Chapter 7 Discharge Formation Of A Company Notes

Description

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Getting a go-to place to access the most current and appropriate legal samples is half the struggle of handling bureaucracy. Finding the right legal papers demands accuracy and attention to detail, which is why it is important to take samples of Chapter 7 Discharge Formation Of A Company Notes only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and see all the information about the document’s use and relevance for the circumstances and in your state or region.

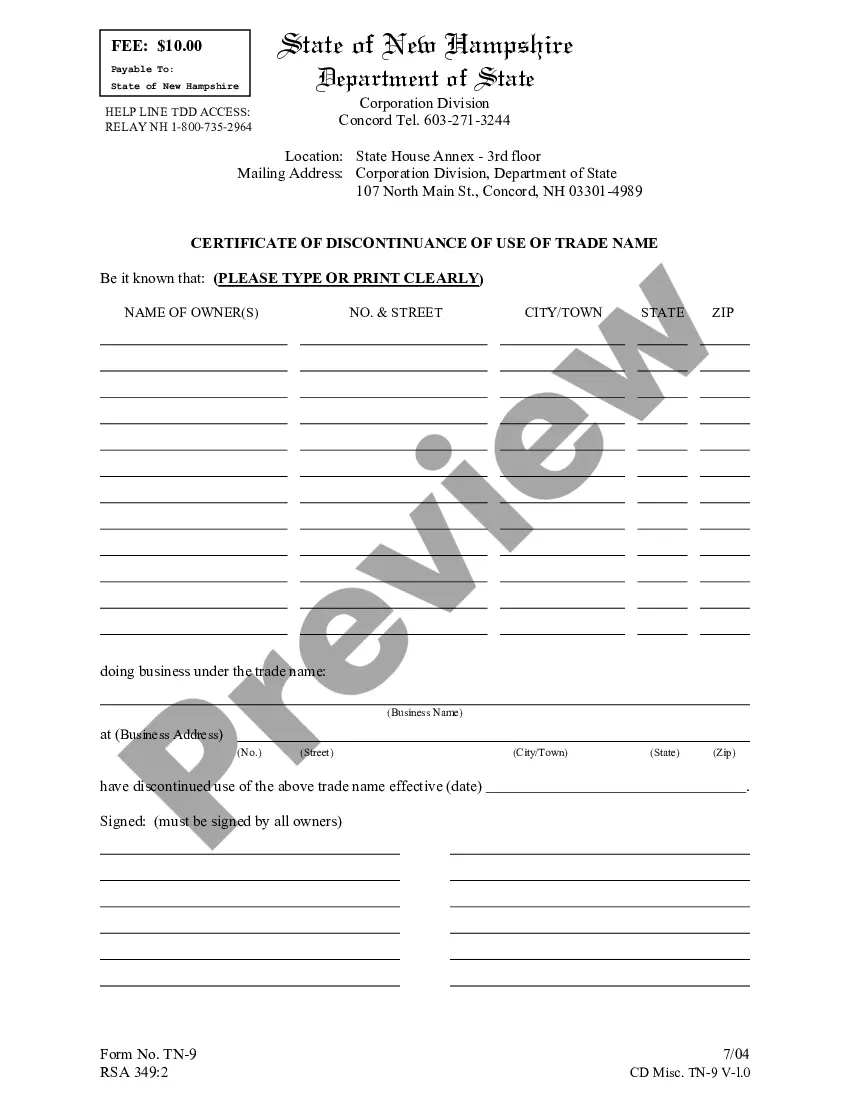

Consider the following steps to complete your Chapter 7 Discharge Formation Of A Company Notes:

- Make use of the library navigation or search field to find your sample.

- View the form’s description to check if it fits the requirements of your state and county.

- View the form preview, if there is one, to ensure the template is the one you are interested in.

- Get back to the search and locate the correct template if the Chapter 7 Discharge Formation Of A Company Notes does not fit your needs.

- If you are positive about the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your requirements.

- Go on to the registration to complete your purchase.

- Complete your purchase by selecting a transaction method (bank card or PayPal).

- Choose the file format for downloading Chapter 7 Discharge Formation Of A Company Notes.

- When you have the form on your device, you can modify it with the editor or print it and finish it manually.

Eliminate the headache that accompanies your legal paperwork. Explore the comprehensive US Legal Forms library where you can find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

The Chapter 7 Discharge. A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor.

If you're a business owner and you file a personal Chapter 7 bankruptcy, you might be able to keep your business. But it could put the company in jeopardy. You'll lose the business if the Chapter 7 trustee can sell any of the following: the company itself.

When a company goes bankrupt, it likely owes others money ? and they don't want to be left unpaid. Your debt is one of the company's assets, and during the bankruptcy, a trustee may try to collect your debt to help settle the company's accounts. The trustee, or a collection agency hired by the trustee, may contact you.

A Chapter 7 filing is the more nuclear option. It means that the company stops operating and all its assets are put up for sale by a court-appointed trustee, with the proceeds divvied up to the company's debtors in order of the seniority of the debt.

Under Chapter 7, the company stops all operations and goes completely out of business. A trustee is appointed to "liquidate" (sell) the company's assets and the money is used to pay off the debt, which may include debts to creditors and investors. The investors who take the least risk are paid first.