims Chapter 13 With Answers without having a specialized background.

Compiling legal documents is a lengthy process that demands specific education and expertise.

So why not entrust the preparation of the Claims Chapter 13 With Answers to the professionals.

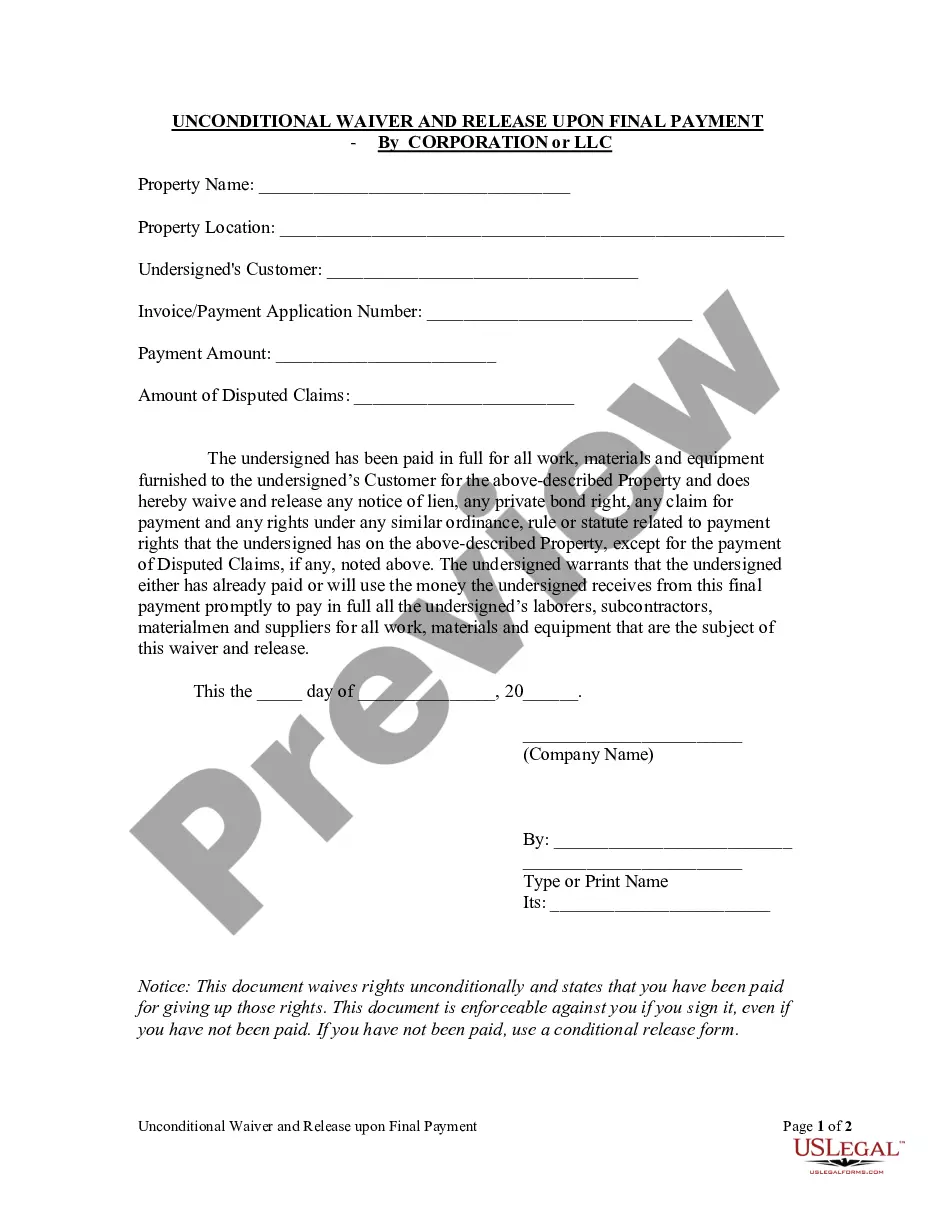

Preview it (if this option is available) and review the accompanying description to ascertain whether Claims Chapter 13 With Answers is what you’re seeking.

Set up a complimentary account and choose a subscription plan to purchase the template.

- With US Legal Forms, a comprehensive legal document repository, you can obtain anything from court documents to templates for office communication.

- We recognize how crucial compliance and adherence to federal and state regulations are.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how you can initiate your journey with our platform and acquire the document you need in just minutes.

- Discover the form you require using the search bar at the top of the page.

Form popularity

FAQ

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

This bankruptcy form Notice of Objecton to Proof of Claim and Notice of Hearing and Objection to Claim can be used in Chapter 13 bankruptcy by a debtor's attorney to object to the proof of claim of a creditor who has overstated the amount due.

An objection to a proof of claim must be in writing and filed with the bankruptcy court. A copy of the objection and the notice of court hearing date must be mailed to the creditor, the trustee, and the debtor at least 30 days before the hearing.

You'll calculate your disposable income in this manner. Take your monthly income and deduct living expenses, priority debt payments, and secured payments. The remaining amount is your disposable income. You'd are responsible to pay this amount to creditors each month.

Keys to Success In Chapter 13 Take the Debtor Financial Management Course Immediately. ... Understand your obligations under the Plan and Confirmation Order. ... Stay current on your Mortgage Payments. ... Stay current on Taxes and Domestic Support Obligations. ... Make Your Plan Payments Through a Wage Deduction Order.