Chapter 13 Bankruptcy Forms Florida

Description

How to fill out Order Fixing Time To Object To Proposed Modification Of Confirmed Chapter 13 Plan - B 231B?

Acquiring legal documents that comply with federal and state laws is crucial, and the web provides numerous alternatives to consider.

However, what is the purpose of spending time searching for the appropriate Chapter 13 Bankruptcy Forms Florida template online when the US Legal Forms online repository already has such documents compiled in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 editable documents created by attorneys for any professional and personal needs. They are easy to navigate with all files categorized by state and intended usage. Our experts stay updated with legal changes, ensuring that your form is always current and compliant when acquiring a Chapter 13 Bankruptcy Forms Florida from our site.

Click Buy Now when you’ve found the appropriate form and select a subscription option. Create an account or Log In and process your payment using PayPal or a credit card. Choose the optimal format for your Chapter 13 Bankruptcy Forms Florida and download it. All templates you find through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents section in your profile. Enjoy the most comprehensive and user-friendly legal documentation service!

- Acquiring a Chapter 13 Bankruptcy Forms Florida is swift and straightforward for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document template you require in the appropriate format.

- If you are new to our website, follow the instructions below.

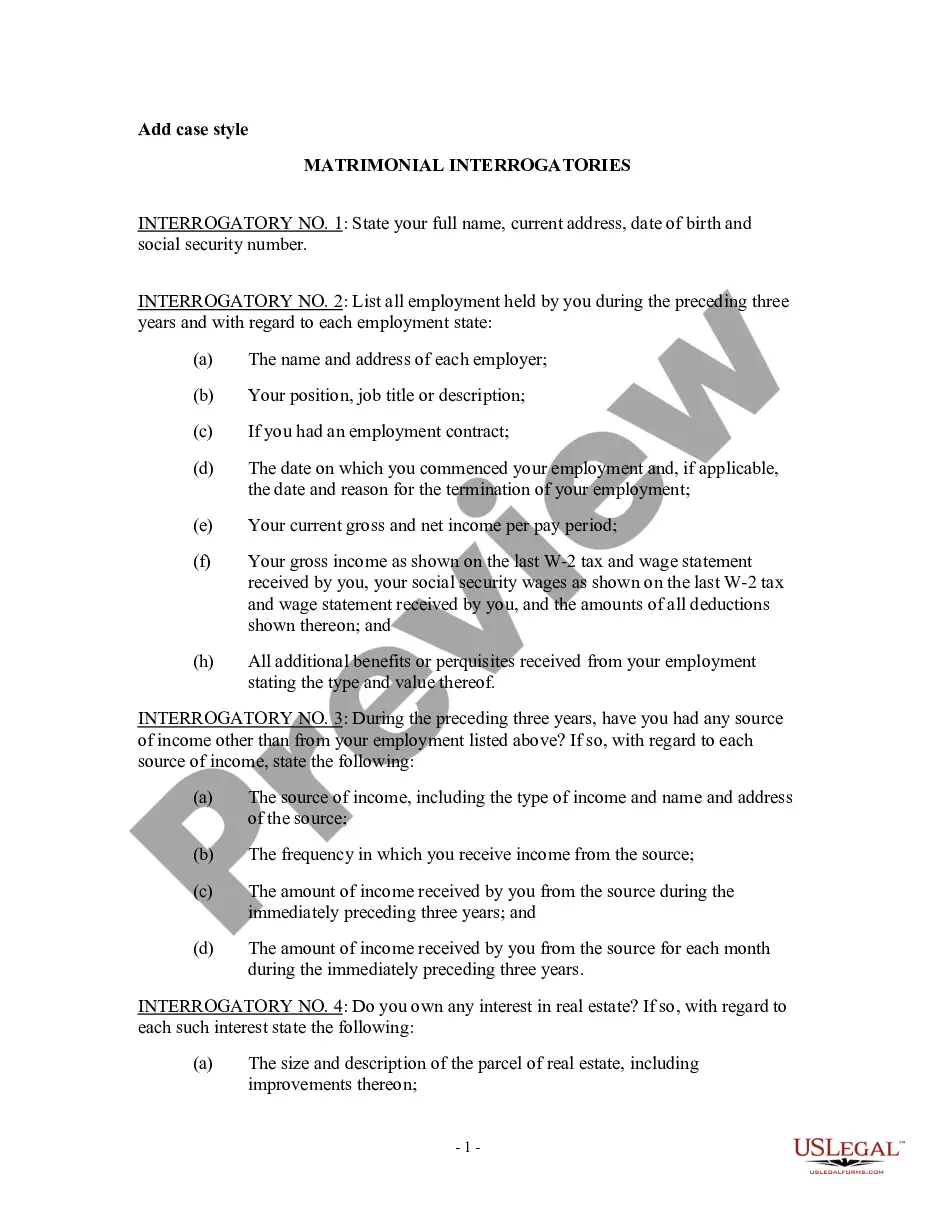

- Review the template using the Preview feature or through the text outline to confirm it suits your requirements.

- Search for an alternative template using the search option at the top of the page if needed.

Form popularity

FAQ

To file Chapter 13 bankruptcy in Florida, you will need several key forms, including the Chapter 13 plan, bankruptcy petition, and schedules of assets and liabilities. It's essential to provide accurate financial information, as this forms the basis of your repayment plan. You can find all the necessary Chapter 13 bankruptcy forms Florida on the US Legal Forms platform. This resource simplifies the process by offering easy access to the correct documents, ensuring you meet all legal requirements.

To fill out Chapter 13 bankruptcy forms in Florida, start by gathering all necessary financial documents, such as income statements and records of debts. Next, navigate the forms provided on the US Legal Forms platform, which offers step-by-step guidance to ensure you complete them correctly. It's crucial to double-check all the information for accuracy before submitting, as errors can delay your case. Utilizing these forms can simplify the process, making your journey through Chapter 13 bankruptcy more manageable.

The average monthly payment for Chapter 13 bankruptcy typically ranges from $400 to $1,200, depending on the total amount of your debt and your income. The court will consider your disposable income when setting your payment plan, which can last from three to five years. Using Chapter 13 bankruptcy forms Florida can help you navigate the calculations necessary to determine your affordable monthly payment, ensuring your proposal meets court guidelines.

To qualify for Chapter 13 bankruptcy, you must have a regular source of income, which can include wages, self-employment income, or pensions. Your debts also need to fall within specific limits; secured debts cannot exceed $1,257,850, and unsecured debts must be below $419,275. Additionally, you cannot be a corporation or partnership; only individual debtors are eligible. By utilizing Chapter 13 bankruptcy forms Florida, you can easily determine how your financial situation aligns with these eligibility criteria.

Filing for Chapter 13 bankruptcy on your own involves several steps. First, gather all necessary financial documents, such as income statements, tax returns, and debt information. Next, complete the Chapter 13 bankruptcy forms Florida, which can be easily found online. Ensure that you file your forms with the bankruptcy court in your district and attend the required hearing to confirm your repayment plan.

You may be disqualified from Chapter 13 bankruptcy if your secured and unsecured debts exceed the limits set by the federal government. For 2023, your secured debts must be less than $1,257,850, and your unsecured debts should not exceed $419,275. Additionally, if you have filed for bankruptcy in the last two years, you may face complications in the process. To understand your specific situation better, utilizing Chapter 13 bankruptcy forms Florida can help clarify your eligibility.

You can file Chapter 13 on your own, but it is often advisable to seek help from a qualified professional. Filing without assistance may lead to mistakes on your Chapter 13 bankruptcy forms in Florida, potentially causing delays or denials. Using resources available through uslegalforms helps ensure that you complete your forms correctly, making the process smoother.

Florida does not impose a strict income limit for filing Chapter 13, but your income must exceed your expenses to create a feasible repayment plan. The court evaluates your income against the state's median income for your household size. Properly filling out your Chapter 13 bankruptcy forms in Florida will reflect this information accurately and aid in your filing process.

You can generally file for Chapter 13 if your unsecured debts are less than $465,275 and secured debts are less than $1,395,875. This threshold can change, so it's wise to check the latest figures relevant to Florida. Completing your Chapter 13 bankruptcy forms in Florida accurately is crucial, as it helps establish your eligibility based on your current debt levels.

Yes, you can be denied Chapter 13 if your income does not meet the requirements or if your repayment plan is not feasible. The court will assess your financial situation thoroughly. To increase your chances of approval, it's essential to correctly complete your Chapter 13 bankruptcy forms in Florida and present a realistic plan for repayment.