Court Bankruptcy State Withholding

Description

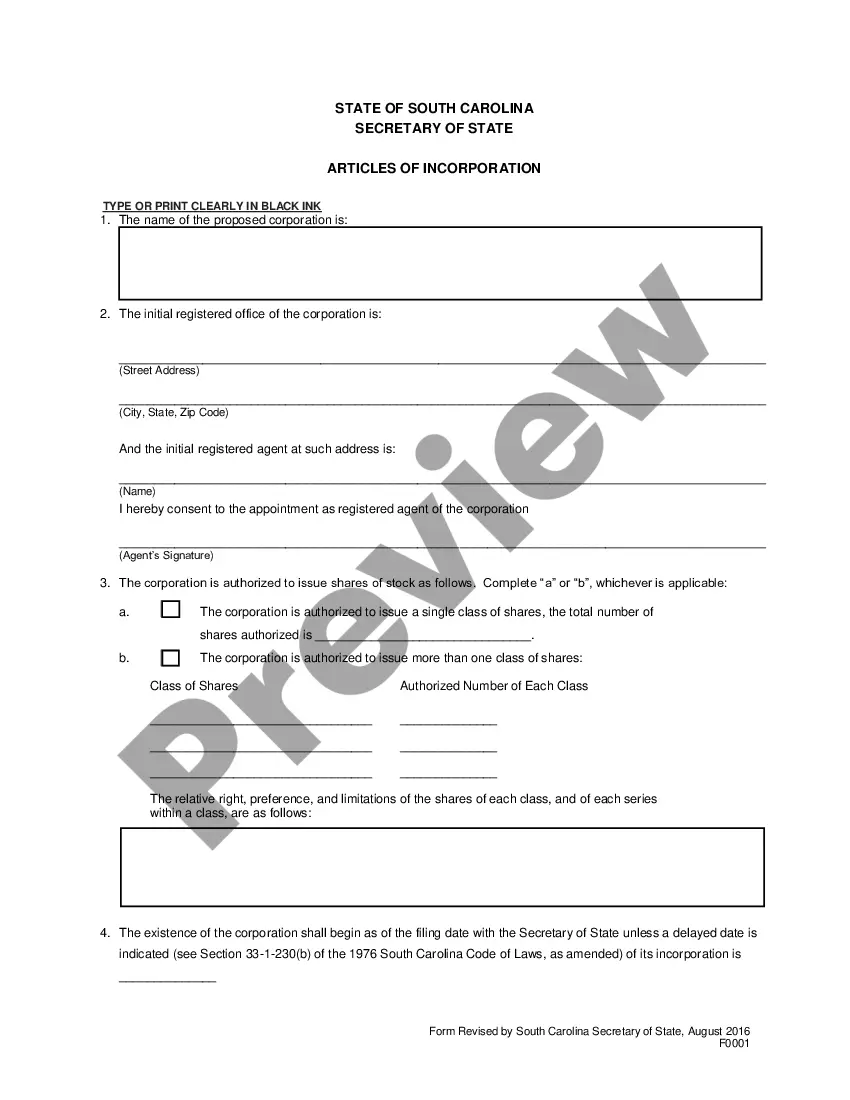

How to fill out Exemplification Certificate - B 131?

The Court Bankruptcy State Withholding you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and local regulations. For more than 25 years, US Legal Forms has provided individuals, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Court Bankruptcy State Withholding will take you only a few simple steps:

- Browse for the document you need and check it. Look through the file you searched and preview it or review the form description to verify it fits your needs. If it does not, use the search option to get the right one. Click Buy Now once you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Pick the format you want for your Court Bankruptcy State Withholding (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a eSignature.

- Download your paperwork one more time. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

Income is calculated by looking at the debtor's income for the six-months prior to filing. A debtor who previously had a higher income but has been laid off in the last year, for example, would be able to rely on their most recent income to satisfy the Means Test.

A petition may be filed by an individual, by spouses together, or by a corporation or other entity. All bankruptcy cases are handled in federal courts under rules outlined in the U.S. Bankruptcy Code. There are different types of bankruptcies, which are usually referred to by their chapter in the U.S. Bankruptcy Code.

You must file all required tax returns for tax periods ending within four years of your bankruptcy filing. During your bankruptcy you must continue to file, or get an extension of time to file, all required returns. During your bankruptcy case you should pay all current taxes as they come due.