Chapter 7 Application Without An Attorney

Description

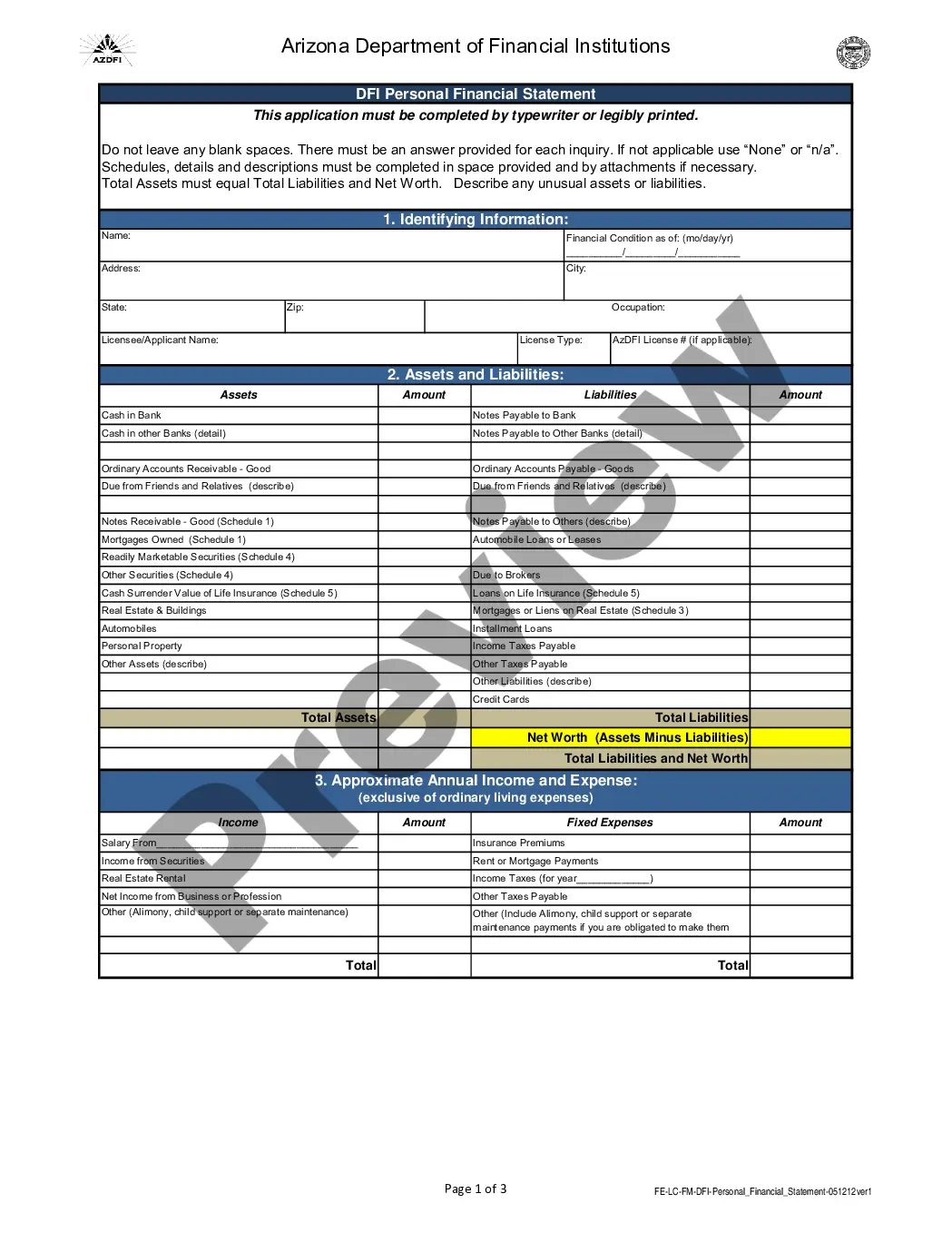

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

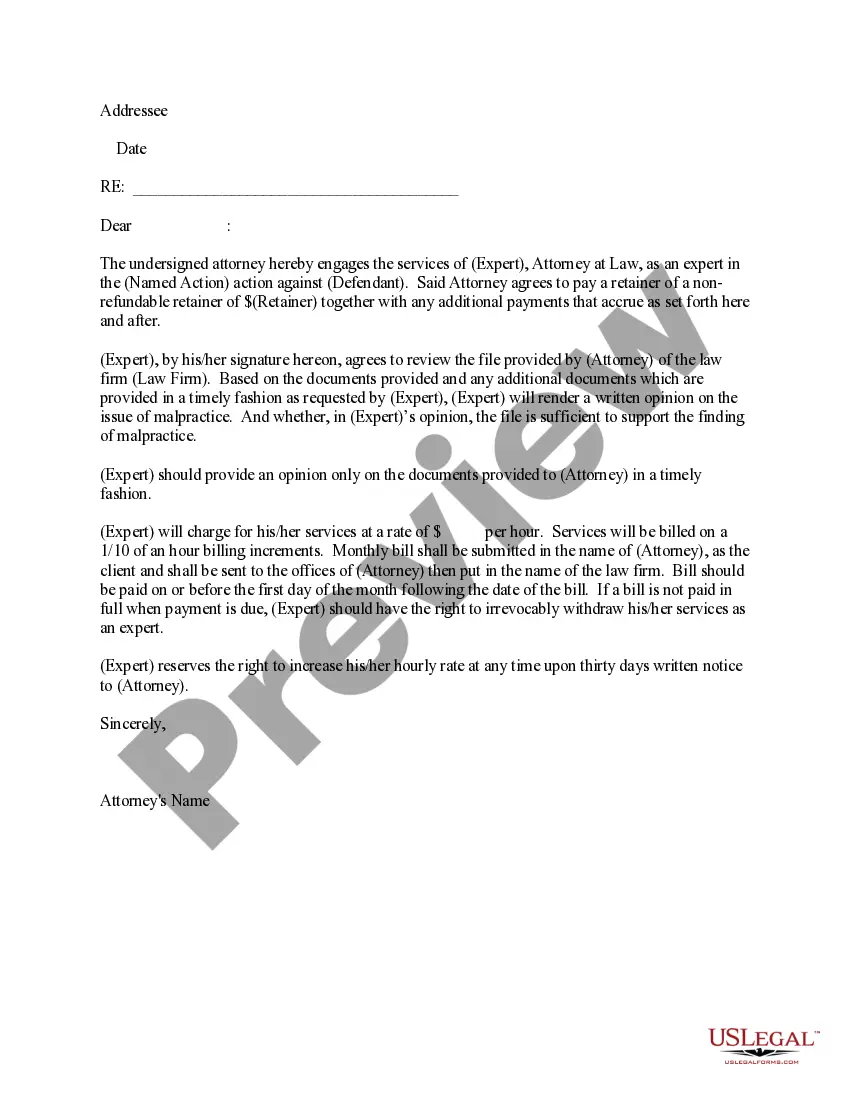

The Chapter 7 Application Without An Attorney presented on this page is a reusable official template created by expert lawyers in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and attorneys with more than 85,000 validated, state-specific documents for any commercial and personal circumstance. It’s the fastest, simplest, and most reliable method to obtain the documentation you require, as the service assures the utmost level of data protection and anti-malware security.

Subscribe to US Legal Forms to have validated legal templates for all of life's situations at your fingertips.

- Search for the document you require and review it.

- Browse through the sample you searched for and preview it or examine the form description to confirm it meets your requirements. If it doesn’t, utilize the search function to locate the appropriate one. Click Buy Now once you have identified the template you need.

- Register and Log Into your account.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to complete a quick transaction. If you already have an account, Log In and review your subscription to continue.

- Obtain the editable template.

- Pick the format you prefer for your Chapter 7 Application Without An Attorney (PDF, Word, RTF) and download the document to your device.

- Fill out and sign the documentation.

- Print the template to fill it out by hand. Alternatively, utilize an online multi-functional PDF editor to swiftly and accurately fill in and sign your form with a legally-binding electronic signature.

- Redownload your documentation when necessary.

- Access the same document again whenever required. Open the My documents tab in your profile to redownload any previously saved documents.

Form popularity

FAQ

Finally you'll submit your application, along with a $25 filing fee, to Alaska's Department of Commerce. Here are the steps. Before you file for a DBA in Alaska, you'll need to make sure the name you want to use isn't already the name of a business in Alaska.

If any portion of a business activity occurs within the State of Alaska then the expectation, per Alaska Statutes (law), is the business will have an Alaska Business License. Per AS 43.70. 020(a) a business license is required for the privilege of engaging in a business in the State of Alaska.

How to Get an Alaska Resale Certificate Using FastFilings Fill out our secure online application. Provide any necessary documentation. Pay your application fee. We review your application for accuracy and file it electronically with the state of Alaska. Receive your Alaska resale certificate as soon as one business day.

How do you register for a sales tax permit in Alaska? Businesses with physical locations in Alaska should consult with the Alaska Department of Revenue ? Tax Division. Remote sellers who exceed the Alaska economic nexus threshold can register online at the Alaska Remote Sellers Sales Tax Commission (ARSSTC) portal.

Food Seller's Permit, or Alaska Seller's Permit All businesses looking to sell tangible goods subject to sales tax need to obtain a seller's permit, including restaurants.

How Much Does a Business License Cost in Alaska? Businesses in the state of Alaska must pay $50 when first filing to receive a business license with the state government. Any businesses selling nicotine or nicotine-related products must be ?endorsed? to receive a business license, which incurs an additional $100 fee.

Register your corporation/entity with the State of Alaska Corporations Section to receive an Alaska entity number. All forms are located on our Forms and Fees page. Once on that page, scroll down to your specific entity type and click on the appropriate form.

Businesses in the state of Alaska must pay $50 when first filing to receive a business license with the state government. Any businesses selling nicotine or nicotine-related products must be ?endorsed? to receive a business license, which incurs an additional $100 fee.