Bankruptcy Petition Preparer Withholding Tax

Description

How to fill out Disclosure Of Compensation Of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act?

Locating a reliable source for the latest and applicable legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires accuracy and careful consideration, which is why obtaining samples of Bankruptcy Petition Preparer Withholding Tax exclusively from trustworthy sources, such as US Legal Forms, is crucial. An incorrect template will squander your time and hinder the process you are engaged in. With US Legal Forms, your concerns are minimal. You can access and review all the details regarding the document’s applicability and relevance for your specific situation and in your region.

Once you have the form on your device, you can modify it using the editor or print it for manual completion. Eliminate the hassle linked to your legal paperwork. Browse the extensive US Legal Forms library where you can discover legal templates, verify their applicability to your situation, and download them instantly.

- Use the catalog navigation or search bar to find your sample.

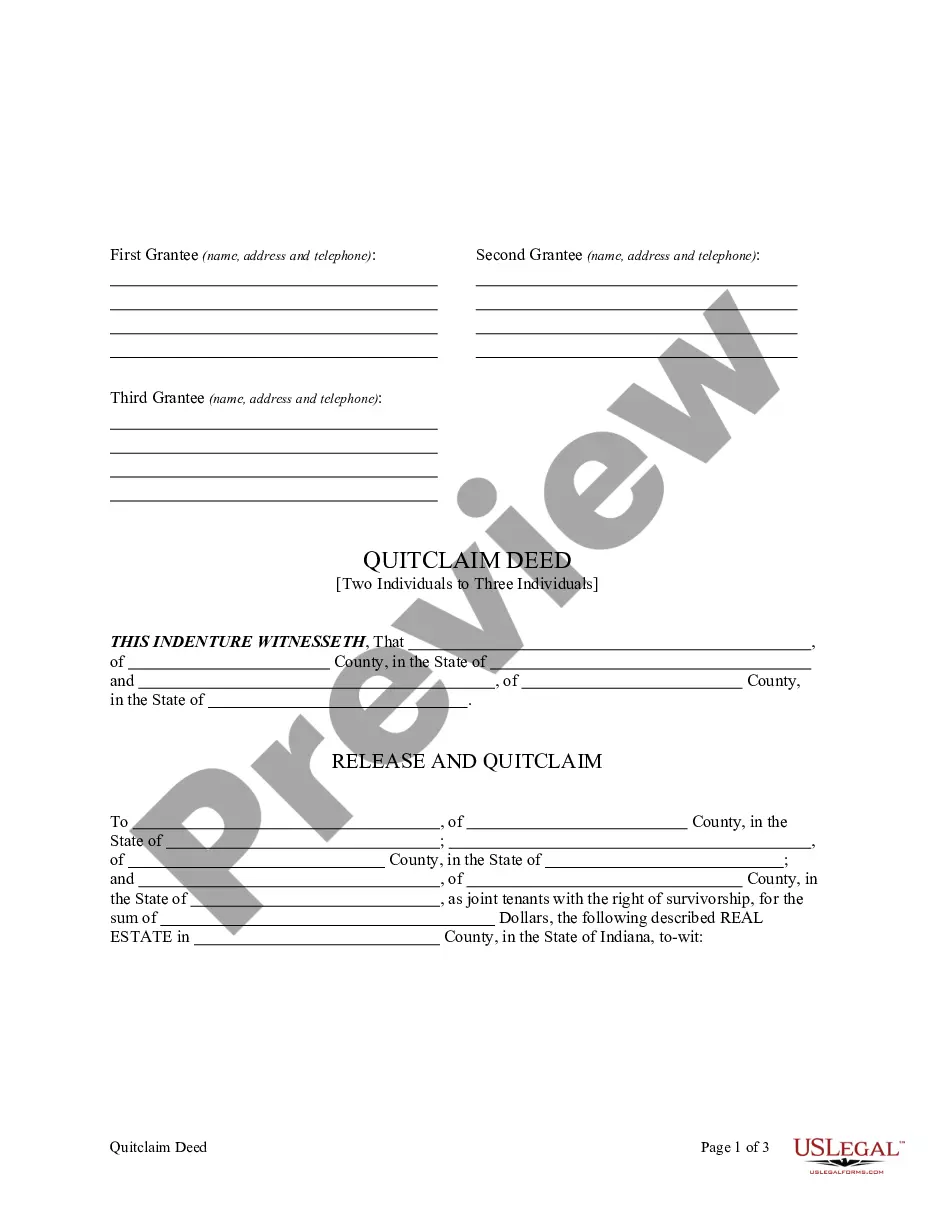

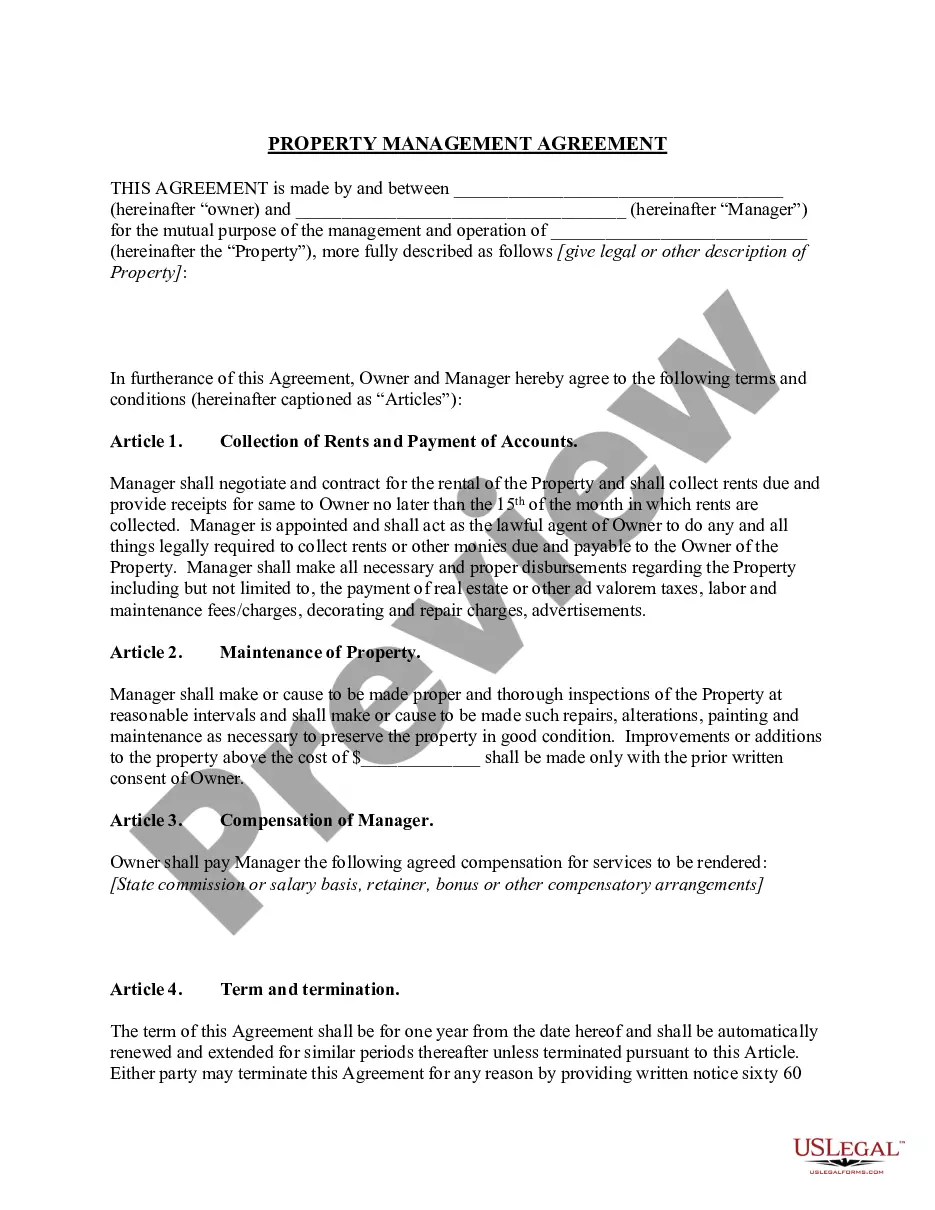

- Review the form’s description to ensure it meets your state's and area’s requirements.

- Preview the form, if available, to confirm it is the correct form you need.

- Return to the search and look for the suitable template if the Bankruptcy Petition Preparer Withholding Tax does not fulfill your requirements.

- If you are confident about the form’s relevance, proceed to download it.

- As an authorized user, click Log in to authenticate and access your selected templates in My documents.

- If you have not yet created an account, click Buy now to secure the template.

- Choose the pricing plan that best suits your needs.

- Complete the registration to finalize your acquisition.

- Confirm your purchase by selecting a payment method (credit card or PayPal).

- Select the file format for downloading the Bankruptcy Petition Preparer Withholding Tax.

Form popularity

FAQ

A bankruptcy petition preparer must adhere to specific regulations, including disclosing fees and providing a written contract. They can assist in filling out forms but cannot offer legal advice. Using services from established platforms like US Legal Forms ensures you work with compliant and qualified professionals, simplifying your bankruptcy petition preparation.

Bankruptcy petition preparers are not attorneys. Even the bankruptcy petition preparers who call themselves "paralegals" are not usually supervised by an attorney. They may not represent debtors in any bankruptcy proceeding and they may not give debtors any legal advice.

Bankruptcy: As above noted, debts discharged in bankruptcy are not considered taxable income. However, the timing of a bankruptcy filing is critical. To benefit from this exclusion you MUST file your bankruptcy BEFORE you receive a Form 1099-C.

If you do not accept that you owe the money, you may want to challenge the petition. You may be able to come to an agreement with the petitioner to pay the debt. If you have other debts, you may be able to enter into an arrangement with all of them. You may decide to accept bankruptcy as the only or best option.

For the average individual consumer, filing bankruptcy and discharging debts has no tax consequences. In contrast, if your debts are forgiven or settled outside of bankruptcy, the forgiven amount may be added to your income and subject to tax. That's called cancellation of debt income.

Income is calculated by looking at the debtor's income for the six-months prior to filing. A debtor who previously had a higher income but has been laid off in the last year, for example, would be able to rely on their most recent income to satisfy the Means Test.