Letter Withdrawal Representation Without Taxation

Description

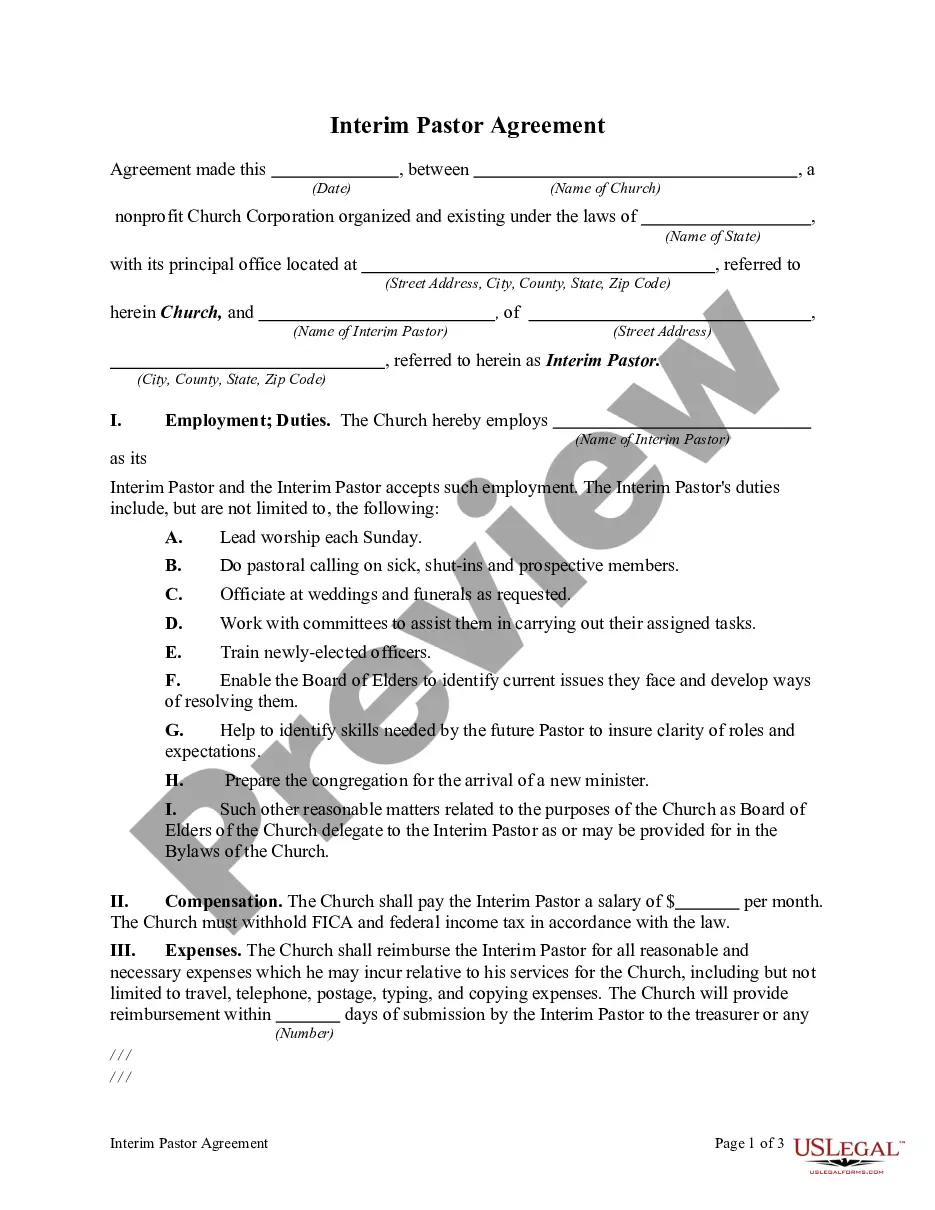

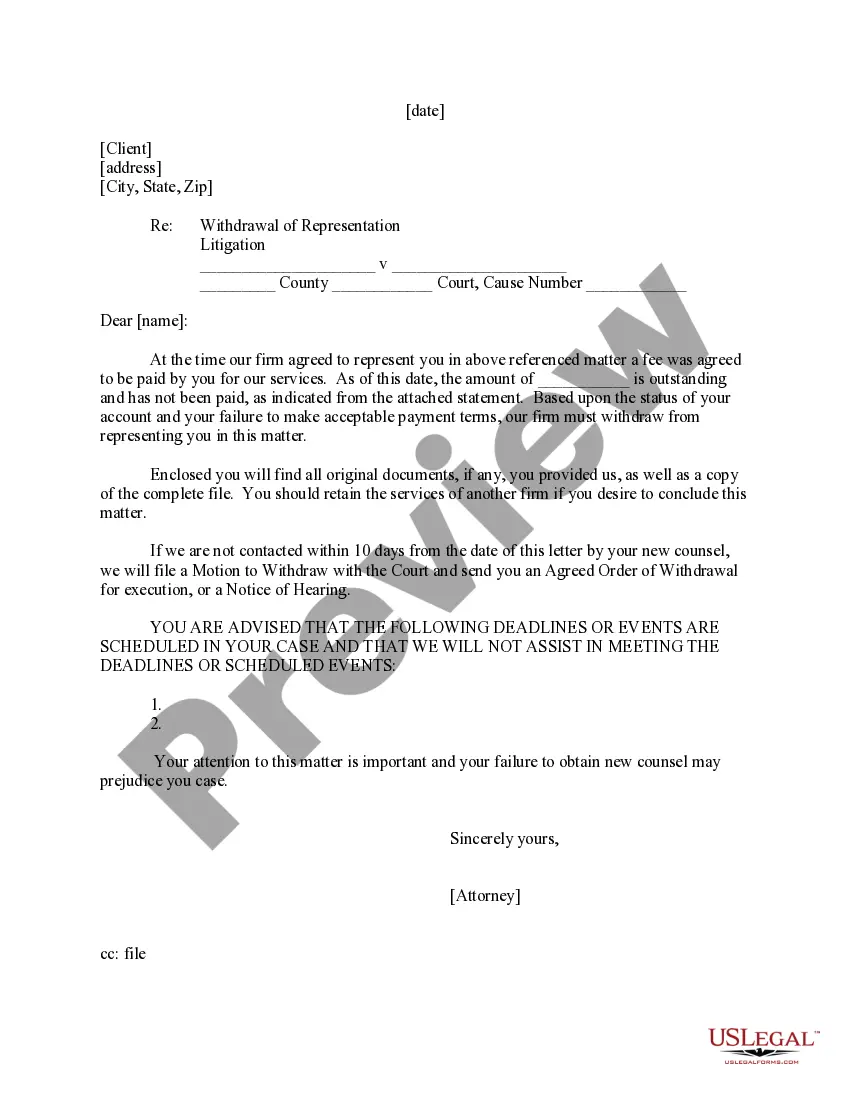

How to fill out Letter To Client - Withdrawal Of Representation?

It’s clear that you cannot become a legal authority instantly, nor can you determine how to swiftly compose a Letter Withdrawal Representation Without Taxation without possessing a specialized skill set.

Assembling legal documents is a lengthy process that necessitates specific training and abilities. So why not entrust the creation of the Letter Withdrawal Representation Without Taxation to the professionals.

With US Legal Forms, one of the most comprehensive legal document repositories, you can access everything from court documents to templates for in-office communication.

If you need any additional form, start your search again.

Create a free account and select a subscription plan to purchase the form. Click Buy now. Once the transaction is complete, you can download the Letter Withdrawal Representation Without Taxation, complete it, print it, and send or mail it to the necessary parties or organizations.

- We understand how crucial compliance and adherence to federal and state laws and regulations are.

- That’s why, on our site, all templates are location-specific and current.

- Here’s how to get started with our platform and acquire the document you need in just a few minutes.

- Locate the form you require using the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to ascertain whether Letter Withdrawal Representation Without Taxation is what you seek.

Form popularity

FAQ

There are 2 ways to revoke a Power of Attorney authorization: Authorize Power of Attorney for a new representative for the same tax matters and periods/years. A new authorization will automatically revoke the prior authorization. Send a revocation to the IRS.

If you need to revoke an IRS power of attorney agreement or withdraw a representative, you must first write ?REVOKE? across the top of the first page and include a signature and date below the annotation. Then, you will need to mail or fax a copy of the document to the IRS.

To update your CAF address, you can either: Sign and date a written notification of address change. Mail or fax it to the location where you filed the Form 2848 or Form 8821. Submit an authorization with Form 2848 or 8821. On the form, mark the checkbox and enter the new address, phone or fax number.

You will receive a Form 1099-R when you make a withdrawal from a IRA, 401(k) or other retirement account. This form includes information such as: the amount you withdrew, how much is taxable (if that was determined), any taxes that were withheld, and a code that shows what type of distribution it was.

Unenrolled return preparers may only represent taxpayers before revenue agents, customer service representatives, or similar officers and employees of the Internal Revenue Service (including the Taxpayer Advocate Service) during an examination of the tax period covered by the tax return they prepared and signed (or ...