Bankruptcy Training For Paralegals

Description

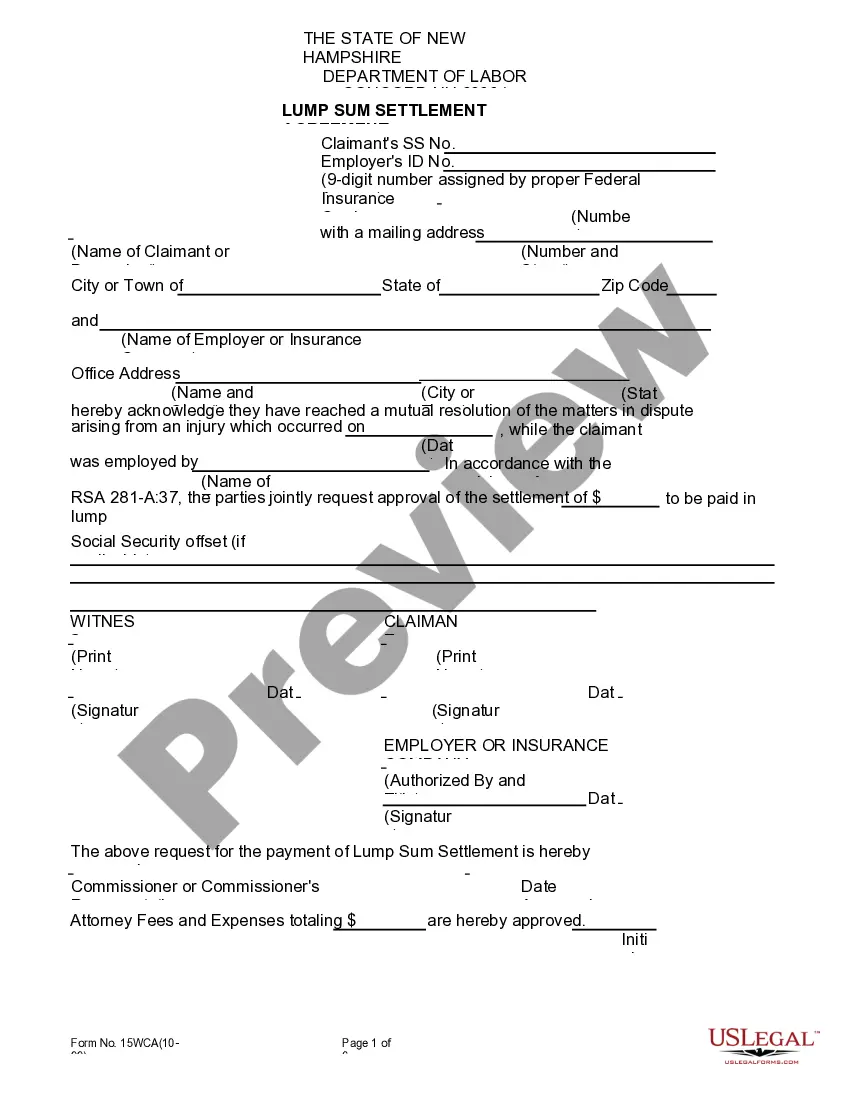

How to fill out Disclosure Of Compensation Of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act?

Handling legal documents can be daunting, even for experienced practitioners.

If you're looking for Bankruptcy Training For Paralegals and lack the time to devote to finding the right and current version, the process might be stressful.

Tap into a valuable repository of articles, guides, and materials pertinent to your situation and needs.

Save time and effort in searching for the documents you require, and use US Legal Forms’ advanced search and Preview tool to locate Bankruptcy Training For Paralegals and obtain it.

Leverage the US Legal Forms online library, supported by 25 years of expertise and trustworthiness. Streamline your daily document management in a seamless and user-friendly manner today.

- If you have a subscription, Log In to your US Legal Forms account, look for the document, and obtain it.

- Check your My documents tab to see the documents you have previously downloaded and to manage your files as needed.

- If it's your first experience with US Legal Forms, create an account to gain unlimited access to all the features of the library.

- Here are the steps to take after finding the form you desire.

- Verify it's the correct document by previewing it and reviewing its description.

- Confirm that the template is valid in your state or county.

- Select Buy Now when you are prepared.

- Choose a monthly subscription plan.

- Select the file format you want, and Download, fill in, sign, print, and send your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you may have, ranging from personal to corporate paperwork, all in one location.

- Utilize cutting-edge tools to complete and oversee your Bankruptcy Training For Paralegals.

Form popularity

FAQ

Mortgage Perfection means the recording of the Mortgages necessary under applicable law for the perfection of Liens granted by the Company or any Guarantor hereunder or under the Security Documents in any Real Property.

Key takeways. When shopping for a mortgage, ask each lender to detail their requirements, annual percentage rate (APR) and fees. Be prepared to answer questions regarding your income, debt, down payment amount and more. You'll need to back up your answers with documentation.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateOregonYPennsylvaniaYRhode IslandYSouth CarolinaY47 more rows

In addition the following information should be included: The Payee Name. The Owner(s) of the mortgage holder. Total amount of mortgage. Mortgage date of execution. Full and legal description of the property to include tax parcel number. Acknowledgement that all payments have been made in full.

Mortgage lien release process? You must send a letter to the bank asking for the restoration of the original documents if you have made your last EMI or all remaining payments on your home loan. The banks typically react to such communications in a minimum of seven business days.

Primary tabs. A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

If the satisfaction of mortgage isn't recorded, the property owner may have trouble when they try to refinance or sell the property. They'll have to chase down the discharge documents and get them recorded in order to clear the title. It can even cause a delay to the closing.