Case Bankruptcy File For Credit Card Debt

Description

How to fill out Subpoena In A Case Under The Bankruptcy Code - B 256?

Obtaining legal document samples that comply with federal and regional regulations is a matter of necessity, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the appropriate Case Bankruptcy File For Credit Card Debt sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by attorneys for any professional and personal case. They are easy to browse with all documents organized by state and purpose of use. Our specialists stay up with legislative updates, so you can always be confident your form is up to date and compliant when getting a Case Bankruptcy File For Credit Card Debt from our website.

Obtaining a Case Bankruptcy File For Credit Card Debt is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the guidelines below:

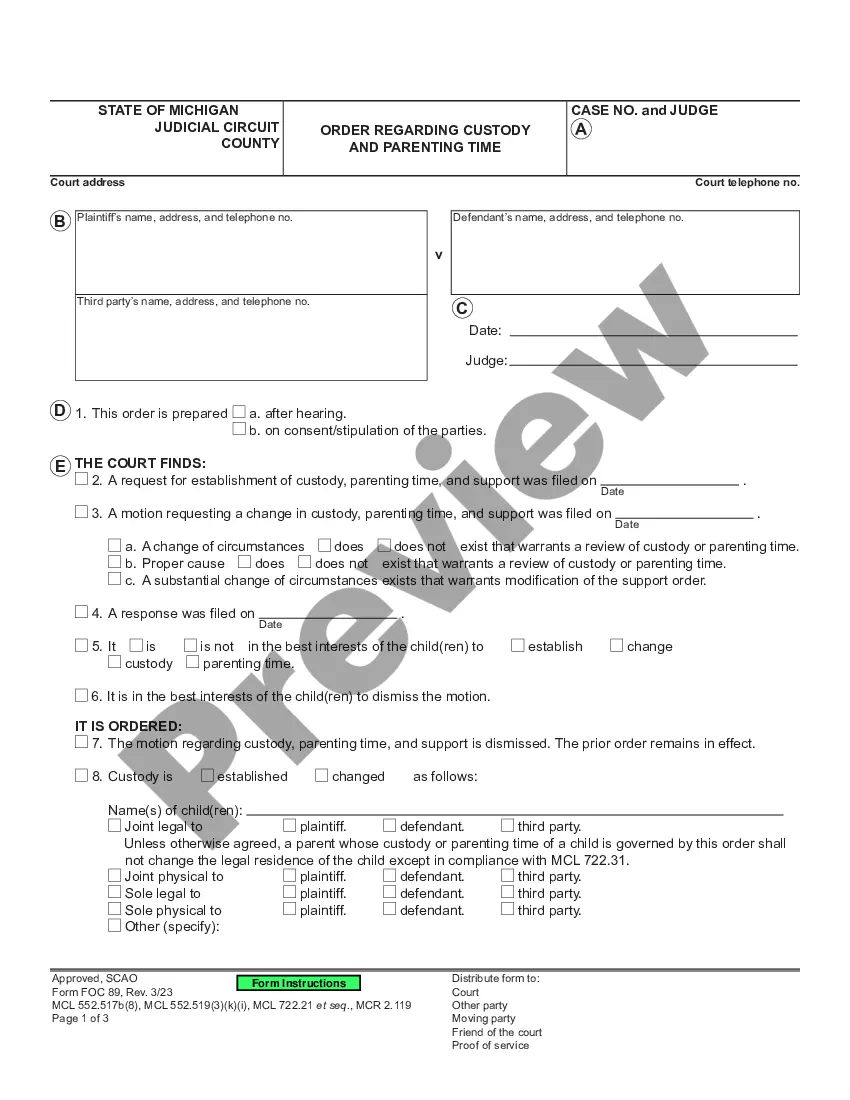

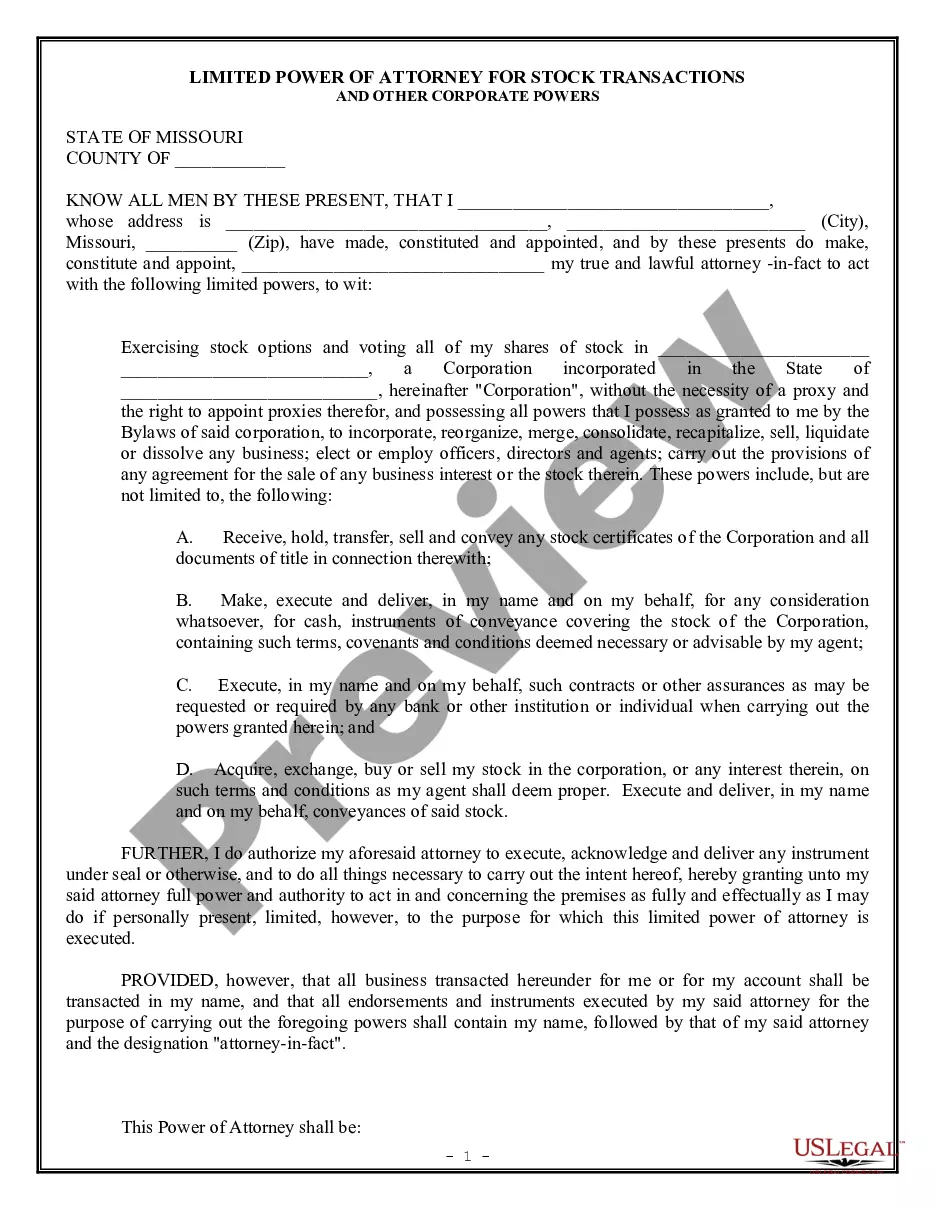

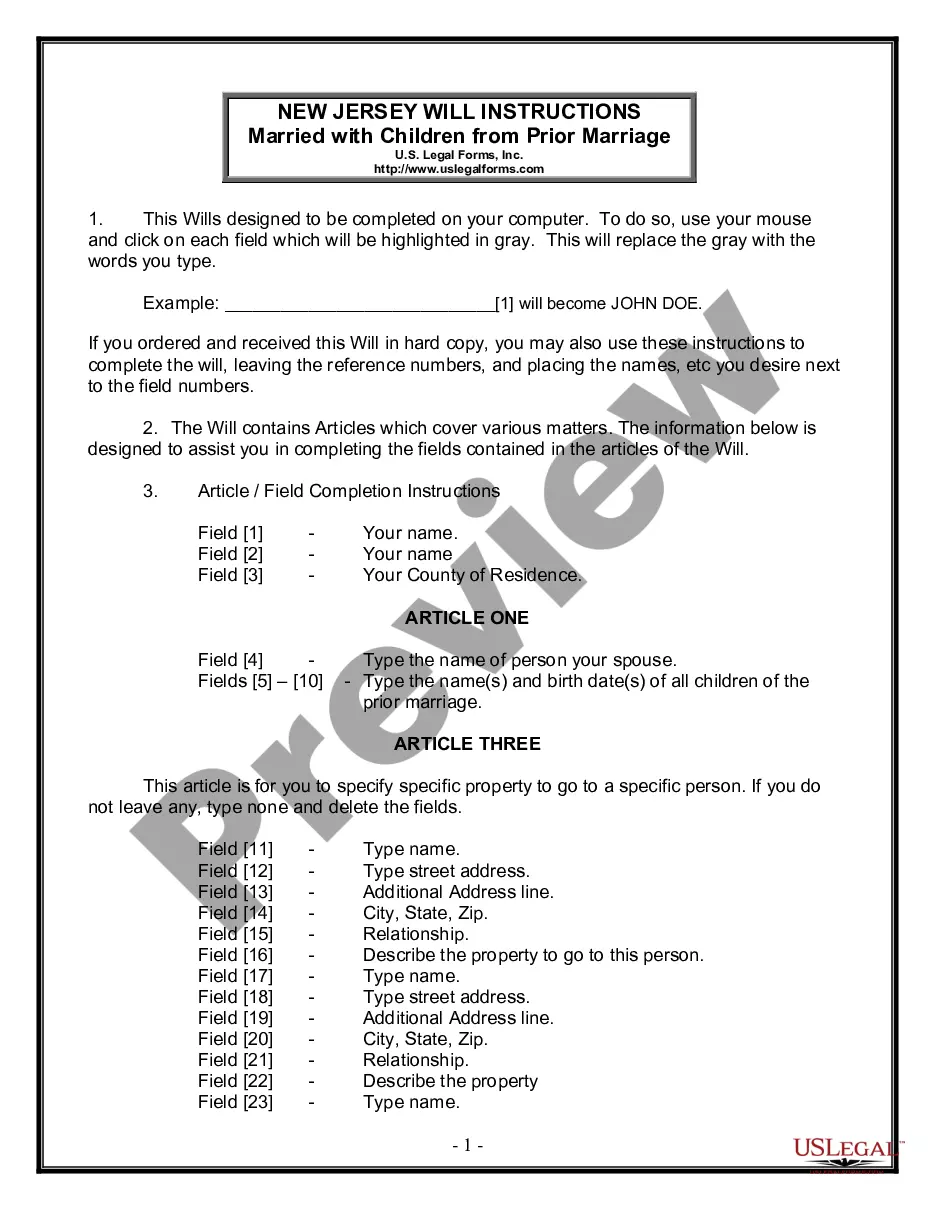

- Analyze the template using the Preview option or via the text description to ensure it fits your needs.

- Browse for another sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Case Bankruptcy File For Credit Card Debt and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

If you've been sued by a creditor because you can't pay your debts, filing bankruptcy will stop the lawsuit. You can also file bankruptcy after you've already lost the lawsuit and a judgment has been entered against you.

Filing Chapter 7 bankruptcy not only can wipe out credit card debt, it also can sweep all forms of unsecured debt into the garbage, if done properly. Among the bills that can go away are: Medical. Utility.

In fact, Jay Fleischman of Money Wise Law recommends defaulting on a loan before filing for bankruptcy. If you default, filing for bankruptcy can protect your assets from being seized by creditors. It can also protect you from having future wages or an inheritance garnished.

Debt settlement can be more lengthy than bankruptcy, and will still damage your credit score. If you need immediate relief or do not have the ability to pay monthly fees, bankruptcy may be the best (or only) solution.

If you declare bankruptcy, all your credit cards will be closed. You could have trouble getting approved by your previous card issuers in the future, depending on how strict the card issuer is. Bankruptcy stays on your credit file for seven to 10 years, but it impacts your credit score less and less as time goes on.