Discharging Debtor For Liquidation Purposes

Description

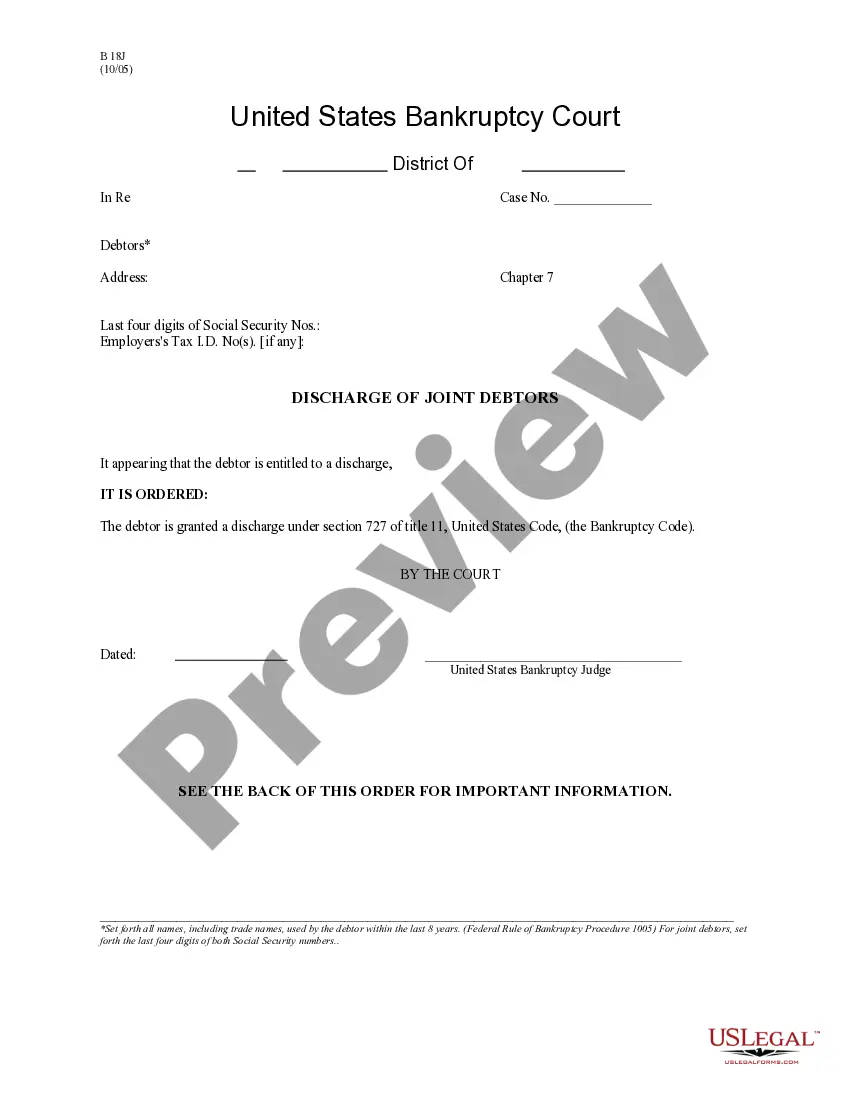

How to fill out Order Discharging Debtor Before Completion Of Chapter 12 Plan - Updated 2005 Act Form?

Managing legal documents and processes can be a lengthy addition to your entire day.

Discharging Debtor For Liquidation Purposes and similar forms frequently necessitate you to locate them and find the most effective way to fill them out correctly.

For this reason, if you are handling financial, legal, or personal issues, utilizing a thorough and user-friendly online directory of forms will significantly help.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms along with several tools to help you complete your documents effortlessly.

Is this your first time using US Legal Forms? Sign up and create an account in just a few minutes, and you’ll gain access to the form directory and Discharging Debtor For Liquidation Purposes. After that, follow the steps below to fill out your form: Ensure you have the correct form by utilizing the Review option and examining the form details. Choose Buy Now when ready, and select the subscription plan that suits your requirements. Click Download, then complete, eSign, and print the form. US Legal Forms has twenty-five years of experience assisting clients in managing their legal documents. Obtain the form you need today and streamline any procedure with ease.

- Browse the collection of relevant documents available with a single click.

- US Legal Forms gives you state- and county-specific forms accessible at any time for download.

- Safeguard your document management processes using a premium service that allows you to assemble any form in minutes without any additional or concealed charges.

- Simply Log In to your account, search for Discharging Debtor For Liquidation Purposes, and obtain it immediately from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

Courts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven.

To qualify for relief under chapter 7 of the Bankruptcy Code, the debtor may be an individual, a partnership, or a corporation or other business entity. 11 U.S.C. §§ 101(41), 109(b).

In individual chapter 11 cases, and in cases under chapter 12 (adjustment of debts of a family farmer or fisherman) and 13 (adjustment of debts of an individual with regular income), the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan.

Your debts after discharge When you're discharged from bankruptcy, you're freed from any debts that were included in your bankruptcy. You'll still need to pay any debts bankruptcy doesn't cover or any caused by your fraudulent activity.

Section 1141(d)(1) generally provides that confirmation of a plan discharges a debtor from any debt that arose before the date of confirmation. After the plan is confirmed, the debtor is required to make plan payments and is bound by the provisions of the plan of reorganization.